- United States

- /

- Specialized REITs

- /

- NYSE:VICI

VICI Properties (VICI) Profit Margin Decrease Reinforces Market Caution Despite Strong Valuation

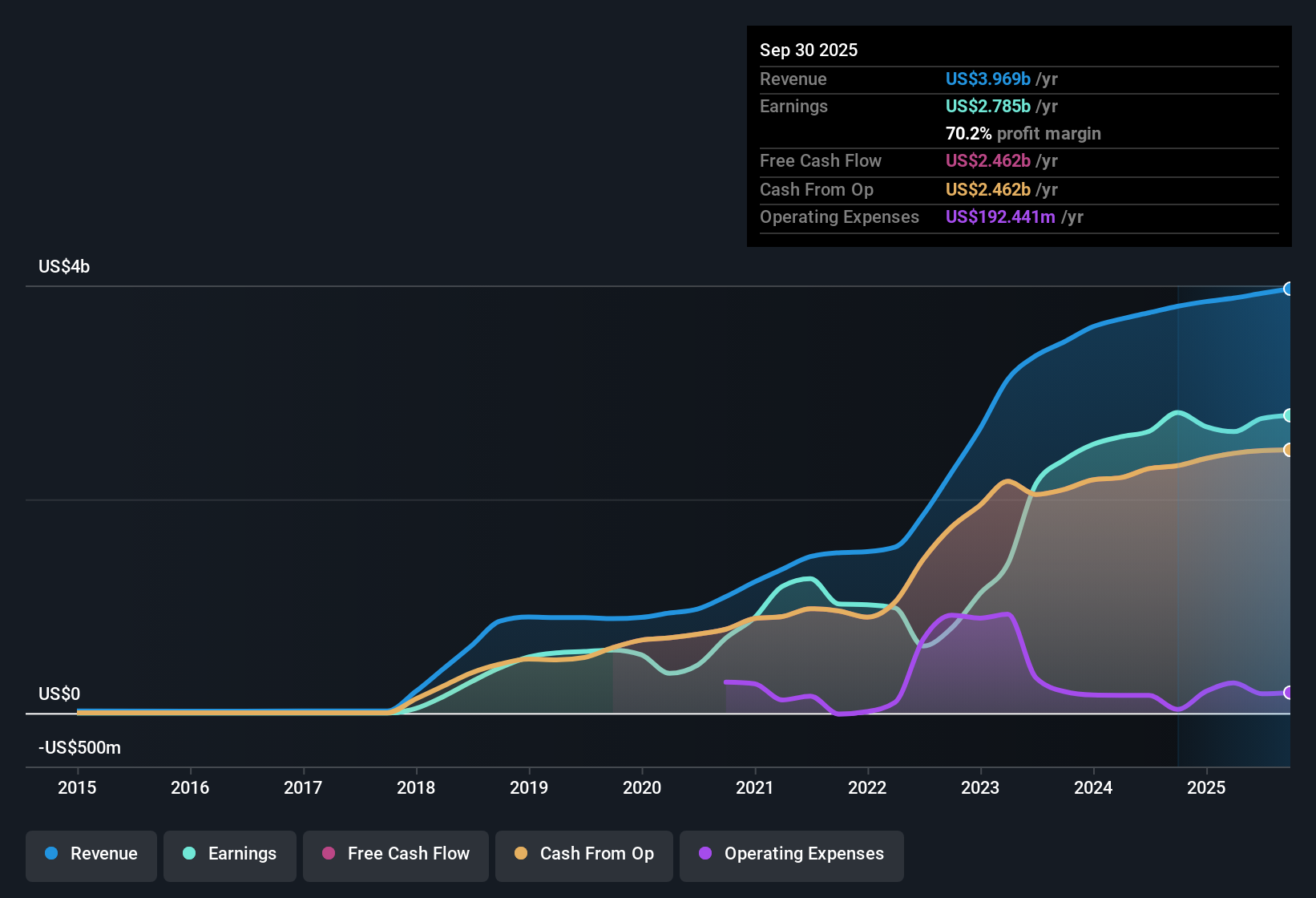

VICI Properties (VICI) reported earnings that are forecast to grow at 4.8% annually, with revenue expected to expand by 3.1% per year. While the company maintains a net profit margin of 70.2%, down from last year’s 73.9%, it trades at a Price-to-Earnings ratio of 11.5x, notably undercutting industry averages. Investors are weighing the ongoing profitability, strong relative value, and forecast growth, even as margins have softened and financial position risk remains a focal point.

See our full analysis for VICI Properties.Next, we will look at how these latest results hold up against the main narratives driving investor sentiment, revealing what the numbers confirm and where the story might be shifting.

See what the community is saying about VICI Properties

Profit Margin Slips, Long-Term Drivers Intact

- Profit margins have tightened to 70.2%, down from last year's 73.9%. Analysts expect further compression to 64.2% within three years, creating a different landscape for returns compared to the profit growth seen earlier this decade.

- Analysts' consensus view centers on how robust demand for diversified experiential real estate, paired with inflation-protected leases and disciplined funding, provides some buffer for VICI's steady earnings. At the same time, growing costs and tenant risk weigh on future performance.

- Occupancy is expected to remain healthy, as demographic trends and rising experience-driven spending support VICI’s high-quality asset base and reinforce top-line resilience.

- However, future rent escalations and profit expansion could moderate, with more cautious expectations due to shifting consumer patterns and ongoing margin softening.

- See which themes are dominating investor discussions and how these shifts shape the consensus story. 📊 Read the full VICI Properties Consensus Narrative.

Peer And Industry Discount Grows Wider

- With a Price-to-Earnings ratio of just 11.5x, VICI trades at roughly half the average industry multiple (26x Specialized REITs) and well below the peer average of 22.3x. This suggests a sizable discount to its direct competitors.

- According to the consensus narrative, this relative undervaluation is a critical reward for long-term investors. The company’s share price at $29.99 also sits under the DCF fair value estimate of $58.93, highlighting a possible disconnect between market caution and VICI’s asset strength.

- Analyst price targets land at $36.74, about 22% above the recent share price, anchoring valuation upside for those willing to look through near-term risks.

- Bulls highlight how this discount reflects ample capital flexibility and potential for accretive acquisitions if tenant performance and sector trends remain supportive.

Growth Forecasts Miss The Market Pace

- VICI’s forecasted annual earnings and revenue growth rates, at 4.8% and 3.1% respectively, trail behind broader US market projections of 15.9% for earnings and 10.4% for revenue. This signals more modest expansion compared to sector peers.

- The consensus view underscores that although VICI’s historical five-year profit growth was strong at 27.9% per year, the recent pivot to negative growth in the latest period marks a meaningful narrative shift, amplified by tepid forward estimates.

- Cautious analysts point out the risk that slowdowns in gaming demand or tenant performance could further erode these already-muted growth rates.

- Still, the company’s ability to maintain healthy margins and recurring revenues may give patient investors confidence if market headwinds ease.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for VICI Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh angle on the figures? Now is the time to shape your own take and share it in three minutes or less. Do it your way

A great starting point for your VICI Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

VICI’s subdued growth forecasts, recent profit margin compression, and underperformance versus market benchmarks suggest it may lag peers delivering stronger expansion and consistency.

If you’re seeking investments with steadier growth and resilience, discover stable growth stocks screener (2103 results) to find companies marked by consistent revenue and earnings even as conditions change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.