- United States

- /

- Health Care REITs

- /

- NYSE:SILA

How Will Wolfe Research Coverage and New Acquisitions Shape Sila Realty Trust’s (SILA) Healthcare Strategy?

Reviewed by Sasha Jovanovic

- Wolfe Research recently initiated coverage on Sila Realty Trust with a Peerperform rating, while Sila expanded its healthcare real estate portfolio by acquiring two inpatient rehabilitation facilities for US$70.3 million.

- This combination of new analyst attention and portfolio expansion highlights Sila Realty Trust's focus on high-quality healthcare properties and investor interest in its sector positioning.

- We'll explore how Sila's recent rehabilitation facility acquisition informs the company's evolving investment narrative and future growth outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sila Realty Trust Investment Narrative Recap

To be a Sila Realty Trust shareholder, you need to believe its focused healthcare property portfolio, supported by demographic trends and long-term leases, can drive steady, resilient income. The latest analyst coverage and portfolio acquisition reinforce management’s sector commitment but do not materially change the key short-term catalyst: continued property acquisitions delivering accretive cash flow, or the biggest risk, interest expense pressures from recent financing and ongoing acquisition activity, which could compress margins if rates stay elevated.

Among recent announcements, the US$70.3 million acquisition of two inpatient rehabilitation facilities is particularly relevant, illustrating the company’s efforts to increase exposure to high-demand medical properties. As Sila pursues deals like this, the immediate benefit is clearer visibility on future rental income, but it also places increased importance on keeping net financing costs contained, as property expansion is often debt-funded.

On the other hand, investors should be aware that if borrowing costs remain high, Sila’s ability to translate acquisitions into meaningful cash flow growth could be at risk...

Read the full narrative on Sila Realty Trust (it's free!)

Sila Realty Trust's narrative projects $243.6 million in revenue and $54.7 million in earnings by 2028. This requires 8.7% yearly revenue growth and a $15.2 million earnings increase from current earnings of $39.5 million.

Uncover how Sila Realty Trust's forecasts yield a $29.62 fair value, a 23% upside to its current price.

Exploring Other Perspectives

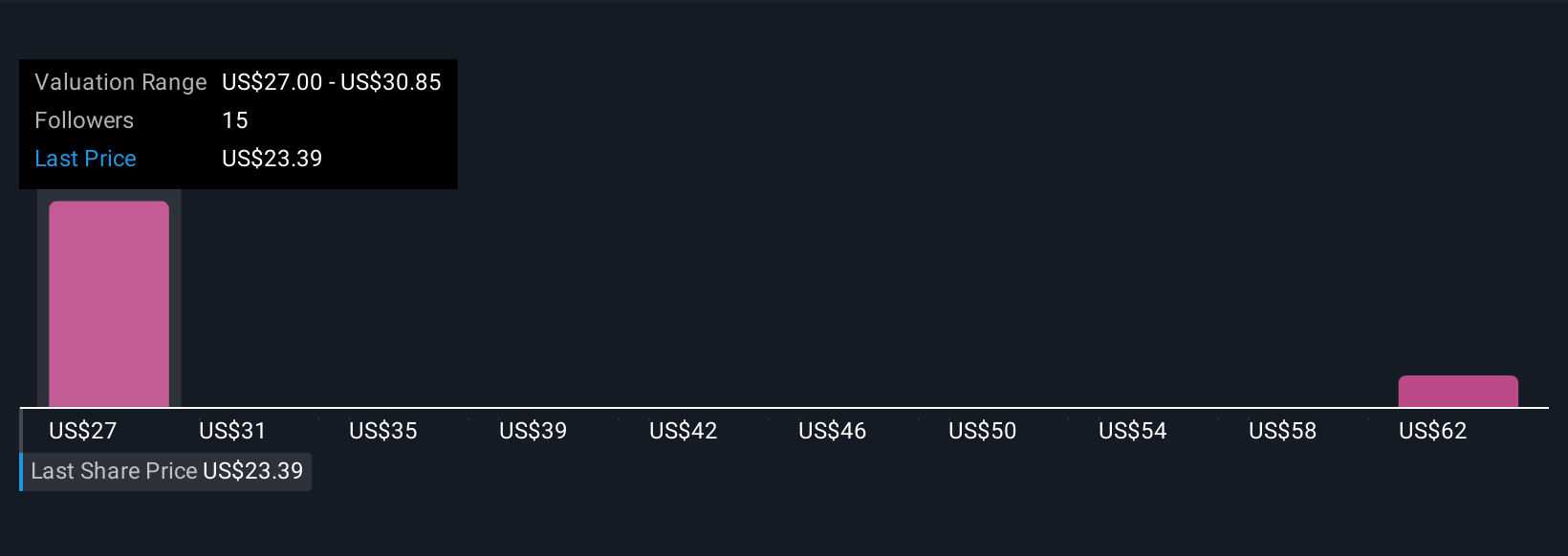

Three fair value estimates from the Simply Wall St Community span US$27 to US$65.38 per share, illustrating a wide range of investor analysis. With interest expenses poised to impact profit margins, it is clear opinions can differ, consider reviewing how others view Sila’s outlook and risk factors.

Explore 3 other fair value estimates on Sila Realty Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Sila Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sila Realty Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sila Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sila Realty Trust's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SILA

Sila Realty Trust

Sila Realty Trust, Inc., headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the growing and resilient healthcare sector.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives