- United States

- /

- Office REITs

- /

- NYSE:SLG

Does SL Green’s Midtown East Acquisition Signal a Strategic Shift for SLG’s Office Portfolio?

Reviewed by Simply Wall St

- SL Green Realty Corp. has entered into a contract to acquire 346 Madison Avenue and 11 East 44th Street for US$160.0 million, with the transaction expected to close in the fourth quarter of 2025, subject to customary closing conditions.

- This acquisition opens the possibility for a modern, high-capacity office development in Midtown East, aligning with strong tenant demand for premium workspaces in one of Manhattan's most sought-after locations.

- We'll assess how this major Midtown East acquisition enhances SL Green Realty's ability to meet Manhattan's growing appetite for state-of-the-art office space.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

SL Green Realty Investment Narrative Recap

To be a shareholder in SL Green Realty, you need to believe that high-quality office space in Midtown Manhattan remains in demand and that redeveloping prime sites will drive long-term value. While the acquisition of 346 Madison Avenue and 11 East 44th Street strengthens the company’s future development pipeline, it does not immediately change the most important short-term catalyst, timely asset sales, or mitigate the biggest current risk from elevated interest costs and uncertain disposition timing.

Of the recent company announcements, the signing of sizable leases at One Madison Avenue stands out. Securing tenants like IBM and Sigma Computing highlights the ongoing leasing momentum for modern Manhattan office space, directly supporting the near-term catalyst of occupancy gains, which helps offset some pressure from financing risks and potential lease rollovers.

However, investors should also consider that, unlike growing leasing activity, persistent high interest rates and delayed asset sales could...

Read the full narrative on SL Green Realty (it's free!)

SL Green Realty's outlook anticipates $659.6 million in revenue and $70.6 million in earnings by 2028. This represents a -1.0% annual decline in revenue and a $108.8 million increase in earnings from the current level of -$38.2 million.

Uncover how SL Green Realty's forecasts yield a $63.28 fair value, a 5% upside to its current price.

Exploring Other Perspectives

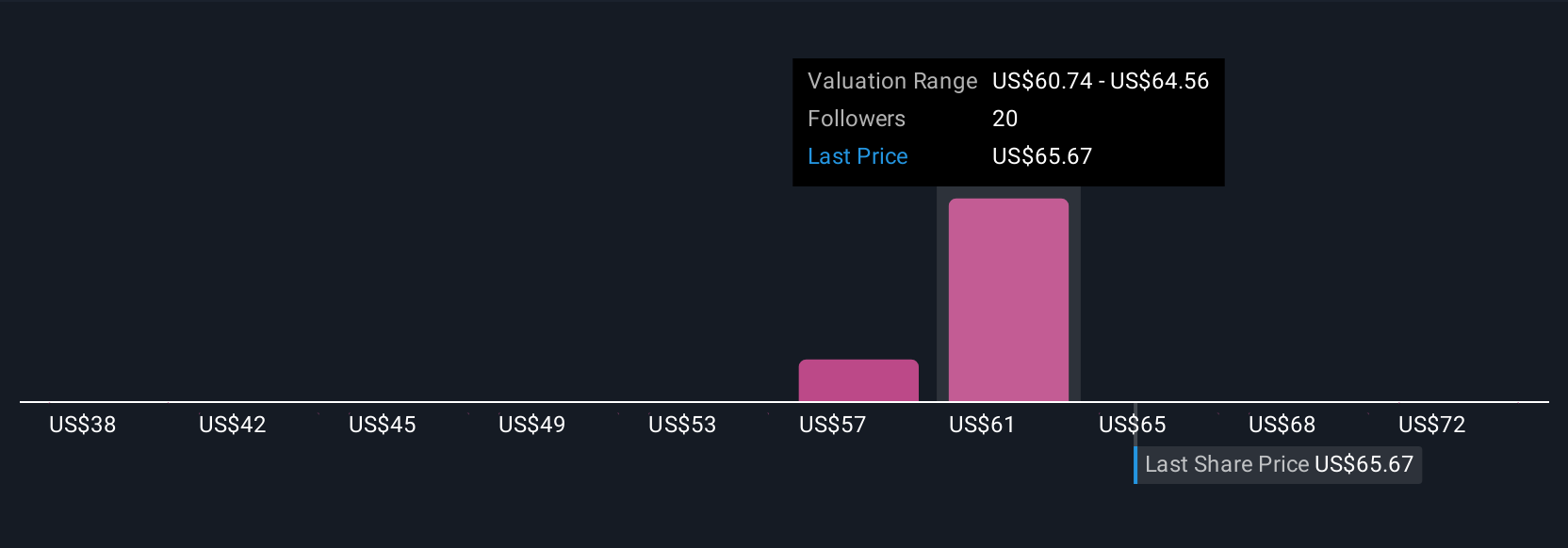

Four Simply Wall St Community members estimate SL Green’s fair value anywhere from US$37.86 to US$76 per share. While expectations vary, the risk of continued high interest expenses and delayed property sales is front of mind for many and could shape the company’s progress. Explore these diverse viewpoints to understand how differently market participants weigh the outlook.

Explore 4 other fair value estimates on SL Green Realty - why the stock might be worth 37% less than the current price!

Build Your Own SL Green Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SL Green Realty research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free SL Green Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SL Green Realty's overall financial health at a glance.

No Opportunity In SL Green Realty?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLG

SL Green Realty

SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial properties.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives