- United States

- /

- Retail REITs

- /

- NYSE:SPG

Simon Property Group (SPG): Net Margin Declines to 36.4%, Challenging Bullish Valuation Narratives

Reviewed by Simply Wall St

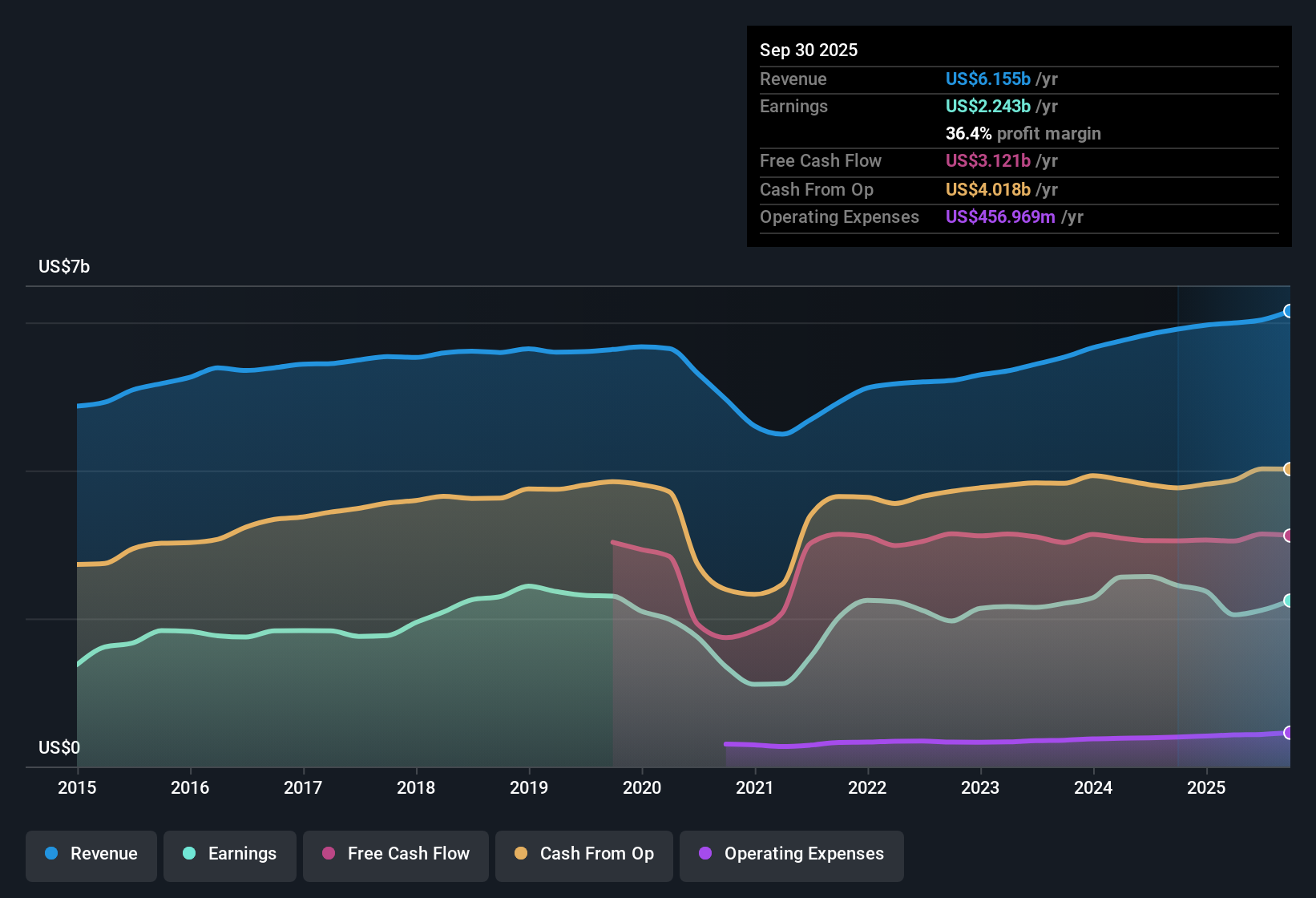

Simon Property Group (SPG) reported a net profit margin of 36.4%, a notable decrease from last year's 41.4%. Earnings have grown at an annual rate of 9.7% over the past five years. Despite high earnings quality, growth is projected to slow as revenue is forecast to rise by just 1.8% per year and EPS by 3.39% per year, both trailing the US market averages. Investors are weighing a muted growth outlook and margin compression against the fact that shares trade below one estimate of fair value. This keeps debates around value and risk firmly in focus.

See our full analysis for Simon Property Group.Next, we compare these headline numbers to the widely discussed narratives shaping market expectations. We look to see where consensus might crack or hold strong.

See what the community is saying about Simon Property Group

Mixed-Use Redevelopment Bolsters Margin Outlook

- Analysts expect Simon’s profit margins to rise from 35.0% now to 38.8% in three years, driven by ongoing mixed-use redevelopments and premium occupancy rates.

- According to the analysts' consensus view, redevelopment of existing properties into experience-focused destinations and high occupancy at flagship centers (such as 99%+ at The Mills and over 96% in Premium Outlets) support long-term margin expansion and earnings power.

- Redevelopment projects, including the Brickell City Centre acquisition, are positioned to diversify income streams and drive incremental revenue beyond traditional retail leasing.

- Persistent strong demand for high-quality locations in dense metropolitan areas underpins the company's ability to command premium lease rates and maintain stable growth.

- Expect analysts to closely monitor redevelopment execution for signs of incremental rent and traffic, as this is key to moving from current margin levels toward the targeted expansion. 📊 Read the full Simon Property Group Consensus Narrative.

Rising Debt and Capex Remain in Focus

- The weighted average interest rate on recent secured loans is 5.84%, and Simon reports $1 billion in development and redevelopment underway, with 40% allocated to mixed-use projects.

- Consensus narrative highlights that rising interest rates and high leverage may pressure earnings growth and dividend coverage, especially if refinancing occurs at less favorable rates.

- Elevated capital expenditures for redevelopment could constrain free cash flow available for dividends, a key watchpoint for income-focused investors.

- The need for ongoing repositioning and property upgrades exposes margins to cost overruns and delays, particularly if tenant demand weakens.

Valuation Discount Versus Peers Despite High P/E

- Simon trades at a 26.6x Price-to-Earnings ratio, above the US Retail REITs industry average of 25.9x but below the peer average of 33.6x. The current share price of $182.59 is also well below the DCF fair value of $261.44.

- Analysts' consensus view notes that this valuation reflects a debate between muted near-term growth and underlying balance sheet strength, with the discount to DCF fair value offset by a premium to industry multiples.

- The current analyst price target of $188.40 sits just 3.2% above the share price, signaling limited upside barring upgrades to growth assumptions or cash flow quality.

- The stock’s value versus peers and DCF measure keeps long-term upside on the table if management executes on redevelopment and occupancy strategies.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Simon Property Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the story another way? Share your perspective by shaping your own narrative in just a few minutes. Do it your way

A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Simon Property Group's margin pressure, slowing earnings growth, and large redevelopment spending raise ongoing concerns over rising debt and financial resilience.

If you'd rather focus on companies with stronger finances, check out solid balance sheet and fundamentals stocks screener (1977 results) with lower leverage and greater balance sheet strength to help safeguard your investments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion