- United States

- /

- Residential REITs

- /

- NYSE:UDR

UDR (UDR): A Fresh Look at the Real Estate REIT’s Valuation After Recent Share Price Declines

Reviewed by Simply Wall St

See our latest analysis for UDR.

UDR’s share price has taken a hit this year, falling nearly 19% year-to-date, and its total shareholder return is also down over the past twelve months. This signals that momentum has been on the softer side, despite some recent rebounds. Investors seem to be recalibrating their expectations based on evolving sector trends and the company’s latest results.

If you’re rethinking your investing strategy, it might be the right moment to broaden your outlook and discover fast growing stocks with high insider ownership

Given the recent declines and the sizeable discount to analyst price targets, the key question is whether UDR’s current share price undervalues its recovery potential, or if the market is already factoring in any future growth. Is there still an opportunity here, or is everything priced in?

Most Popular Narrative: 19.5% Undervalued

UDR’s most widely followed narrative places its fair value nearly 20% above the last close price, implying meaningful upside if projected trends hold. This difference is tied to specific growth forecasts and margin improvements, which underpin the upgraded valuation but have also stirred debate among analysts.

“Portfolio optimization, rotating out of lower-growth assets into higher-yielding East/West Coast and selected Sunbelt markets with robust fundamentals, continues to support higher average rent roll growth and NOI expansion. This is improving UDR's earnings trajectory. Innovations such as smart home upgrades, customer experience initiatives, and offering value-added services (leading to double-digit other income growth) are driving operational efficiencies and tenant retention, likely supporting higher margins and long-term net operating income growth.”

How do record occupancy rates, aggressive innovation bets, and a bold profit margin outlook shape this valuation? The real surprise is what analysts are projecting for UDR’s next earnings jump and future multiple, with numbers rarely seen for REITs. Curious to see the assumptions that power this fair value? Dive deeper for the financial blueprint behind the story.

Result: Fair Value of $42.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained supply pressures in key markets or new regulatory hurdles could quickly undermine the bullish outlook and disrupt UDR’s anticipated recovery narrative.

Find out about the key risks to this UDR narrative.

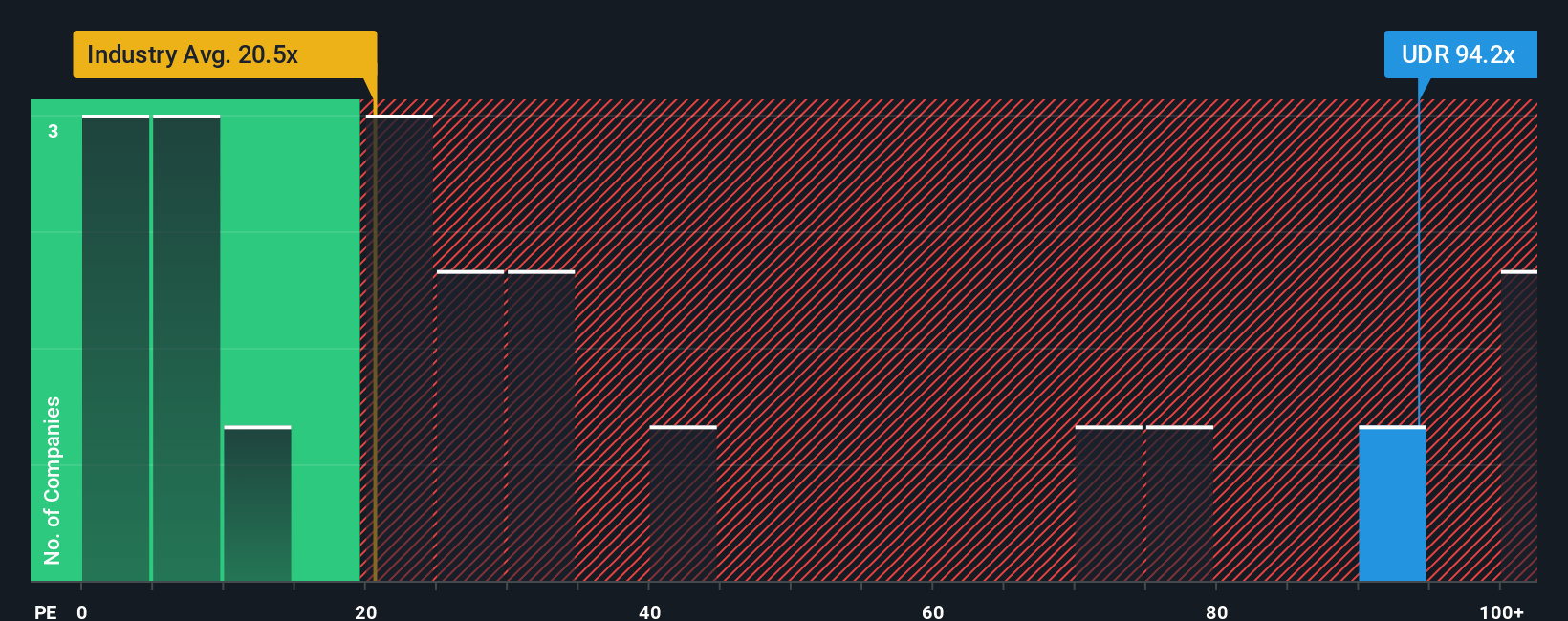

Another View: Market Multiples Tell a Different Story

While the fair value narrative hints at upside, looking at traditional valuation ratios paints a more cautious picture. UDR trades at a whopping 78.6 times earnings, much higher than both its sector peers and even the fair ratio of 34.7. This gulf suggests the market is building in big expectations, or potentially exposing investors to downside if those do not materialize. With such a wide gap, is the opportunity as strong as it looks on paper?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UDR Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own view in just a few minutes. Do it your way

A great starting point for your UDR research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait for the next trend to pass you by when you can get ahead with strategies trusted by savvy investors worldwide, all in one place.

- Unlock potential by targeting steady income streams. Start with these 16 dividend stocks with yields > 3% delivering reliable yields above 3%.

- Get in early on the technological transformation by checking out these 25 AI penny stocks set to shape tomorrow’s markets.

- Capitalize on value opportunities others might overlook by reviewing these 876 undervalued stocks based on cash flows based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives