- United States

- /

- Specialized REITs

- /

- NYSE:VICI

VICI Properties (NYSE:VICI) Reports Q1 Revenue Increase To US$984 Million

Reviewed by Simply Wall St

VICI Properties (NYSE:VICI) recently demonstrated a favorable share price movement of 7% over the last quarter. This performance came amid a backdrop of increasing market optimism, supported by the surge in major tech stocks that bolstered broader indices such as the S&P 500 and the Dow. During this period, VICI reported increased revenue for Q1 2025, although net income and EPS experienced declines. Additionally, the company completed a significant debt offering and maintained dividend payments, actions which may have added support to broader market trends rather than countering them.

Be aware that VICI Properties is showing 1 weakness in our investment analysis.

The recent 7% rise in VICI Properties' shares over the last quarter reflects growing investor confidence amidst market optimism. This, alongside a significant debt offering and stable dividend payments, underscores a commitment to financial fortitude which may diversify income streams via its new luxury hospitality partnerships with Cain International and Eldridge Industries. These strategic moves could bolster VICI's revenue outlook, capitalizing on enhanced assets like MGM Grand and Caesars. However, potential dilution from forward equity agreements could temper growth expectations, reflected in VICI's current share price being 10.6% below the analyst consensus price target of US$36.10.

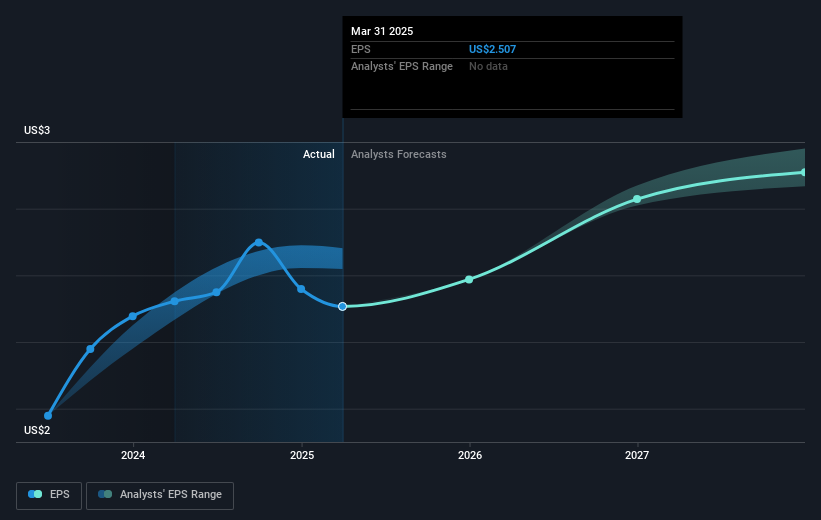

Over the long-term, VICI's shareholders have experienced robust total returns, including share price appreciation and dividends, totaling 155.25% over five years. In contrast, the company underperformed the US Specialized REITs industry, which posted higher returns of 14.5% over the past year. Nevertheless, such growth over a five-year horizon indicates the resilience and potential in VICI's strategic initiatives. Analyst forecasts suggest revenue growth of 2.4% annually over the next three years, with profit margins expected to rise. The partnerships could serve as significant catalysts, but they also present risks if partner-specific conditions or market dynamics shift unfavorably.

Examine VICI Properties' earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade VICI Properties, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives