- United States

- /

- Residential REITs

- /

- NYSE:UMH

UMH Properties (UMH): Valuation Check After $91.8 Million Fannie Mae Financing Boosts Liquidity and Growth Plans

Reviewed by Simply Wall St

UMH Properties (UMH) just folded seven of its manufactured home communities into an existing Fannie Mae credit facility, unlocking about $91.8 million in fixed rate financing and immediately shoring up its liquidity profile.

See our latest analysis for UMH Properties.

Despite the new financing boost, UMH’s share price has been choppy, with a 30 day share price return of 7.38 percent but a year to date share price return of negative 16.08 percent. Its five year total shareholder return of 33.29 percent hints that long term momentum still favors patient holders.

If this liquidity move has you thinking about where else capital might compound steadily, it could be worth scanning stable growth stocks screener (None results) for other businesses quietly building long term records.

With liquidity fortified, a meaningful discount to analyst targets, and robust revenue and income growth, is UMH quietly mispriced and offering patient investors upside, or is the market already baking in its next leg of expansion?

Most Popular Narrative Narrative: 15.4% Undervalued

With UMH Properties last closing at $15.86 against a narrative fair value of $18.75, the gap reflects ambitious long term growth expectations baked into detailed models.

Strategic investments in community infrastructure improvements, value add upgrades, and green initiatives are enabling regular rent increases, improving resident retention, and expanding margins by lowering operating costs, which should increase both net operating income and net margins over time.

Want to see how steady rent growth, rising margins, and a richer earnings mix justify this valuation gap over time? The narrative unpacks the compounding effect of accelerating profits, expanding cash flows, and a premium earnings multiple that rivals high growth sectors. Curious which financial levers have to click perfectly for that upside to materialise? Dive in to see the exact growth and profitability path behind this fair value.

Result: Fair Value of $18.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on UMH securing new deals and managing higher debt costs, with any slowdown or refinancing squeeze potentially undermining growth assumptions.

Find out about the key risks to this UMH Properties narrative.

Another Angle on Valuation

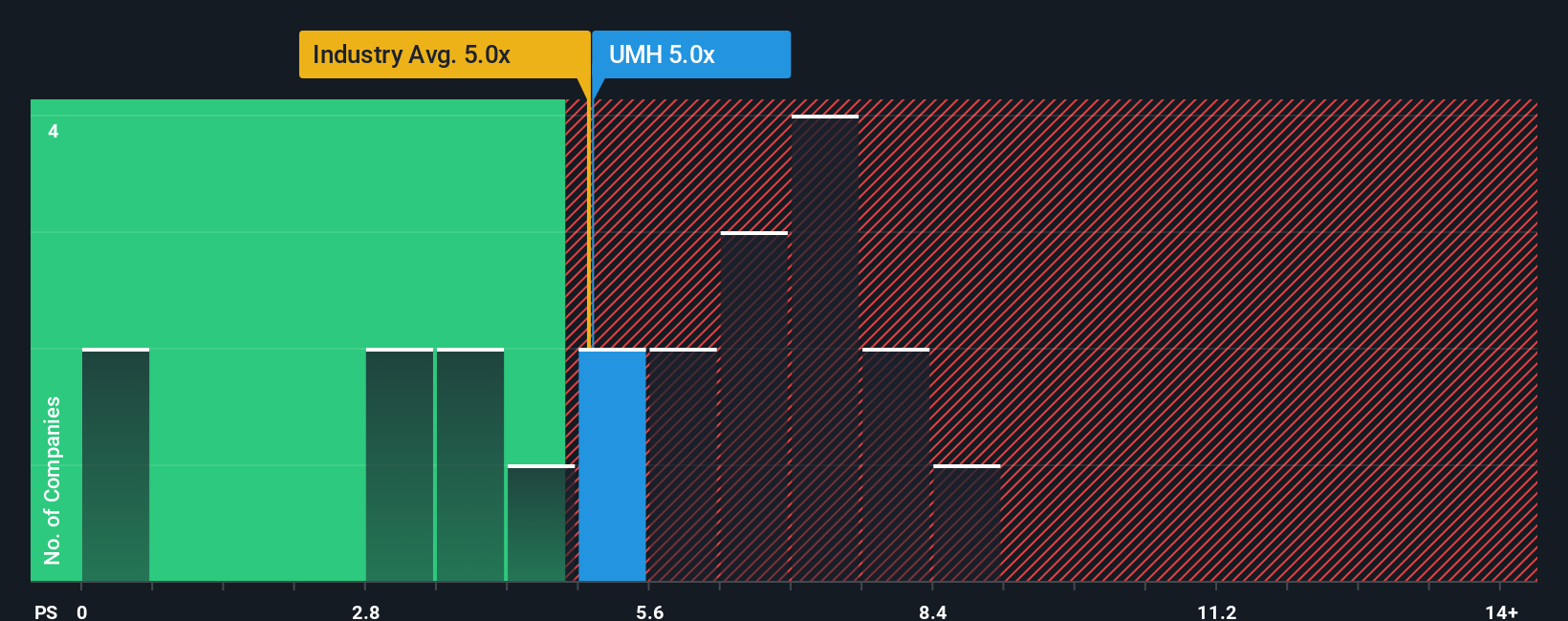

On a simple price to sales lens, UMH looks less generous. It trades at 5.3 times sales, richer than the 3.5 times fair ratio our models suggest the market could migrate toward, and above the sector at 5.1 times. Is this a justified growth premium or an air pocket in waiting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMH Properties Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalized narrative in minutes, Do it your way.

A great starting point for your UMH Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at UMH. Put your watchlist to work by using targeted screeners that surface opportunities most investors overlook but long term portfolios quietly rely on.

- Capture potential market mispricings by scanning these 914 undervalued stocks based on cash flows that may be trading below what their future cash flows justify.

- Ride powerful structural trends by focusing on these 25 AI penny stocks positioned to benefit from accelerating adoption of intelligent automation.

- Strengthen your income stream by filtering for these 13 dividend stocks with yields > 3% that can support consistent cash payouts in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UMH

UMH Properties

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that currently owns and operates 145 manufactured home communities, containing approximately 27,000 developed homesites, of which 10,800 contain rental homes, and over 1,000 self-storage units.

Established dividend payer with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion