- United States

- /

- Retail REITs

- /

- NYSE:SKT

Tanger (SKT): Valuation Check After Zacks Rank 2 Upgrade on Rising Earnings Estimates

Reviewed by Simply Wall St

Tanger (SKT) just picked up a Zacks Rank 2, or Buy, after analysts lifted their earnings estimates, a signal that the fundamentals of its outlet-heavy retail portfolio are quietly improving beneath the recent share gains.

See our latest analysis for Tanger.

Those higher earnings expectations are landing at a time when momentum is quietly building, with the share price at about $34.41 and a solid multi year total shareholder return suggesting patient investors have already been well rewarded.

If Tanger’s steady improvement has your attention, this could be a good moment to see what else is working in retail and beyond with fast growing stocks with high insider ownership

Yet with shares hovering just below analysts’ targets and trading at a noticeable discount to some intrinsic value estimates, the real question now is whether Tanger remains a buy or if the market has already priced in the growth.

Most Popular Narrative Narrative: 6.3% Undervalued

The most widely followed narrative sees Tanger’s fair value modestly above the last close, framing today’s price as a potential entry point rather than an exit.

Tanger's active remerchandising and ongoing addition of differentiated brands and experiential tenants (such as food, beverage, and entertainment) is drawing new customer demographics and increasing dwell times, which has led to notable leasing spreads and supports continued rental income growth and margin improvement.

Curious how steady rent growth, rising margins and a richer earnings mix can point to a higher fair value than today’s price? See the full blueprint.

Result: Fair Value of $36.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if e commerce gains more share or key national tenants retrench, which could pressure occupancy, rent growth and margin expansion.

Find out about the key risks to this Tanger narrative.

Another Lens on Value

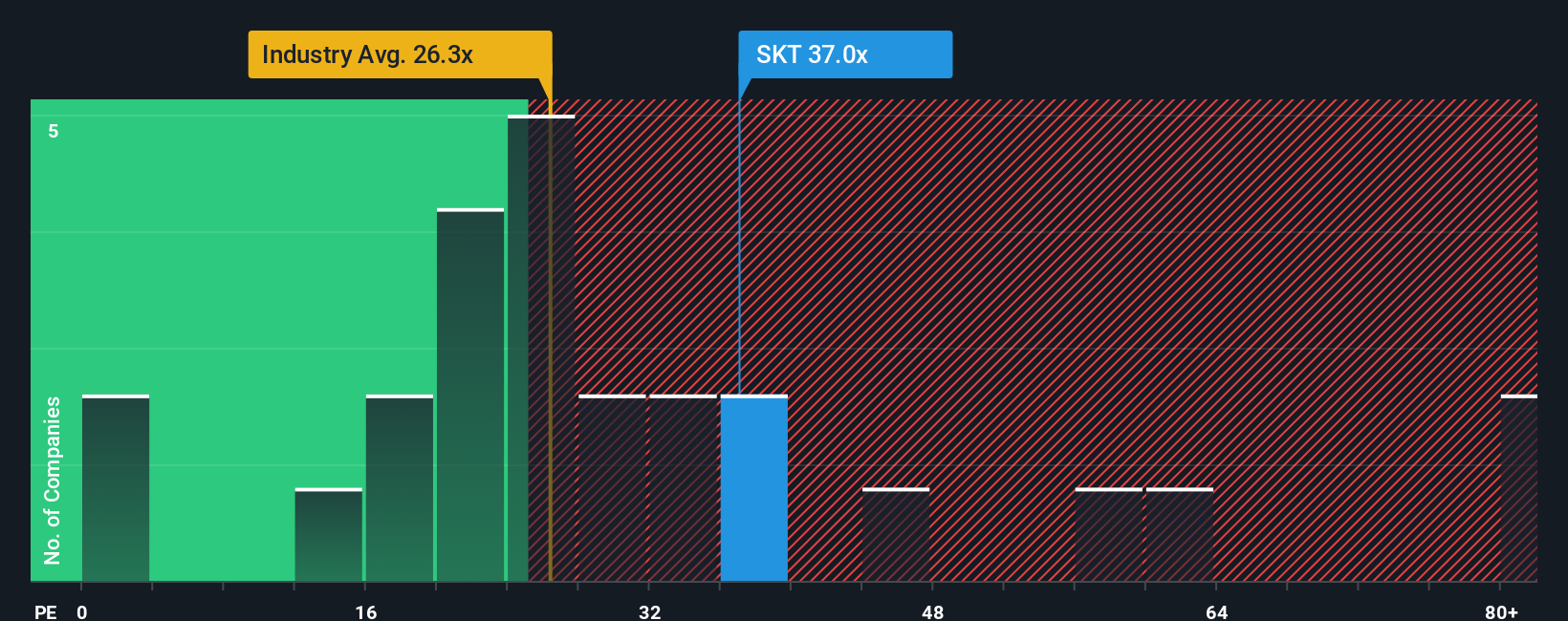

While the narrative model suggests Tanger is modestly undervalued, its 37x price to earnings ratio looks punchy against a fair ratio of 33.9x and the US Retail REITs average of 27.4x. That gap hints at valuation risk, not a bargain, if sentiment or growth expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tanger Narrative

If you see Tanger’s story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes using Do it your way.

A great starting point for your Tanger research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Move now to uncover fresh opportunities beyond Tanger using Simply Wall Street’s powerful screener tools so you do not miss the next market leaders.

- Capitalize on potential bargain opportunities by targeting companies screened as these 916 undervalued stocks based on cash flows based on their future cash flows and fundamentals.

- Ride structural growth trends in automation and machine learning by focusing on these 24 AI penny stocks shaping tomorrow’s digital economy.

- Strengthen your income strategy by filtering for these 13 dividend stocks with yields > 3% that can help support long term, cash generating portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tanger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKT

Tanger

Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 44 years of expertise in the retail and outlet shopping industries.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion