- United States

- /

- Office REITs

- /

- NYSE:SLG

Should SL Green Realty’s (SLG) 11 Madison Avenue Refinance Signal Shifting Strategies in Manhattan Office Markets?

Reviewed by Sasha Jovanovic

- SL Green Realty Corp., in collaboration with PGIM, recently completed a US$1.4 billion refinancing for 11 Madison Avenue in Manhattan, securing a five-year fixed-rate loan led by multiple global financial institutions and finalizing retail property transactions in Times Square, including a discounted debt acquisition and new interim lease agreements.

- This move highlights SL Green's focus on strengthening liquidity and showcasing proactive management of both its office and retail portfolios in New York's most competitive corridors.

- We'll explore how the successful refinancing of 11 Madison Avenue signals investor confidence and enhances SL Green Realty's investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

SL Green Realty Investment Narrative Recap

To see value in SL Green Realty, shareholders need to believe premium Manhattan office and retail assets can weather today’s pressures and generate resilient cash flow, even as interest expenses and leasing risks persist. The recent US$1.4 billion refinancing at 11 Madison Avenue addresses short-term liquidity and debt-market access, but does not materially change the fundamental near-term catalysts or mitigate the company's core risk: high debt levels amidst delayed asset sales and elevated vacancies.

Among recent announcements, the Times Square retail property transactions are directly relevant, reflecting ongoing portfolio management and incremental leasing progress in an otherwise uncertain market for both office and retail assets.

But despite headline refinancing wins, investors should also watch for shifts in Manhattan’s leasing fundamentals and what happens if...

Read the full narrative on SL Green Realty (it's free!)

SL Green Realty's narrative projects $659.6 million revenue and $70.6 million earnings by 2028. This requires a 1.0% yearly revenue decline and a $108.8 million increase in earnings from -$38.2 million today.

Uncover how SL Green Realty's forecasts yield a $63.28 fair value, a 7% upside to its current price.

Exploring Other Perspectives

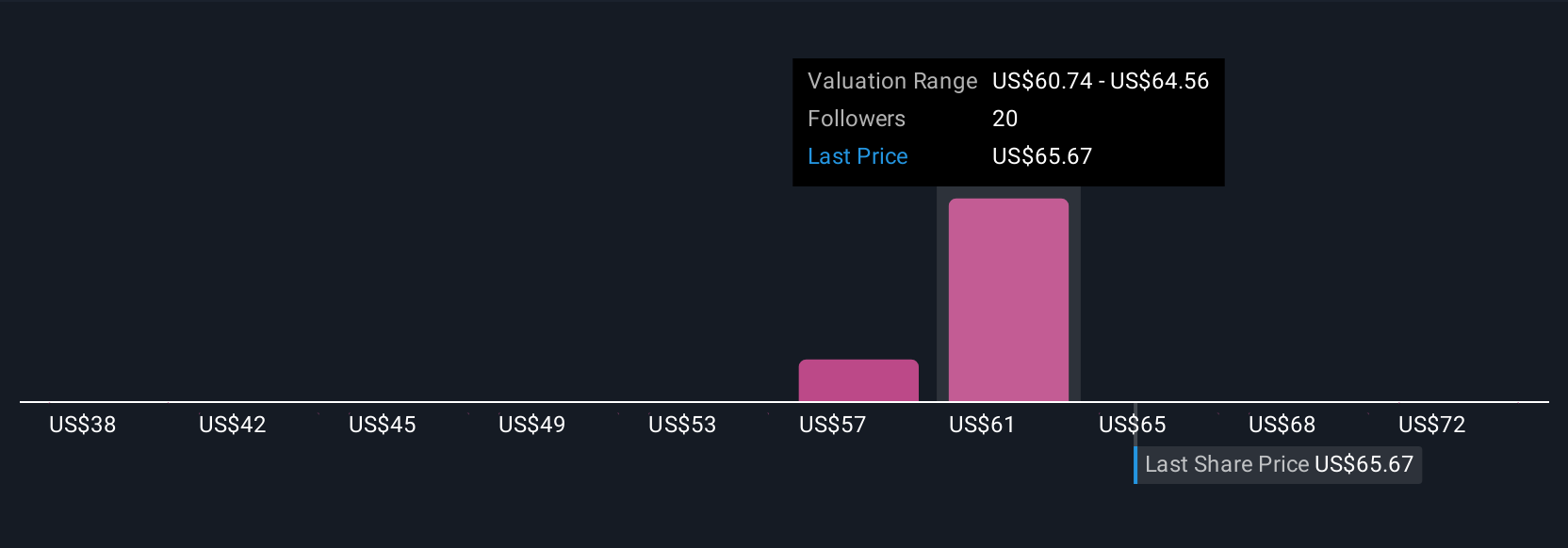

Four individual fair value estimates from the Simply Wall St Community span US$37.86 to US$76 per share, a broad range that reflects diverse outlooks on SL Green. Many cite the risk of prolonged high interest rates and delayed asset sales as an ongoing concern affecting future margins and returns, highlighting why your own expectations may differ from others and inviting you to explore more viewpoints.

Explore 4 other fair value estimates on SL Green Realty - why the stock might be worth as much as 28% more than the current price!

Build Your Own SL Green Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SL Green Realty research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free SL Green Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SL Green Realty's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLG

SL Green Realty

SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial properties.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives