- United States

- /

- Industrial REITs

- /

- NYSE:TRNO

Does Terreno Realty’s Latest Acquisition and Dividend Hike Reveal a Shift in Growth Strategy for TRNO?

Reviewed by Simply Wall St

- Terreno Realty Corporation announced the acquisition of a fully-leased, two-building industrial property in Redondo Beach, California for approximately US$35.5 million, as well as an early renewal of a 52,000-square-foot lease in Washington, D.C. with a wine and spirits distributor commencing April 2026.

- These actions come alongside a 6.1% increase in the quarterly dividend and strong second quarter earnings, highlighting an ongoing approach to growth and shareholder returns.

- We’ll explore how the acquisition of a fully-leased Redondo Beach industrial property fits into Terreno Realty’s evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Terreno Realty's Investment Narrative?

For anyone considering Terreno Realty right now, the core story hinges on faith in the strength and resilience of industrial real estate in U.S. coastal markets. The newly acquired, fully-leased Redondo Beach property underscores a preference for income-producing assets that fit well with Terreno’s ongoing expansion, adding scale and reinforcing a clustered approach near existing holdings. Alongside another early lease renewal, a rising dividend, and positive second quarter earnings, these actions point to a focus on near-term revenue visibility and cash flow reliability. However, the company’s net income surge for the quarter was buoyed by a sizeable one-off gain, so normalized numbers aren't as strong as they first appear. While recent acquisitions shore up stable income, the headline catalysts and risks remain: future earnings are forecast to decline, and valuation multiples are not cheap versus global peers, which may limit price momentum despite operational progress. The Redondo Beach deal enhances property quality but likely won’t materially shift the biggest investor debates just yet, with risk from slower earnings growth and a still-cautious market mood persisting.

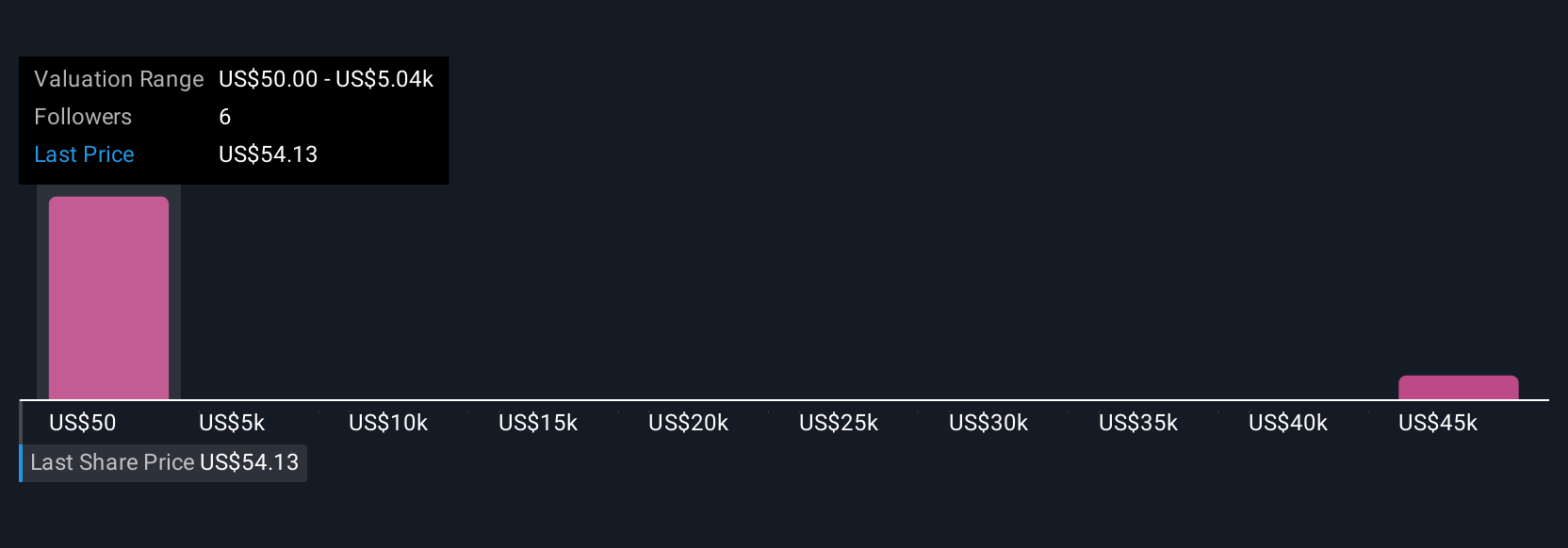

Yet as bright as the dividend story is, earnings growth expectations remain a key concern for shareholders. Despite retreating, Terreno Realty's shares might still be trading 36% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on Terreno Realty - why the stock might be a potential multi-bagger!

Build Your Own Terreno Realty Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terreno Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Terreno Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terreno Realty's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terreno Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRNO

Terreno Realty

Terreno Realty Corporation (“Terreno”, and together with its subsidiaries, the “Company”) acquires, owns and operates industrial real estate in six major coastal U.S.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives