- United States

- /

- Industrial REITs

- /

- NYSE:TRNO

Is Now the Right Moment for Terreno Realty After Strong Industrial REIT Earnings in 2025?

Reviewed by Bailey Pemberton

If Terreno Realty is on your radar right now, you are definitely not alone. Investors are eyeing its chart, wondering if this is the moment to buy, hold, or just watch from the sidelines. After all, the stock has not exactly been sleeping. In just the past week, shares are up 2.7%, although the past month dipped slightly by 1.8%. Year to date, it has eked out a gain of 1.1%. Looking at a broader timeframe, the last year has been tough, with an 8.0% decline, but Terreno has climbed a solid 24.5% over the last three years and still holds a 7.5% gain over five years. That kind of mixed track record has many asking whether the company's growth story is back on, or if risks are changing in the industrial real estate world.

Part of what makes Terreno so interesting now is how recent macro trends have boosted certain real estate stocks. While not every daily news headline moves the needle, overall market appetite for industrial space, e-commerce expansion, and evolving logistics demands have all contributed to shifting perceptions of value in this sector. For Terreno, that evolving risk-reward profile is starting to show up in valuation scores. By our count, its valuation racks up a score of 4 out of 6 on key checks for being undervalued.

You might be wondering what exactly goes into that score, and whether traditional metrics are giving us the true picture. Let us break down the main approaches to valuing Terreno Realty, and stay tuned—there is an even smarter way to understand if this stock deserves a spot in your portfolio coming up at the end of this article.

Approach 1: Terreno Realty Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of Terreno Realty by forecasting its adjusted funds from operations into the future and then discounting those expected cash flows back to their present value. This approach gives investors a sense of what the company might be worth today, based solely on the money it is expected to generate over time.

Currently, Terreno Realty reports trailing twelve-month free cash flow of $231.9 million. Analysts forecast this to rise steadily, with projections reaching around $375 million by the end of 2029. While analyst estimates cover the next five years, further cash flow assumptions are extrapolated based on typical industry growth rates. All projections in this model are in US dollars and reflect Terreno’s ability to generate cash from its real estate portfolio and operations, rather than just reported profits.

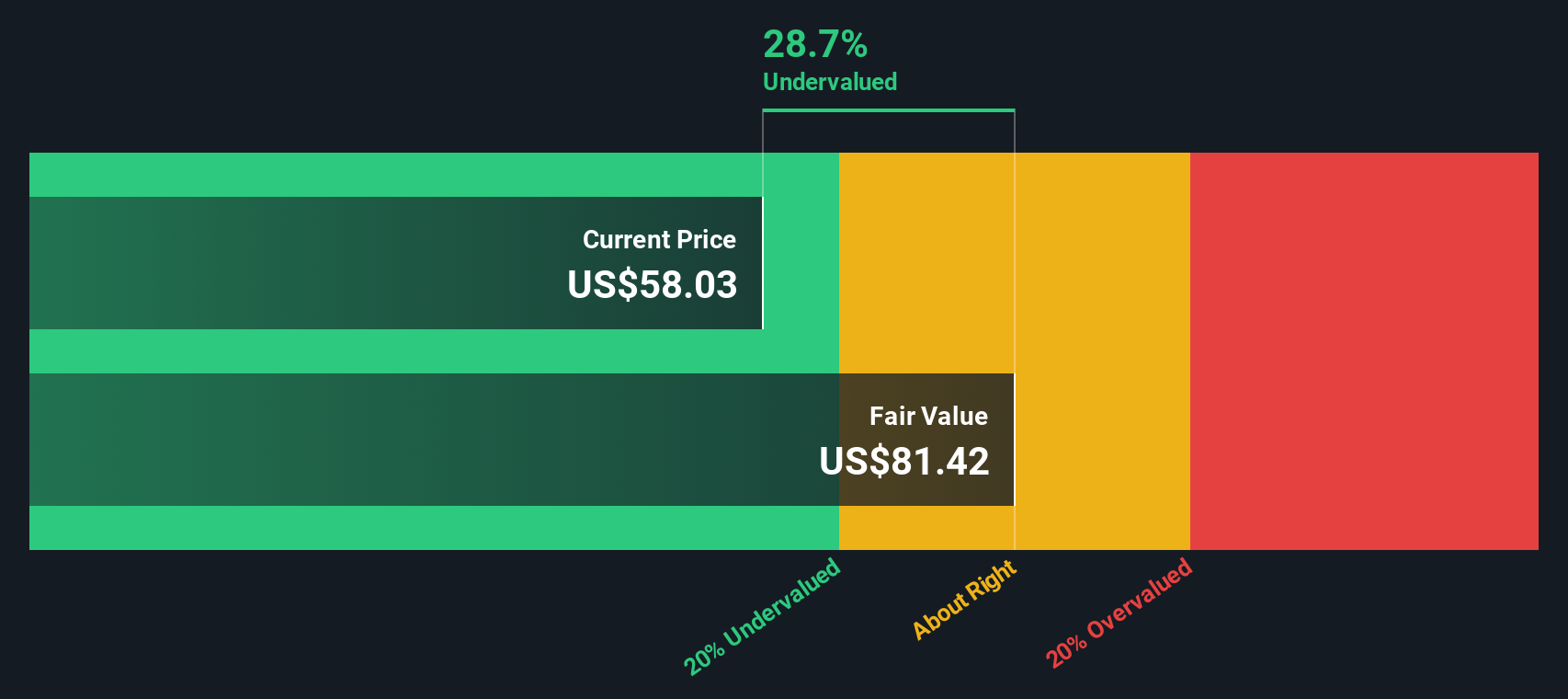

Based on these cash flow assumptions, the DCF model suggests a fair value of $81.37 per share for Terreno Realty. Compared to the current trading price, this represents a 28.7% discount. This suggests the stock is significantly undervalued if the assumptions hold true.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Terreno Realty is undervalued by 28.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Terreno Realty Price vs Earnings (P/E Ratio)

For profitable companies like Terreno Realty, the price-to-earnings (P/E) ratio is a widely used metric to quickly gauge how the market values current and future earnings potential. It is especially relevant for established real estate investment trusts, where consistent profitability offers a solid foundation for this comparison.

Whether a company’s P/E is seen as justified, high, or low often depends on factors like expected earnings growth and risk. Higher growth prospects or lower risk profiles typically warrant a higher P/E, while the reverse can push valuations down. This is why comparing a stock’s P/E to industry averages gives a useful, though sometimes narrow, perspective.

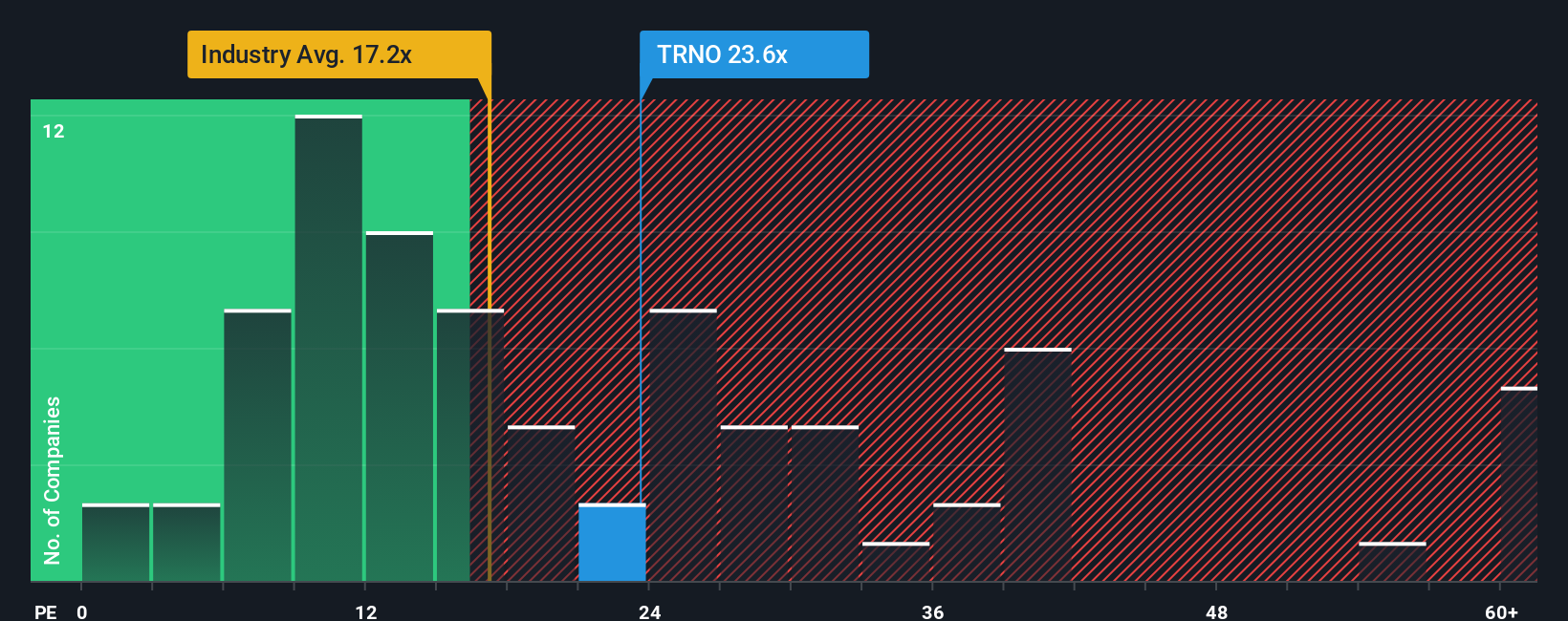

Terreno Realty’s current P/E is 23.7x. Looking at benchmarks, the average P/E for Industrial REIT peers stands at 31.2x, while the wider industry average is somewhat lower at 16.7x. However, Simply Wall St’s proprietary “Fair Ratio” goes a step further by accounting for Terreno’s specific growth outlook, profit margins, and risk profile, along with its industry and market cap. For Terreno, the Fair Ratio is 29.9x, providing a more tailored benchmark than generic peer averages.

Comparing Terreno’s actual P/E of 23.7x to its Fair Ratio of 29.9x suggests the shares are trading below what would be expected given the company’s fundamentals. This may indicate potential undervaluation at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Terreno Realty Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you link a company’s story and outlook directly to your own financial forecasts and fair value estimates. Instead of just relying on past data or someone else’s assumptions, you can outline your view of Terreno Realty’s future, such as where you believe its revenue, earnings, or margins are headed, and see how those beliefs translate into a fair value for the stock.

Narratives make investing much more accessible, allowing you to test your perspectives and share them with the Simply Wall St Community, where millions of investors collaborate and learn. They help guide your buy or sell decisions by letting you compare your calculated Fair Value with the latest market Price. Best of all, Narratives update dynamically as new information, like fresh earnings or market news, comes in so your outlook can stay current.

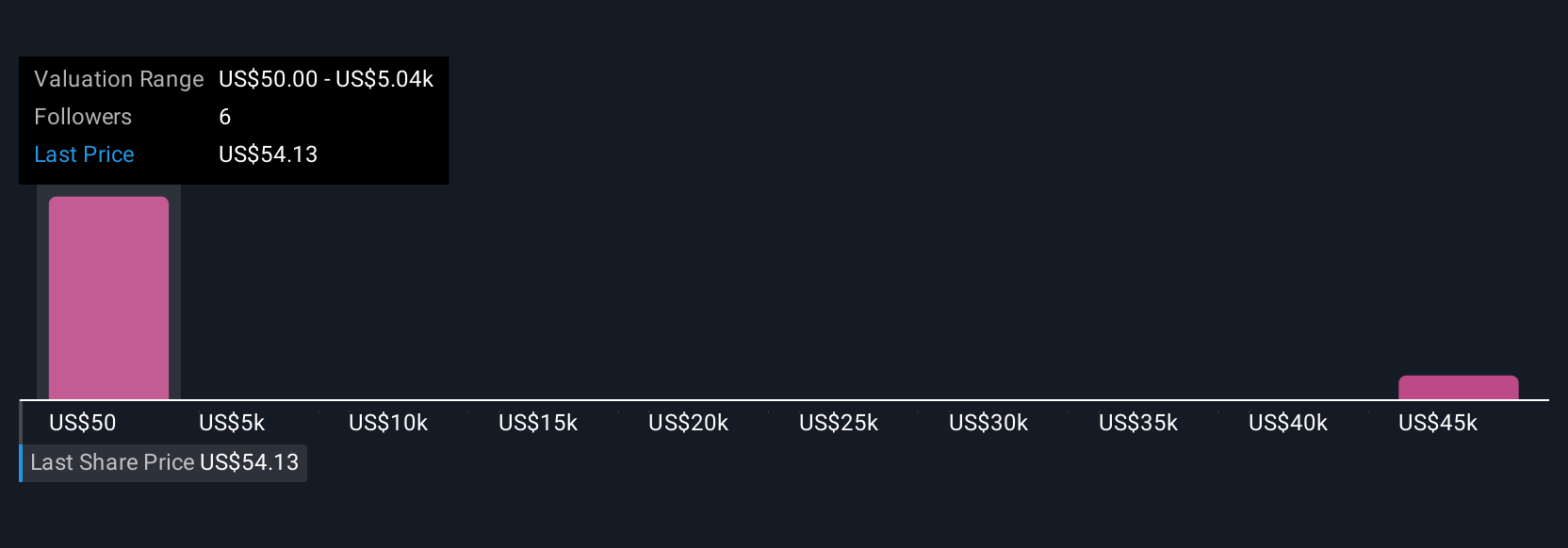

For Terreno Realty, one investor’s Narrative might predict significant upside based on renewed industrial demand, while another may see softer growth ahead and arrive at a much lower fair value, highlighting how Narratives reflect each investor’s unique story and outlook.

Do you think there's more to the story for Terreno Realty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terreno Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRNO

Terreno Realty

Terreno Realty Corporation (“Terreno”, and together with its subsidiaries, the “Company”) acquires, owns and operates industrial real estate in six major coastal U.S.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives