- United States

- /

- Retail REITs

- /

- NYSE:SPG

Stanley Shashoua’s New Role Might Change the Case for Investing in Simon Property Group (SPG)

Reviewed by Sasha Jovanovic

- On October 15, 2025, Simon Property Group announced the promotion of Stanley Shashoua to President of International Real Estate, putting him in charge of the company's international portfolio, including 26 International Premium Outlets and stakes in Klépierre SA and McArthurGlen Investments.

- This marks a further emphasis on global expansion and continued oversight of special corporate investments by Mr. Shashoua, who has been closely involved in Simon’s international strategy.

- We’ll now explore how this leadership change, focusing on Simon’s international real estate assets, could influence the company’s broader investment narrative.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Simon Property Group Investment Narrative Recap

To be comfortable as a Simon Property Group shareholder, you need to believe that well-located, experience-driven retail and mixed-use centers will remain resilient and continue to attract strong tenant demand, even as e-commerce grows and consumer preferences evolve. The recent promotion of Stanley Shashoua to President of International Real Estate brings additional leadership focus to Simon’s overseas portfolio, but doesn’t materially alter the near-term catalyst, robust leasing momentum, nor does it address the biggest risk, which remains retailer bankruptcies and associated tenant turnover.

Of the recent company announcements, the Q3 2025 earnings report scheduled for November 3 is most relevant to the current investment narrative, as analysts anticipate an 8.8% increase in funds from operations compared to last year. The upcoming earnings will shed light on whether rental growth and high occupancy rates can continue offsetting risks tied to tenant stability and international expansion.

However, investors should also be alert to the potential impact of persistent retailer bankruptcies, which could start to pressure Simon’s rental income and occupancy if the trend spreads to major tenants...

Read the full narrative on Simon Property Group (it's free!)

Simon Property Group's outlook forecasts $6.2 billion in revenue and $2.4 billion in earnings by 2028. This projection assumes revenue will decline by 0.7% per year, while earnings are expected to rise by $0.3 billion from the current $2.1 billion.

Uncover how Simon Property Group's forecasts yield a $186.45 fair value, a 5% upside to its current price.

Exploring Other Perspectives

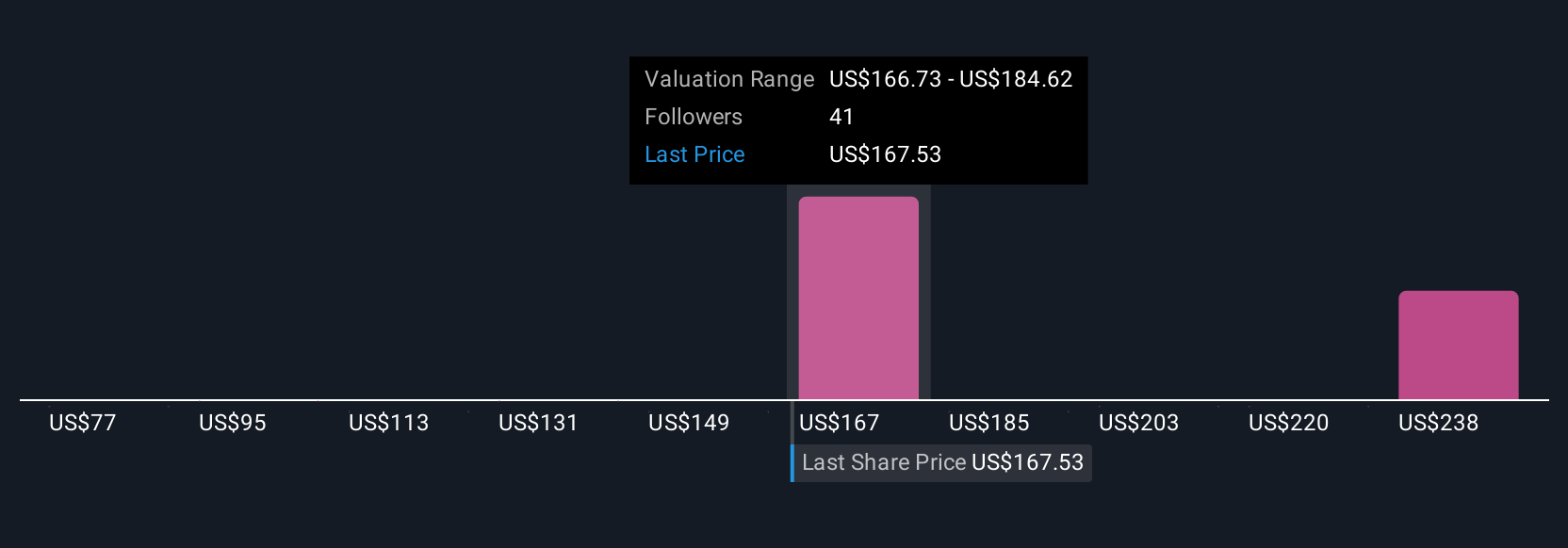

Eight individual fair value estimates from the Simply Wall St Community span US$77.30 to US$246.43 per share, reflecting a wide spectrum of outlooks. Against this, persistent tenant turnover remains a focus, with broad implications for Simon Property Group’s income stability and resilience, compare these varied opinions to your own and consider all angles.

Explore 8 other fair value estimates on Simon Property Group - why the stock might be worth less than half the current price!

Build Your Own Simon Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simon Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simon Property Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives