- United States

- /

- Retail REITs

- /

- NYSE:UE

Urban Edge Properties (UE): Net Margin Plunge Challenges Bullish Valuation Narratives

Reviewed by Simply Wall St

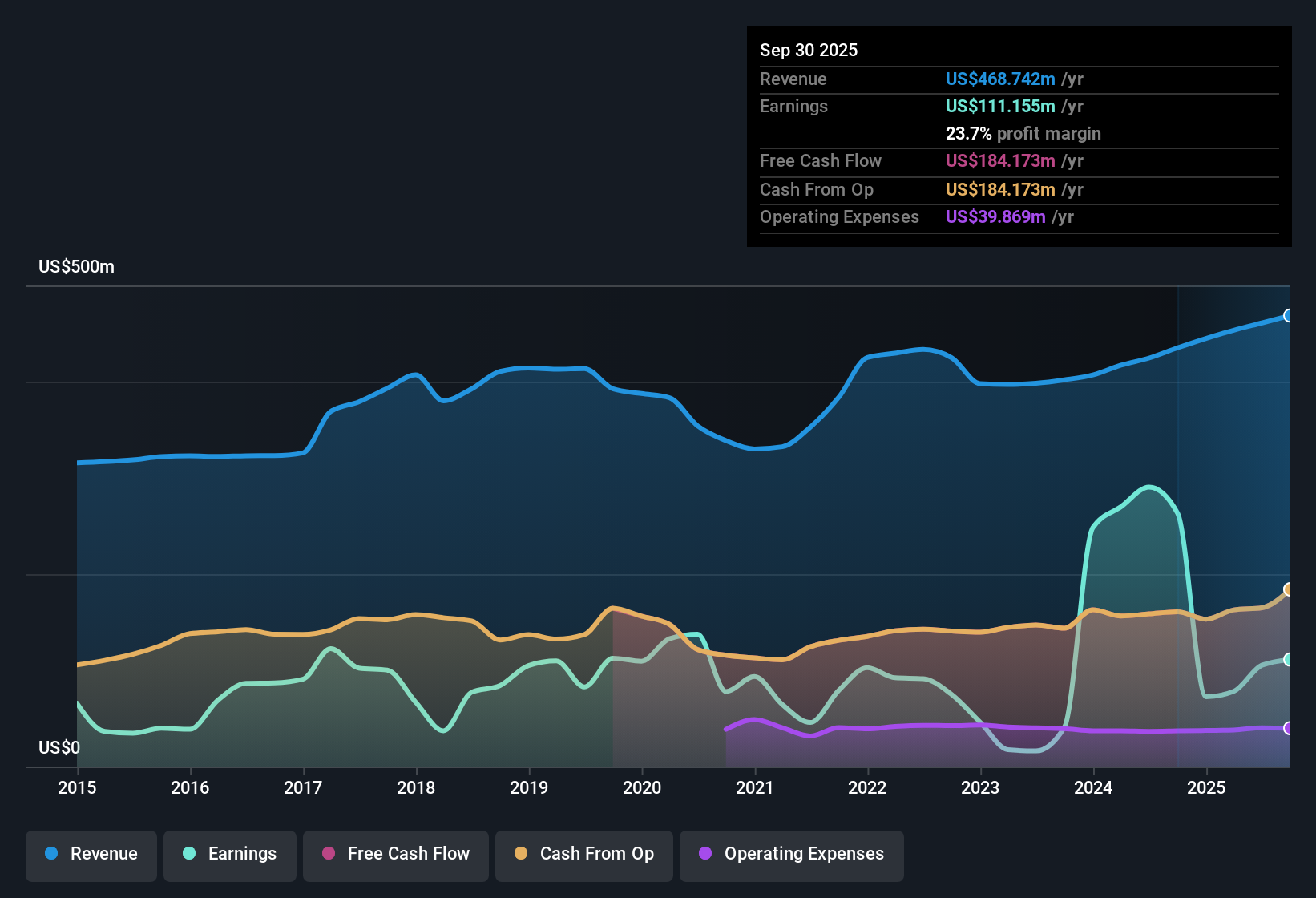

Urban Edge Properties (UE) is navigating a challenging earnings environment, with revenue expected to decline at an annual pace of 3.6% and EPS forecast to tumble by 29.8% per year over the next three years. After years of strong average earnings growth at 18.5% per year, the company recently posted a sharp drop in profitability, as net profit margins contracted to 23.7% from 60.5% a year ago. These results were skewed by a $73.5 million one-off gain that does not reflect ongoing operations. Despite these setbacks, shares are trading at $19.35, a discount to both the estimated fair value of $22.42 and to sector-average valuation multiples. Investors are left to weigh near-term headwinds against apparent value opportunities.

See our full analysis for Urban Edge Properties.Next, we’ll set the latest numbers against the dominant narratives shaping Urban Edge’s story, highlighting where market perceptions hold true and where the data tells a different story.

See what the community is saying about Urban Edge Properties

Net Margins Compressed by 36.8 Percentage Points

- Net profit margins fell from 60.5% last year to 23.7%, a drop of 36.8 percentage points, as recent results included a $73.5 million one-off gain that will not recur in ongoing operations.

- Analysts' consensus view expects further margin pressure, pointing out:

- Consensus forecasts indicate profit margins will shrink from 22.8% today to 7.4% within three years, suggesting that margin compression is expected to persist.

- The consensus narrative highlights that over 70% of major redevelopment projects are now complete. While this should help margins over time, ongoing sector headwinds may outweigh operational gains in the near term.

- Despite ongoing margin contraction and headwinds to earnings, markets see a credible path for Urban Edge to stabilize recurring income via redevelopment and lease renewal. Still, the pace of improvement is likely to be slow given shrinking margins.

- With margins dropping so steeply, analysts are watching whether recent capital recycling efforts and higher-yield acquisitions can provide enough offset to strengthen bottom-line results over time.

Dividend Sustainability Faces New Pressure

- Urban Edge’s declining earnings, with future annual decreases forecast at 29.8%, put renewed strain on the company’s ability to sustain its dividend over the coming years.

- Analysts' consensus view raises concerns about dividend safety, noting:

- Dividend sustainability is questioned as profit margins are projected to compress from 22.8% to 7.4% by 2028, shrinking earnings potential to $36.9 million.

- As recurring earnings fall, management’s assumption that reduced CapEx will fully balance payout obligations could be challenged by persistent tenant churn and shifting market demand.

Share Price Discounts Both Fair Value and Analyst Target

- The current share price of $19.35 is trading below both DCF fair value ($22.42) and the analyst target ($22.86), while the price-to-earnings ratio stands at 21.9x, under industry and peer averages.

- According to the analysts' consensus view:

- The apparent discount reflects a cautious market stance as analysts expect revenues to decline (3.6% per year projected) and question whether Urban Edge can deliver enough operational upside to justify a higher price.

- Consensus also points out that the valuation gap signals skepticism about aggressive growth forecasts and doubts regarding Urban Edge’s ability to sustain prior levels of profitability or earnings growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Urban Edge Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? Share your perspective and shape your own story in just a few minutes. All it takes is Do it your way.

A great starting point for your Urban Edge Properties research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

See What Else Is Out There

Urban Edge’s steeply shrinking margins and tumbling earnings projections raise concerns about its ability to sustain both profitability and dividends in the years ahead.

If reliable payouts matter most to you, check out these 2003 dividend stocks with yields > 3% to discover companies with stronger track records and yields above 3%. These companies may better fit a long-term income strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UE

Urban Edge Properties

A NYSE listed real estate investment trust focused on owning, managing, acquiring, developing, and redeveloping retail real estate in urban communities, primarily in the Washington, D.C.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives