- United States

- /

- Office REITs

- /

- NYSE:VNO

Assessing Vornado Realty Trust (VNO) Valuation After 8% Share Price Rebound

Reviewed by Kshitija Bhandaru

See our latest analysis for Vornado Realty Trust.

Vornado Realty Trust's share price has rebounded over the past month, adding to renewed optimism following a challenging period for real estate stocks. Despite some bumps along the way, the company's recent 30-day share price return of 8% stands out. Its 1-year total shareholder return of 6% also signals that upward momentum is building for long-term holders rather than fading.

If the renewed interest in Vornado has you watching for other market movers, now is an ideal moment to discover fast growing stocks with high insider ownership.

With shares rebounding and optimism on the rise, investors are left to wonder whether Vornado Realty Trust is still undervalued or if the recent gains reflect markets fully pricing in its future growth prospects.

Most Popular Narrative: 5% Overvalued

Vornado Realty Trust closed at $41.06, notably above the fair value estimate of $39 from the most widely followed narrative, sparking debate about whether recent optimism is fully justified by its long-term fundamentals.

The current valuation likely anticipates continued robust rent growth in Manhattan's premium office segment. Pent-up demand, low vacancy in Class A properties, and severely constrained new supply are forecasted to create a landlord's market. This is expected to drive a significant step-up in revenues and same-store NOI as new leases and lease roll-ups take effect in coming years.

What bold assumptions are fueling this price tag? The narrative banks on rapid revenue expansion, shrinking profit margins, and a future profit multiple that may raise eyebrows. Want to discover which one variable drives the valuation story? Dive into the full narrative to see the detailed projections behind this fair value call.

Result: Fair Value of $39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong leasing momentum in Manhattan and successful redevelopment projects could reignite earnings growth, which challenges the argument that Vornado remains overvalued.

Find out about the key risks to this Vornado Realty Trust narrative.

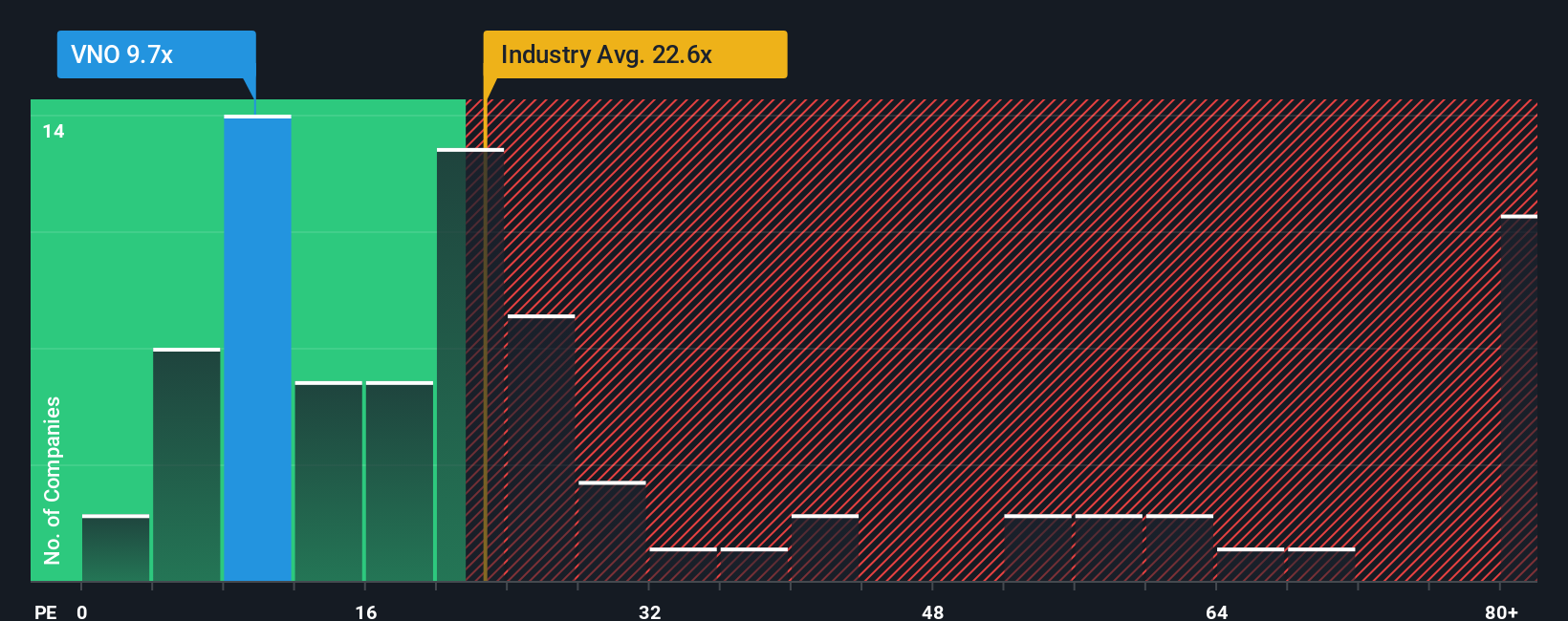

Another View: Comparing Real-World Market Ratios

While the most followed narrative suggests Vornado Realty Trust is overvalued, the company’s price-to-earnings ratio tells a different story. At just 9.7x, it trades well below both its peers’ average of 38.3x and the global industry’s 22.7x. The fair ratio, which markets could shift toward, is 12.2x. This gap could point to a value opportunity or highlight investor caution. Are markets underestimating Vornado’s potential, or do risks linger beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vornado Realty Trust Narrative

If you have a different take or want to dig into the numbers yourself, you can build your own perspective in just a few minutes with Do it your way.

A great starting point for your Vornado Realty Trust research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Expand your strategy now with targeted lists designed to help you spot tomorrow’s outperformance before the crowd catches on.

- Tap into the high-yield advantage and strengthen your income stream with these 19 dividend stocks with yields > 3%, which features attractive yields above 3%.

- Break into the next frontier of technology by checking out these 24 AI penny stocks, leading advancements in artificial intelligence and automation.

- Unleash your portfolio’s potential by reviewing these 904 undervalued stocks based on cash flows, which the market may have overlooked based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk with proven track record.

Similar Companies

Market Insights

Community Narratives