- United States

- /

- Residential REITs

- /

- NYSE:UMH

UMH Properties (UMH): Assessing Valuation After Latest Portfolio Expansion in Georgia

Reviewed by Kshitija Bhandaru

UMH Properties recently expanded its portfolio by acquiring a 130-homesite manufactured home community in Albany, Georgia. While only 32% of sites are currently occupied, this step adds 43 acres to their holdings and signals ongoing growth.

See our latest analysis for UMH Properties.

After a year marked by steady expansion and ongoing dividends, UMH Properties has struggled to inspire much optimism in its share price, with a 1-year total shareholder return of -20.2%. While the company’s acquisition in Georgia hints at long-term growth ambitions, momentum has clearly faded in recent months and the stock is still down 24.8% year-to-date based on price return.

If you’re looking for other property players with strong momentum, it is a great moment to discover fast growing stocks with high insider ownership.

With shares still trading well below analyst targets despite positive revenue and income growth, investors are left to wonder if UMH Properties now offers a genuine value opportunity or if the market has already priced in future upside.

Most Popular Narrative: 26.7% Undervalued

With the most widely followed narrative setting fair value around $19.38, UMH Properties continues to trade well below this target, closing at $14.21. This notable gap highlights what is driving such a high estimate, and whether the market could eventually catch up.

Legislative momentum and regulatory changes are making it easier to develop and expand manufactured housing communities, particularly with HUD's support for innovative housing and zoning reforms; this is expected to unlock new revenue streams and drive NOI growth as UMH brings new sites and communities online.

Want to unpack the fundamental force behind this bullish outlook? The main catalyst is a dramatic shift in profit margins, and a growth trajectory that rivals the sector's best. What is the big number analysts are betting on to justify this premium? Tap through for the bold financial assumptions that fuel this fair value calculation.

Result: Fair Value of $19.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around future acquisitions and a greater reliance on debt could easily disrupt UMH's growth story if conditions shift unfavorably.

Find out about the key risks to this UMH Properties narrative.

Another View: What Do the Multiples Say?

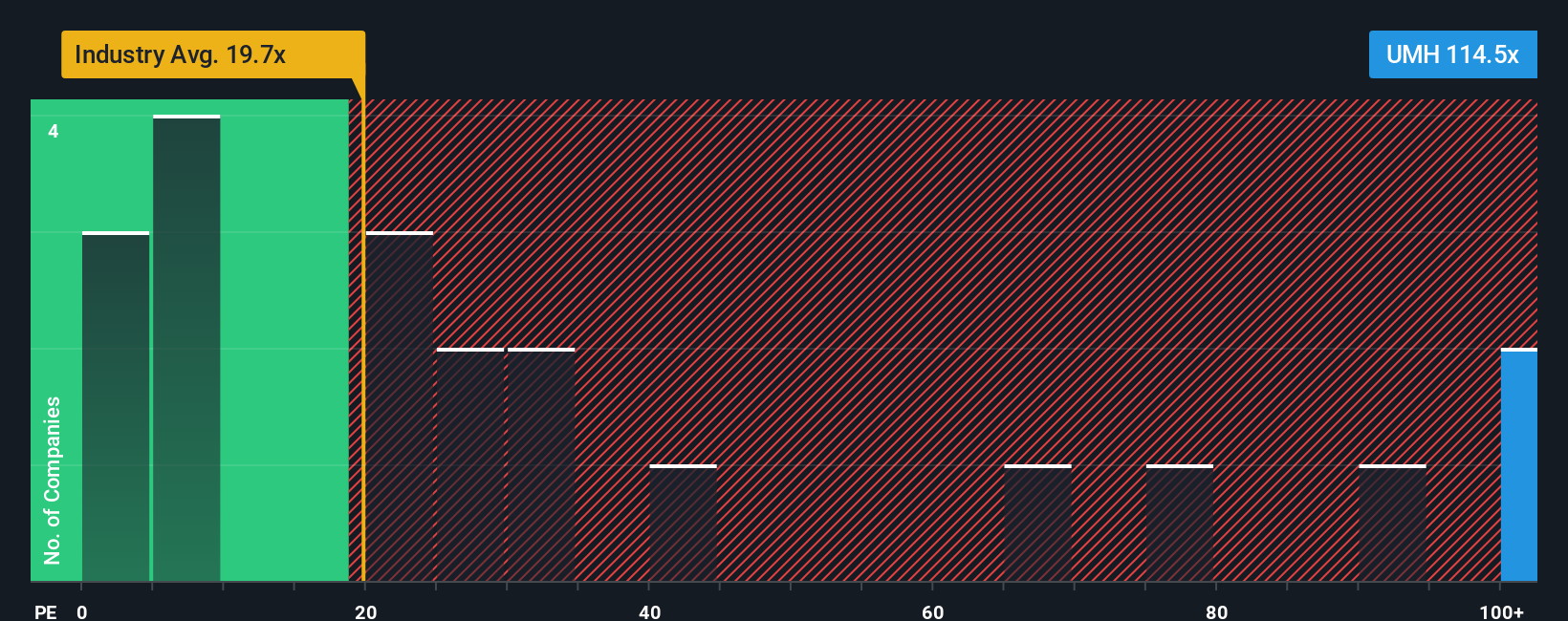

While fair value models suggest UMH Properties is undervalued, a look at its price-to-earnings ratio tells another story. Trading at 115.3x earnings, the stock is far higher than both its industry average of 19.7x and the fair ratio of 50.8x. This sharp premium points to real valuation risk if expectations are not met, leaving investors to consider whether the market is pricing in too much optimism or if there is hidden growth still to come.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMH Properties Narrative

If you see the story differently or want to dive into the data on your own terms, you can easily build and share your perspective in under three minutes. Do it your way.

A great starting point for your UMH Properties research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Supercharge your portfolio by taking action with these hand-picked ideas that could help you find your next winner. Don’t let these pass you by.

- Spot early trends with these 25 AI penny stocks that are pushing the boundaries in artificial intelligence, powering smarter automation, and setting the pace for tomorrow.

- Unlock income potential and reliable cash flow by checking out these 18 dividend stocks with yields > 3% designed to offer steady yields and support long-term wealth building.

- Take advantage of hidden bargains with these 893 undervalued stocks based on cash flows so you never miss an opportunity to grab quality companies at an attractive price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UMH

UMH Properties

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that currently owns and operates 144 manufactured home communities containing approximately 26,800 developed homesites, of which 10,600 contain rental homes, and over 1,000 self-storage units.

Established dividend payer and fair value.

Market Insights

Community Narratives