- United States

- /

- Retail REITs

- /

- NYSE:SPG

How Simon Property Group's (SPG) Full Acquisition of Brickell City Centre Has Changed Its Investment Story

Reviewed by Simply Wall St

- Simon Property Group recently reported second-quarter 2025 real estate FFO per share of US$3.05, surpassing expectations amid higher revenues driven by increased occupancy and rents, and announced the full acquisition of Brickell City Centre in Miami.

- This expansion into complete ownership of a major mixed-use asset highlights Simon Property's ongoing commitment to enhancing its portfolio with high-traffic, experience-focused destinations.

- We'll explore how the Brickell City Centre acquisition supports Simon Property's growth strategy and impacts its investment outlook.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Simon Property Group Investment Narrative Recap

To be a shareholder in Simon Property Group, you need conviction in the enduring value of well-located retail and mixed-use destinations, especially as the company pivots toward experience-driven, high-traffic centers. The full acquisition of Brickell City Centre reinforces a core catalyst: strengthening Simon’s portfolio of premium assets, though this news does not fundamentally change the immediate biggest risk, which remains retail tenant turnover and structural shifts in consumer behavior.

Among recent announcements, the Q3 2025 dividend increase to US$2.15 per share stands out and underscores management’s emphasis on returning capital to shareholders amid ongoing redevelopment and expansions like Brickell City Centre. This gesture signals confidence but is also set against persistent risks around tenant bankruptcies and cash flow coverage.

But while full ownership of Brickell City Centre is a growth milestone, investors should be aware that persistent retailer bankruptcies still pose a structural risk to Simon’s...

Read the full narrative on Simon Property Group (it's free!)

Simon Property Group is forecast to achieve $6.2 billion in revenue and $2.4 billion in earnings by 2028. This projection assumes an annual revenue decline of 0.7% and an earnings increase of $0.3 billion from the current earnings of $2.1 billion.

Uncover how Simon Property Group's forecasts yield a $184.05 fair value, in line with its current price.

Exploring Other Perspectives

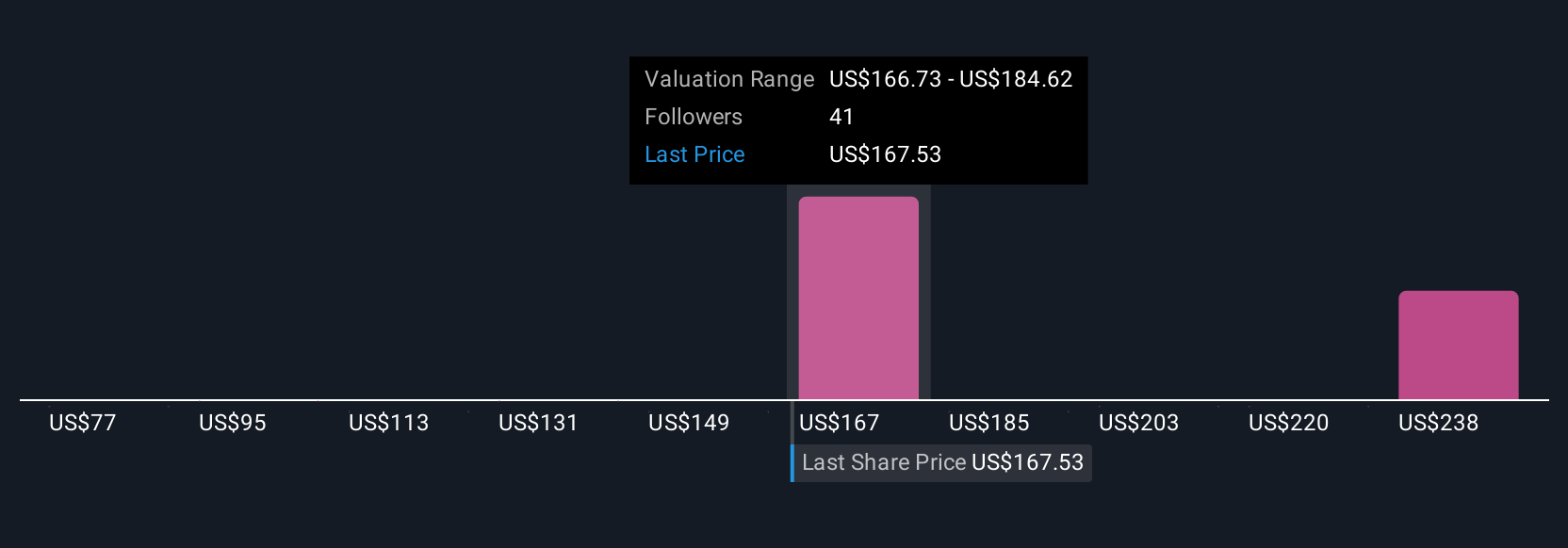

Nine community members on Simply Wall St assigned fair values for Simon Property Group ranging from US$77.30 to US$238.80, reflecting diverse outlooks. Given ongoing tenant turnover, your perspective on risk and reward could differ significantly from consensus.

Explore 9 other fair value estimates on Simon Property Group - why the stock might be worth less than half the current price!

Build Your Own Simon Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simon Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simon Property Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion