- United States

- /

- Office REITs

- /

- NYSE:VNO

Vornado’s $218 Million Bet on Midtown Revitalization Might Change the Case for Investing in VNO

Reviewed by Simply Wall St

- Vornado Realty Trust recently announced it has agreed to purchase the 36-story, 382,500 square foot office condominium at 623 Fifth Avenue in Midtown Manhattan for US$218 million, with plans to fully redevelop the 75% vacant property into a premier Class A boutique office building.

- This move will expand Vornado’s high-profile Midtown portfolio and signals a major commitment to repositioning underutilized office assets in New York City’s key commercial corridor.

- We'll examine how the planned transformation of 623 Fifth Avenue could shape Vornado Realty Trust’s future investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vornado Realty Trust Investment Narrative Recap

To own Vornado Realty Trust, you need to believe in the recovery and repositioning of Manhattan’s prime office market, driven by strong demand for high-quality, well-located assets. The 623 Fifth Avenue acquisition reinforces Vornado’s presence in Midtown and aligns with hopes for rent growth and occupancy gains, but given the project’s timeline, it is unlikely to be an immediate catalyst for stronger results, nor does it shift the main near-term risk of ongoing office market softness.

Of recent announcements, Verizon’s long-term lease at PENN 2 is especially relevant. It highlights leasing momentum in Manhattan’s higher-end office inventory and supports the case that Vornado can attract quality tenants to redeveloped assets, echoing the opportunity envisioned at 623 Fifth Avenue and its importance to recurring revenue and margin stability.

But on the other hand, investors should be aware of the risk that delivery timelines and leasing targets for redevelopments may slip if...

Read the full narrative on Vornado Realty Trust (it's free!)

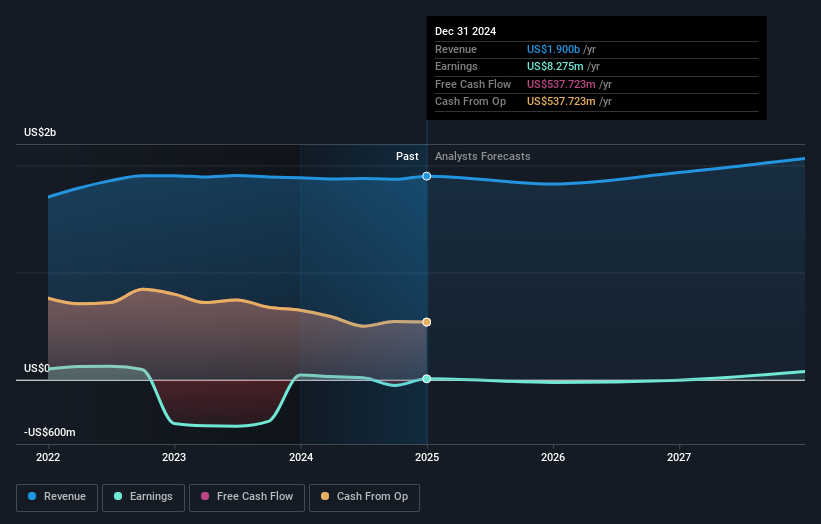

Vornado Realty Trust is expected to generate $2.1 billion in revenue and $22.1 million in earnings by 2028. This outlook assumes a 3.0% annual growth rate in revenue, but earnings are forecast to decrease sharply by $790.6 million from current earnings of $812.7 million.

Uncover how Vornado Realty Trust's forecasts yield a $38.21 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates for Vornado Realty Trust, ranging from US$38.21 to US$39.01 per share. With optimistic bets on rising rents in Manhattan’s premium office sector among analysts, you can find a number of different views on what could drive Vornado’s share price next.

Explore 2 other fair value estimates on Vornado Realty Trust - why the stock might be worth as much as $39.01!

Build Your Own Vornado Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vornado Realty Trust research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Vornado Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vornado Realty Trust's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives