- United States

- /

- Office REITs

- /

- NYSE:SLG

SL Green Realty (SLG): Evaluating Valuation Following $1.4 Billion 11 Madison Avenue Refinance and Times Square Moves

Reviewed by Kshitija Bhandaru

SL Green Realty (NYSE:SLG) just wrapped up a $1.4 billion refinancing of 11 Madison Avenue, a key Manhattan office tower. The deal highlights continued institutional interest in Class A New York real estate, even as market dynamics shift.

See our latest analysis for SL Green Realty.

While SL Green Realty’s eye-catching $1.4 billion refinancing grabs headlines, the company has also been active on the retail front, tying down new deals at a marquee Times Square property. Despite these strategic moves and robust institutional demand for its assets, recent momentum has yet to translate into significant gains. Over the past year, the stock’s total shareholder return remains down 6.9%, even as longer-term returns have edged back into positive territory. Investors appear cautious, weighing near-term headwinds against the company’s ability to navigate a changing real estate landscape.

If you’re interested in uncovering what else is catching institutional attention, this is the perfect moment to check out fast growing stocks with high insider ownership.

With these high-profile moves making headlines, the question for investors becomes clear: is SL Green’s recent weakness a sign of a bargain, or is the current price already factoring in the company’s potential rebound?

Most Popular Narrative: 6.2% Undervalued

Consensus estimates put SL Green Realty's fair value at $63.28 per share, about 6% above the last close of $59.33. This signals a modest upside based on a blend of strategic catalysts and future earnings potential.

Portfolio optimization and disciplined capital recycling, including strategic dispositions and realizing significant gains on debt and preferred equity investments, are strengthening liquidity, setting the stage for new accretive investments, and reducing interest expense to enhance future earnings growth.

How did analysts get here? There are bold shifts in earnings, revenue, and profit margin forecasts baked into this valuation. The biggest surprises are under the surface; discover which future leaps are expected to justify today's premium price.

Result: Fair Value of $63.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and unpredictable lease turnovers could present challenges to SL Green's recovery, limiting future rent growth and earnings momentum.

Find out about the key risks to this SL Green Realty narrative.

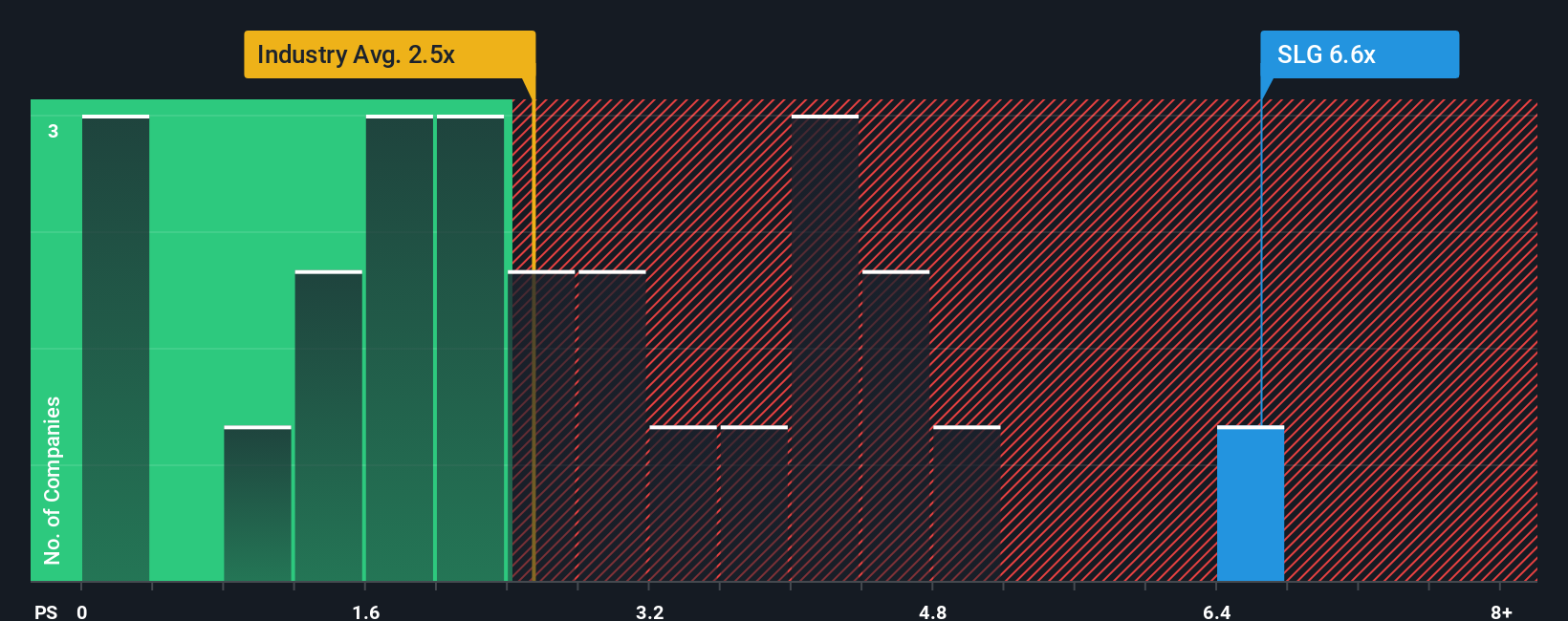

Another View: Multiples Tell a Different Story

Looking at the numbers through the lens of price-to-sales, SL Green Realty trades at 6.6 times sales, considerably above both the industry average of 2.5 and a fair ratio of 2.1. The premium is hard to miss and raises real questions about whether today's price reflects opportunity, optimism, or risk. Could the market be too confident in a rebound, or is there something analysts are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SL Green Realty Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can easily shape your own perspective in just a few minutes. Do it your way

A great starting point for your SL Green Realty research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always look beyond the headlines. Unlock unique opportunities and cutting-edge companies picked for their standout growth, tech momentum, or steady income potential using the Simply Wall Street Screener. Don’t let fresh opportunities pass you by.

- Uncover hidden gems with potential for rapid growth by checking out these 3568 penny stocks with strong financials in the market right now.

- Capitalize on tomorrow’s technology by targeting these 25 AI penny stocks, which are positioned at the forefront of artificial intelligence innovation.

- Supercharge your portfolio’s income stream when you investigate these 19 dividend stocks with yields > 3%. These consistently deliver strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLG

SL Green Realty

SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial properties.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives