- United States

- /

- Industrial REITs

- /

- NYSE:STAG

STAG Industrial (STAG): Valuation Insights Following Solid Q3 Earnings and Strengthened Investor Confidence

Reviewed by Simply Wall St

STAG Industrial (STAG) reported third-quarter earnings in line with market expectations, with both earnings per share and revenue coming in slightly above projections. The company’s recent results highlight steady operational resilience and sustained investor confidence.

See our latest analysis for STAG Industrial.

STAG Industrial’s share price momentum has picked up. The stock has reached a new 52-week high and is up 19% year-to-date. Despite some recent volatility, the company’s strong operational performance has contributed to an 11% total shareholder return over the past year and a robust 62% total return for long-term holders, indicating steady confidence in its growth potential.

If this kind of momentum has you curious about other standouts, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares trading near recent highs and STAG Industrial showing steady growth, investors are left to wonder if the stock still offers hidden value, or if the market is already pricing in its future potential.

Most Popular Narrative: 4.8% Undervalued

According to the most widely followed narrative, STAG Industrial’s fair value is set slightly above the last close price. This view reflects moderate optimism that the company’s current momentum and improving revenue outlook justify a small upside from current levels.

The analysts have a consensus price target of $38.545 for STAG Industrial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $47.0, and the most bearish reporting a price target of just $35.0.

Want to know how much growth, margin pressure, or expanding share counts are baked into this narrative? The underlying projections may surprise you. The details of this valuation reflect bold assumptions about future market dynamics, demand trends, and STAG’s operational performance. See how these pieces add up to a fair value that has everyone talking.

Result: Fair Value of $41.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Slower lease-up times and shifting tenant demand could challenge occupancy levels and future income growth for STAG Industrial.

Find out about the key risks to this STAG Industrial narrative.

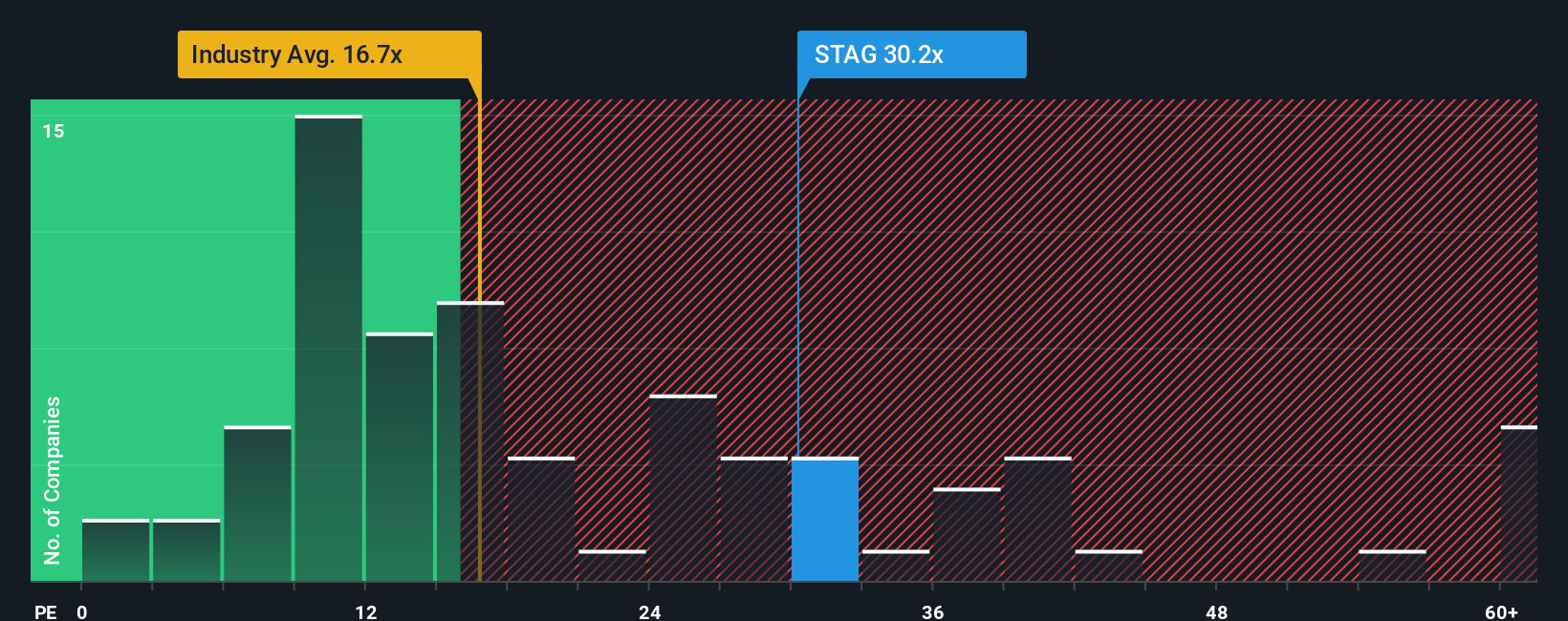

Another View: Multiples Raise a Red Flag

While the fair value estimate points to STAG Industrial being undervalued, a look at its price-to-earnings ratio tells a different story. The stock trades at 30.5x earnings, which is notably higher than the global industrial REITs industry average of 16.2x and just above the peer average of 30.2x. Even so, it is trading very close to its fair ratio of 31x, suggesting there is little room for error if growth expectations slip. Does the market premium signal opportunity or heightened risk for buyers at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAG Industrial Narrative

You might see things differently, or want to examine the numbers before making a decision. Consider putting together your own perspective in just a few minutes. Do it your way

A great starting point for your STAG Industrial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. The next standout stock might be off your radar, but Simply Wall Street’s screener puts smart ideas at your fingertips.

- Unlock high-yield potential by checking out these 15 dividend stocks with yields > 3% that consistently deliver attractive income and stability for your portfolio.

- Target companies at compelling prices using these 921 undervalued stocks based on cash flows to spot hidden gems trading below their intrinsic value before the crowd catches on.

- Get ahead of tomorrow’s trends by scanning these 25 AI penny stocks leading the charge in artificial intelligence across diverse industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STAG

STAG Industrial

A real estate investment trust focused on the acquisition, development, ownership, and operation of industrial properties throughout the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.