- United States

- /

- Specialized REITs

- /

- NYSE:VICI

Should Renewed Analyst Optimism on Experiential Expansion Require Action From VICI Properties (VICI) Investors?

Reviewed by Sasha Jovanovic

- VICI Properties recently received a wave of positive analyst coverage, including Cantor Fitzgerald initiating with an Overweight rating and a new price target, highlighting optimism around its expanding portfolio in the experiential real estate sector.

- Notably, VICI Properties continues to diversify beyond gaming and hospitality, with rising dividends reinforcing its reputation as a leading dividend payer among REITs.

- We'll explore how the renewed analyst confidence, driven by VICI's growth in experiential assets, could influence its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

VICI Properties Investment Narrative Recap

To be a shareholder in VICI Properties, you need confidence in the long-term resilience of experiential and gaming real estate, supported by demographic tailwinds and robust, inflation-protected cash flows. The recent wave of positive analyst coverage, especially Cantor Fitzgerald's Overweight rating, doesn’t materially alter the primary catalyst of continued portfolio diversification, nor does it lessen the key short-term risk of tenant concentration among a few major gaming operators.

One of the most relevant announcements to this analyst optimism is VICI’s consistent, rising dividend, recently increasing for the eighth consecutive year. This highlights the company’s strong cash flow, reinforcing its appeal to income-focused investors and providing reassurance amid ongoing sector diversification efforts. However, investors should not overlook the fact that VICI's tenant base remains highly concentrated, which means...

Read the full narrative on VICI Properties (it's free!)

VICI Properties' outlook projects $4.3 billion in revenue and $2.8 billion in earnings by 2028. This is based on a 3.4% annual revenue growth rate and flat earnings, showing no change from the current $2.8 billion in earnings.

Uncover how VICI Properties' forecasts yield a $36.73 fair value, a 13% upside to its current price.

Exploring Other Perspectives

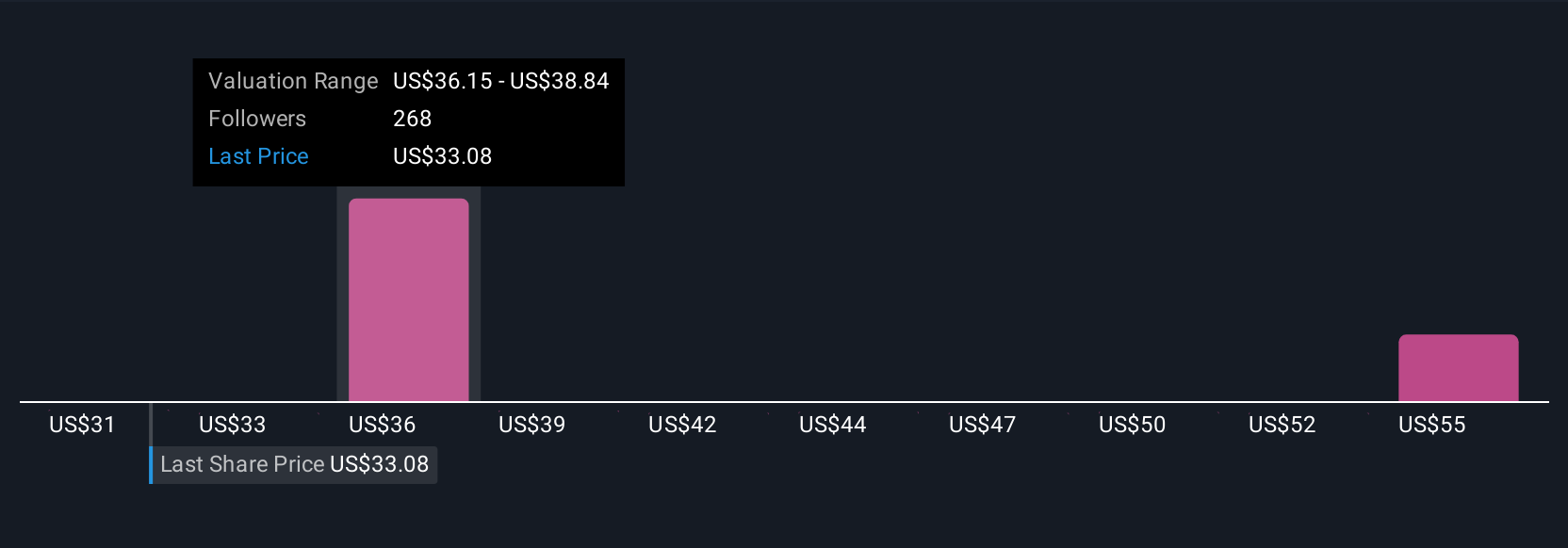

Simply Wall St Community members set VICI’s fair value between US$30.78 and US$57.44, across 12 individual forecasts. While growth in experiential assets drives analyst optimism, remember tenant concentration remains a key issue shaping portfolio risk and future returns.

Explore 12 other fair value estimates on VICI Properties - why the stock might be worth 6% less than the current price!

Build Your Own VICI Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VICI Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VICI Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VICI Properties' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives