- United States

- /

- Office REITs

- /

- NYSE:VNO

Vornado Realty Trust (VNO): Assessing Valuation After a Month of Sideways Share Price Movement

Reviewed by Simply Wall St

See our latest analysis for Vornado Realty Trust.

Vornado’s share price has edged down 6.09% over the last month, reflecting some investor caution even as the real estate landscape remains in flux. While recent momentum has been muted, its three-year total shareholder return stands out at 76.4%. This reminds investors that longer-term holders have been well rewarded despite occasional turbulence.

If steady gains and market shifts have you thinking about broader opportunities, now’s a great chance to explore fast growing stocks with high insider ownership

With Vornado’s shares moving sideways and returns trailing over the past year, investors are left to consider whether the market is overlooking hidden value, or if every ounce of future growth is already built into today’s share price.

Most Popular Narrative: 1.3% Undervalued

Vornado Realty Trust's narrative fair value sits at $39.67, hovering just above the last close of $39.15, with a negligible gap. This proximity means every assumption packed into the forecast is crucial to justifying its current pricing.

The current valuation likely anticipates continued robust rent growth in Manhattan's premium office segment. Pent-up demand, low vacancy in Class A properties, and severely constrained new supply are forecasted to create a landlord's market. This is expected to drive a significant step-up in revenues and same-store NOI as new leases and lease roll-ups take effect in coming years.

Curious how a Manhattan supply crunch could shape future earnings and raise the stakes for Vornado’s trophy assets? Discover the audacious forecasts, tight occupancy bets, and high-stakes growth formulas that underpin this contention. It's not what you expect. Find out what’s fueling the narrow margin between market price and narrative fair value.

Result: Fair Value of $39.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong tenant demand for premium Manhattan space or faster redevelopment success could lead to higher rents and occupancy, challenging current cautious expectations.

Find out about the key risks to this Vornado Realty Trust narrative.

Another View: DCF Model Suggests a Different Story

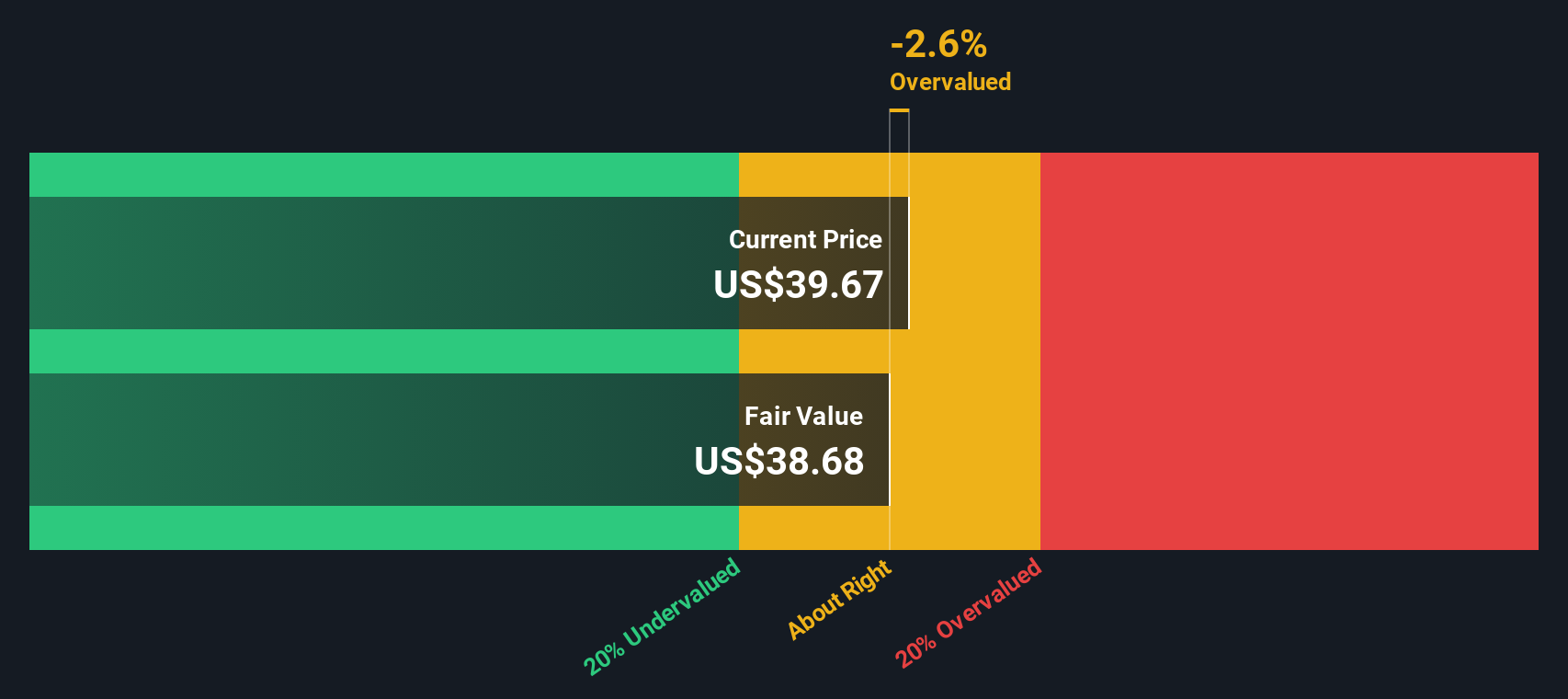

Taking a look at our SWS DCF model, Vornado’s estimated fair value is $38.62 per share, which is slightly below the current market price. This result presents the stock as just a touch overvalued, countering the narrative of fair value and raising fresh questions about how much optimism is already priced in.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vornado Realty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vornado Realty Trust Narrative

If these views haven't convinced you, or you want to see the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Vornado Realty Trust research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to spot opportunities before everyone else, don’t wait on the sidelines. Amp up your investing strategy by browsing these powerful hand-picked stock ideas now:

- Unlock higher yields and pursue steady passive income with these 17 dividend stocks with yields > 3% that consistently outperform the market on payouts.

- Catch tomorrow’s technology giants early by scanning these 25 AI penny stocks propelling innovation in artificial intelligence and automation.

- Target hidden value by zeroing in on these 878 undervalued stocks based on cash flows where strong fundamentals suggest room for upside that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk with proven track record.

Similar Companies

Market Insights

Community Narratives