- United States

- /

- Health Care REITs

- /

- NYSE:VTR

Ventas (VTR) Valuation: Is There More Upside After Recent Share Price Momentum?

Reviewed by Simply Wall St

Ventas (VTR) has recently caught investor attention, with shares trending higher over the past month. The company's performance in the real estate sector has piqued curiosity, especially as broader market sentiment remains mixed.

See our latest analysis for Ventas.

Ventas is riding a wave of upward momentum, with a 30-day share price return of nearly 5 percent and a year-to-date climb over 21 percent. This renewed interest follows some resilience in the real estate space. While the 1-year total shareholder return of just above 10 percent trails the S&P 500’s strongest, the multi-year view is much brighter, boasting more than 100 percent total returns over three and five years. Recent price gains suggest investors are becoming more optimistic about the company’s long-term growth and risk profile.

If you’re interested in discovering what else investors with an eye for momentum are watching, now is a timely chance to broaden your search and explore fast growing stocks with high insider ownership

Yet with shares hovering just below analyst price targets and sporting double-digit gains this year, the real question for investors is whether Ventas is undervalued at these levels or if the market has already priced in all the good news.

Most Popular Narrative: 9% Undervalued

Ventas’s most followed narrative places fair value at $77.39 a share, compared to a last close of $70.46. There is a meaningful gap here, sparking debate over whether the optimism reflected in the narrative’s forecasts can be achieved in a sector not known for explosive growth.

Ventas is positioned to benefit from a rapidly growing aging population driving sustained demand for senior housing and healthcare facilities, combined with historically low new construction, supporting multi-year occupancy gains and net operating income (NOI) growth as occupancy rates rise from the low 80% toward the 90%+ level. This is likely to drive substantial operating leverage and margin expansion.

Curious how these forecasts add up? The narrative’s target is built on bold long-term assumptions about profit margins and earnings. Want to know what’s driving this valuation, and if the market agrees? Dive into the full narrative to see which future financial milestones it’s banking on.

Result: Fair Value of $77.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and persistent labor cost pressures could quickly challenge the optimistic outlook for Ventas’s growth if conditions become unfavorable.

Find out about the key risks to this Ventas narrative.

Another View: SWS DCF Model Suggests Deeper Value

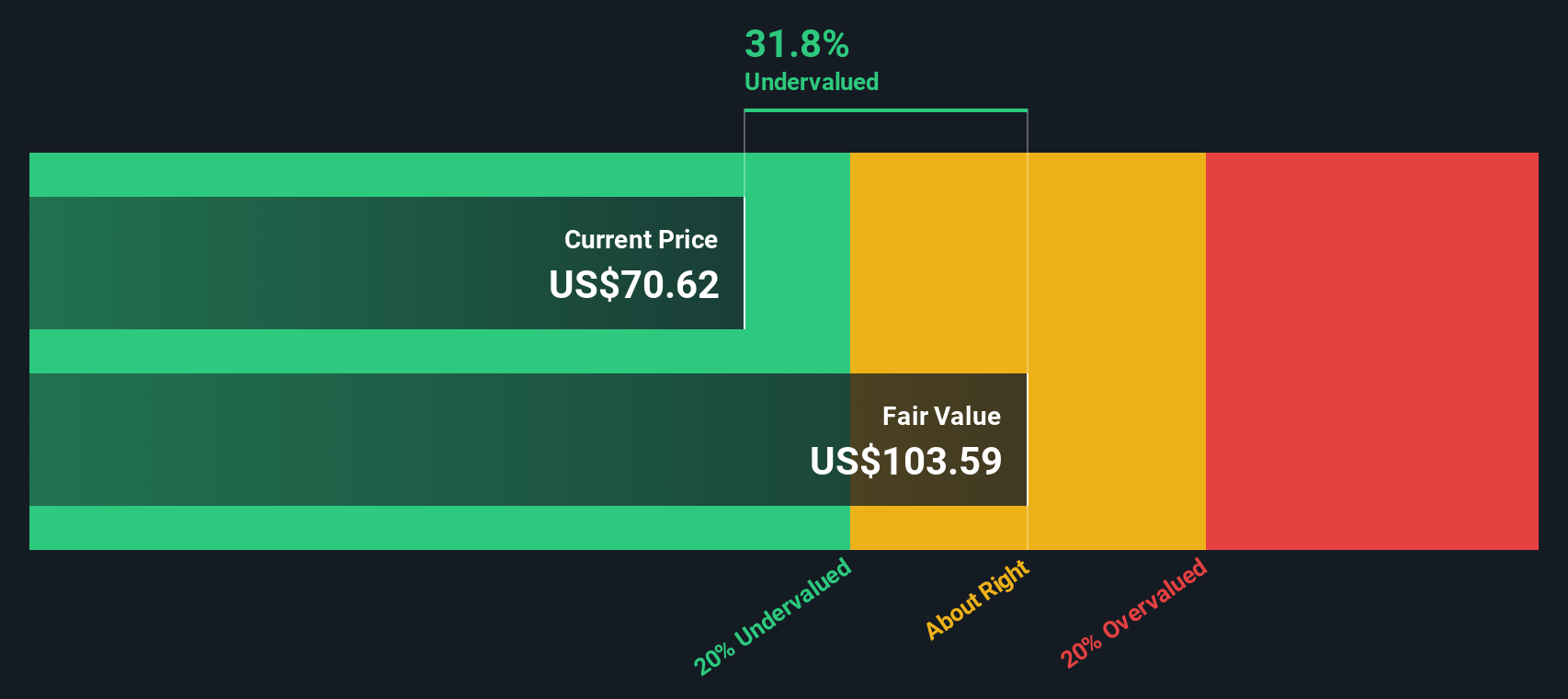

While analyst narratives point to roughly 9 percent undervaluation, our SWS DCF model takes a more generous view. It estimates Ventas’ fair value closer to $103.48, which is significantly higher than both the current share price and consensus target. Such a wide gap raises the question: could the market be missing the company’s longer-term cash flow potential, or is there something holding investors back?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ventas Narrative

If you see things differently or want to dig into the numbers on your own, you can easily build your own Ventas narrative in just a few minutes. Do it your way

A great starting point for your Ventas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead of the curve. Expand your watchlist and spot opportunities others might overlook using these fresh market themes:

- Supercharge your portfolio by chasing strong cash flows and growth among these 878 undervalued stocks based on cash flows, which stand out for their attractive valuations and resilient fundamentals.

- Ride the next wave of healthcare transformation by exploring these 33 healthcare AI stocks, where tech and medicine come together to create smarter, future-ready companies.

- Tap into steady returns by targeting these 17 dividend stocks with yields > 3% that deliver reliable income with yields over 3 percent, helping to boost your long-term wealth-building plan.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTR

Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust enabling exceptional environments that benefit a large and growing aging population.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives