- United States

- /

- Residential REITs

- /

- NYSE:UMH

UMH Properties (UMH): Unpacking Valuation After $91.8 Million Credit Facility Expansion and Refinancing

Reviewed by Simply Wall St

UMH Properties (UMH) just completed a refinancing deal by adding seven communities to its Fannie Mae credit facility. This unlocked about $91.8 million in proceeds at a fixed 5.46% interest-only rate over nine years. This move positions the company to target new acquisitions, expansions, additional rental homes, and pay down higher-interest debt in the short term.

See our latest analysis for UMH Properties.

After the refinancing news, UMH Properties' short-term momentum remains mixed. The past week’s share price return is up 3.1%, but the year-to-date share price return sits at -19.4%. As a result, the stock’s 1-year total shareholder return is -16.5%. It is still up over 30% for long-term holders over five years. This refinancing, combined with recent insider buying and the company’s steady acquisitions, is seen as a strategic play to support future growth and gradually restore investor confidence.

If UMH’s moves have you thinking about fresh opportunities, now could be the perfect time to discover fast growing stocks with high insider ownership

With the refinancing unlocking new capital and analyst targets suggesting upside from current levels, the big question now is whether UMH Properties is trading at a true discount or if the market has already priced in the next stage of growth.

Most Popular Narrative: 19% Undervalued

UMH Properties’ most popular narrative prices the shares well above the latest closing price of $15.23, suggesting a significant disconnect that sets the stage for bold expectations. This highlights optimism about the company’s potential and invites scrutiny into the catalysts behind this valuation.

Legislative momentum and regulatory changes are making it easier to develop and expand manufactured housing communities, particularly with HUD's support for innovative housing and zoning reforms. This is expected to unlock new revenue streams and drive NOI growth as UMH brings new sites and communities online.

What is fueling this valuation? Dig deeper to discover the unconventional growth drivers, legislative tailwinds, and future profit assumptions that could redefine UMH’s market trajectory. The financial math behind this price target might surprise you, and the narrative’s core logic may challenge what you think you know about REIT valuation.

Result: Fair Value of $18.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on acquisitions and rising interest rates could weigh on UMH Properties’ long-term earnings growth and challenge the prevailing undervalued narrative.

Find out about the key risks to this UMH Properties narrative.

Another View: Multiples Send a Caution Signal

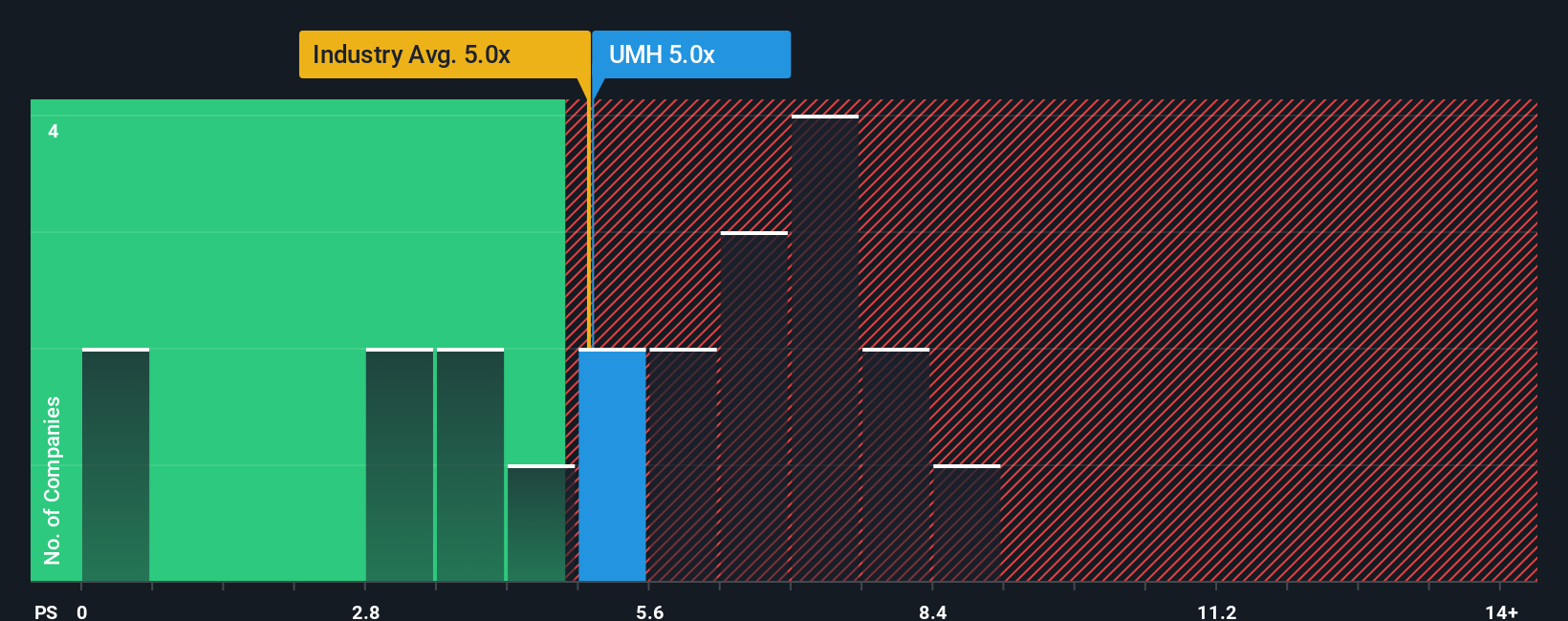

Looking at UMH Properties through the lens of its price-to-sales ratio, the stock trades at 5.1x, which is slightly above the North American Residential REITs industry average of 5.0x. Compared to its peers' average of 5.3x, there is a modest discount, but the current ratio is well above the fair ratio of 3.4x implied by market fundamentals. This gap suggests investors are still baking in optimism, perhaps too much. How long will the market pay a premium for anticipated growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMH Properties Narrative

If you see the numbers differently or want to dive deeper, you can easily build your own view from scratch. Do it your way

A great starting point for your UMH Properties research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your portfolio by targeting opportunities others miss. The smartest investors always have an eye on what’s next; don’t let the best themes pass you by.

- Capitalize on groundbreaking innovation when you assess these 25 AI penny stocks shaping every aspect of the modern economy.

- Boost your passive income. See which businesses are standing out for high yields with these 15 dividend stocks with yields > 3%.

- Seize value now and get ahead of the crowd by finding these 926 undervalued stocks based on cash flows poised for a potential rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UMH

UMH Properties

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that currently owns and operates 144 manufactured home communities containing approximately 26,800 developed homesites, of which 10,600 contain rental homes, and over 1,000 self-storage units.

Established dividend payer and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success