- United States

- /

- Health Care REITs

- /

- NYSE:SILA

Sila Realty Trust (SILA): Evaluating Valuation After Analyst Spotlight and $70 Million Healthcare Portfolio Expansion

Reviewed by Simply Wall St

Sila Realty Trust (SILA) has caught investor attention following two key developments. Wolfe Research has newly started their coverage of the company, and Sila expanded its healthcare real estate portfolio with a $70 million acquisition.

See our latest analysis for Sila Realty Trust.

Despite Sila Realty Trust’s latest $70 million acquisition and the fresh analyst spotlight, momentum has cooled recently, with a 1-year total shareholder return of -2.15%. While the company remains active and focused on growth, the market response suggests investors are watching for more convincing signs of upside ahead.

Curious where else healthcare real estate potential might show up? Take the next step and explore the opportunity with our See the full list for free.

The question now is whether Sila Realty Trust’s recent underperformance means the stock is undervalued, or if investors have already priced in its growth prospects, which could leave little room for upside from here.

Most Popular Narrative: 19.8% Undervalued

With the most widely followed fair value estimate at $29.62, Sila Realty Trust’s latest close of $23.76 emerges as a notable discount. The market appears to be factoring in less ambitious growth than the outlook set by leading narrative sources, setting up a stark comparison for potential investors.

Sila Realty Trust is benefitting from structural tailwinds related to the growing demand for healthcare facilities from the "aging adult" demographic and the increasing focus on necessity-based outpatient and post-acute care. This trend supports stable long-term occupancy and predictable revenue from long lease terms with annual rent escalators, supporting both revenue growth and margin stability.

Earnings growth and margin stability are the engines behind this bullish view. The most surprising part is how those numbers come together to justify such a significant premium. Want to discover the key assumptions, bold projections, and financial runway fueling this valuation? Dive into the full narrative to uncover what the current stock price might be missing.

Result: Fair Value of $29.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated interest expenses or unexpected tenant distress could quickly disrupt Sila Realty Trust's growth thesis and challenge even the most optimistic forecasts.

Find out about the key risks to this Sila Realty Trust narrative.

Another View: Looking Through a Different Lens

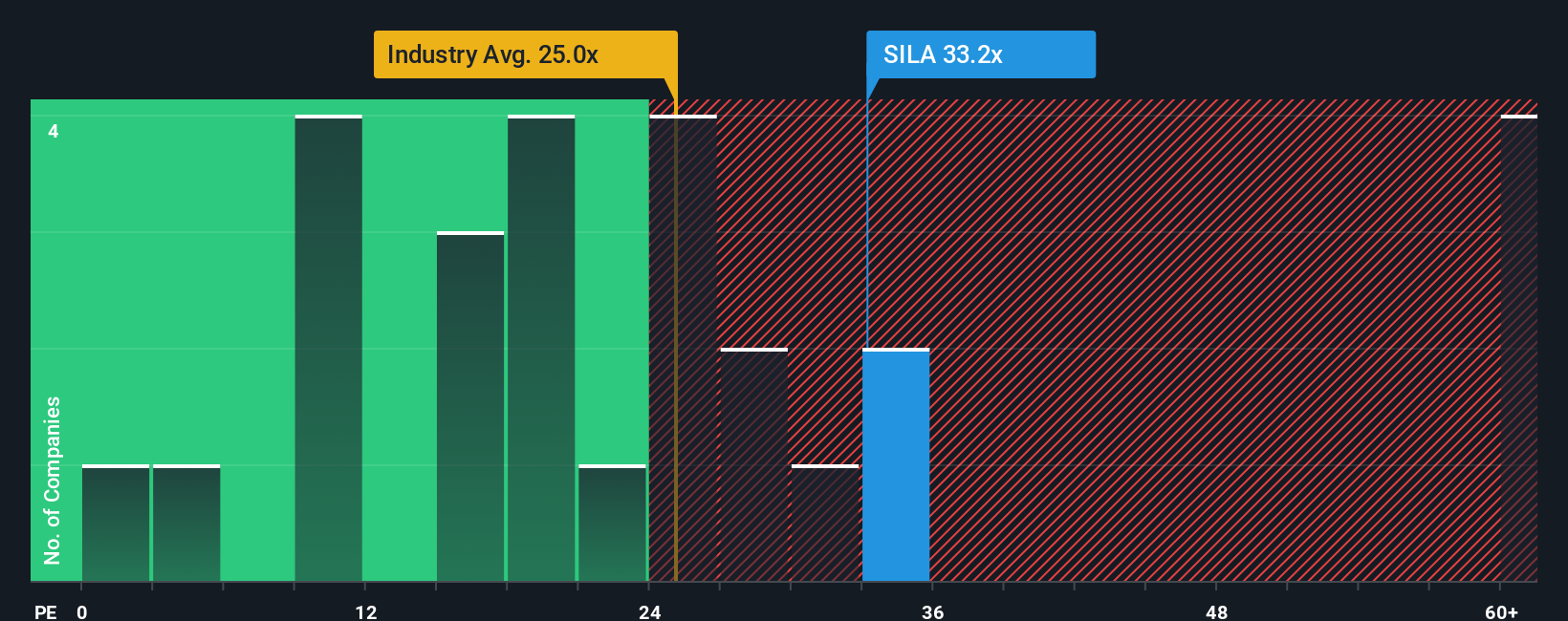

While narrative-driven fair value estimates suggest Sila Realty Trust is undervalued, its price-to-earnings ratio tells a more cautious story. Currently at 33.1x, the ratio is well above the global health care REIT industry average of 24.3x, though below the peer average of 41.8x. Compared to the fair ratio of 35.7x, the current market price leaves little cushion for disappointment. Does this signal strong growth potential or reveal valuation risk hidden beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sila Realty Trust Narrative

If you're not convinced by these perspectives or want to draw your own conclusions, you can easily put together your own analysis in just a few minutes with our Do it your way.

A great starting point for your Sila Realty Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on today’s market shifts and open your mind to unique opportunities that go beyond the obvious. Don’t let these exciting stock prospects pass you by. Your portfolio will thank you.

- Boost your potential returns as you zero in on these 879 undervalued stocks based on cash flows fueled by robust cash flows and attractive pricing that the market may be overlooking.

- Ride the next tech megatrend by targeting these 25 AI penny stocks leading progress in artificial intelligence, automation, and digital transformation.

- Secure stable income streams when you investigate these 17 dividend stocks with yields > 3% that consistently deliver strong yields above 3% to shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives