- United States

- /

- Hotel and Resort REITs

- /

- NYSE:SHO

Did Tarsadia Capital's Push for a Sale Just Shift Sunstone Hotel Investors' (SHO) Investment Narrative?

Reviewed by Simply Wall St

- On September 12, 2025, Tarsadia Capital publicly called on the board of Sunstone Hotel Investors to launch a strategic review, urging options such as a company sale, asset liquidation, and board refreshment to address alleged persistent undervaluation.

- This activist intervention signals a push for significant change in Sunstone’s management and overall direction, potentially influencing the company’s future strategy and governance.

- We’ll consider how Tarsadia Capital’s campaign for a corporate sale or asset liquidation could alter Sunstone Hotel Investors’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sunstone Hotel Investors Investment Narrative Recap

To be a shareholder in Sunstone Hotel Investors right now, you would need to believe that the company’s portfolio of high-end urban and resort hotels can deliver improved earnings through higher group and luxury travel demand, despite recent headwinds. Tarsadia Capital’s activist push for a sale or asset liquidation introduces major uncertainty that could overtake near-term catalysts, while the biggest risk remains ongoing volatility at key assets like Wailea and D.C., where local disruptions have muted fundamental performance. If the board opts for strategic review or asset sales, existing operational improvement stories may be deprioritized, shifting the balance of risks and rewards.

The most relevant recent announcement is Sunstone’s lowered full-year net income guidance on August 6, 2025, reducing expectations to US$14 million to US$28 million. This came as profits and margins compressed compared to last year, amplifying concern about persistent softness at core properties and providing context for activist calls to explore more radical changes. But with activist pressure escalating and near-term profitability still challenged, investors should be mindful of how shifts in boardroom dynamics could influence...

Read the full narrative on Sunstone Hotel Investors (it's free!)

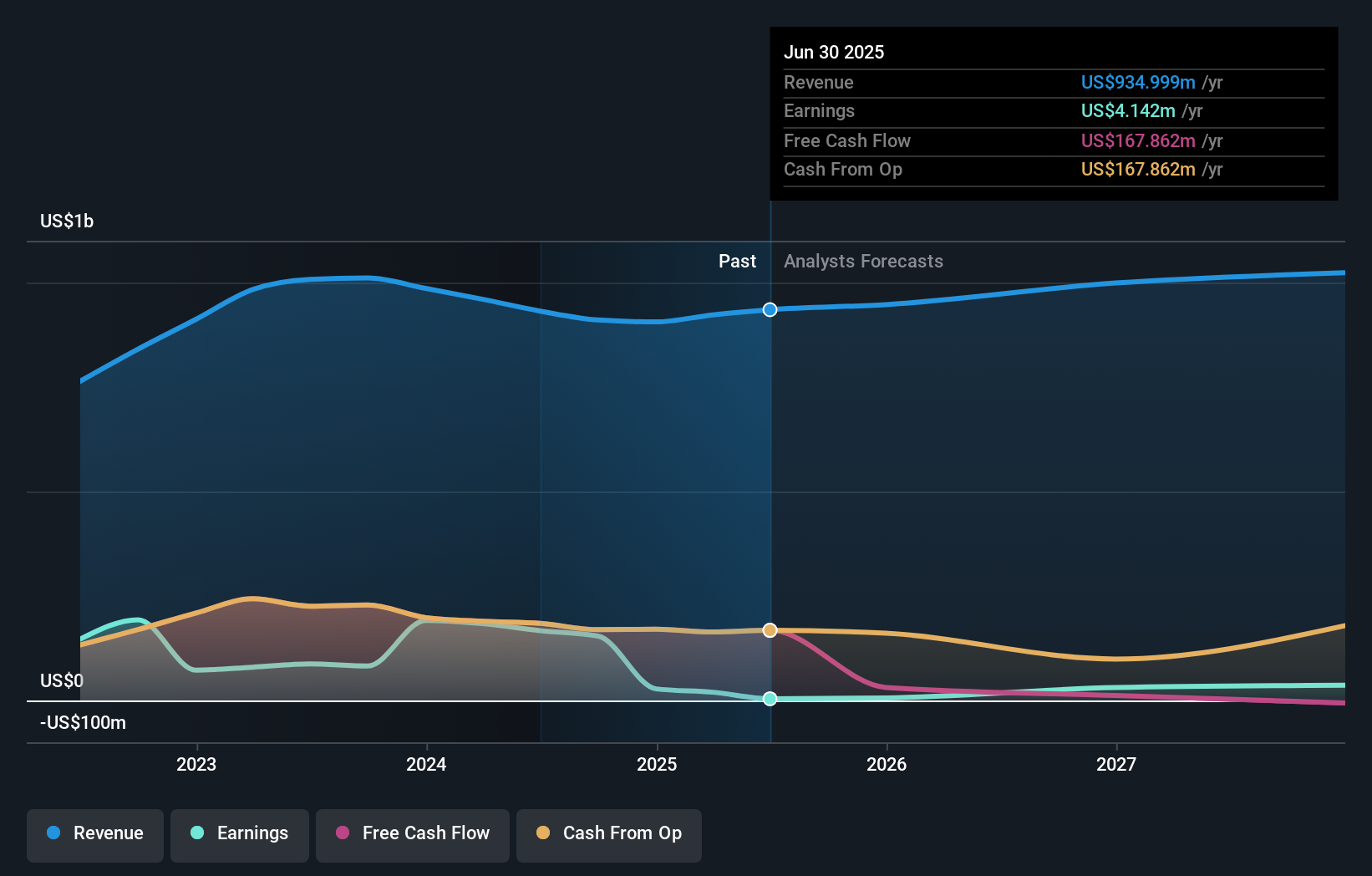

Sunstone Hotel Investors' outlook projects $1.1 billion in revenue and $67.9 million in earnings by 2028. This requires a 4.0% annual revenue growth rate and a $63.8 million increase in earnings from the current $4.1 million.

Uncover how Sunstone Hotel Investors' forecasts yield a $9.64 fair value, in line with its current price.

Exploring Other Perspectives

One Simply Wall St Community member estimated fair value at US$6.37 per share, with no variation among submissions. With activist calls for a strategic overhaul and Sunstone’s current operational hurdles, you can see how investors’ outlooks may diverge widely as events unfold.

Explore another fair value estimate on Sunstone Hotel Investors - why the stock might be worth 35% less than the current price!

Build Your Own Sunstone Hotel Investors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunstone Hotel Investors research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Sunstone Hotel Investors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunstone Hotel Investors' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHO

Sunstone Hotel Investors

A lodging real estate investment trust ("REIT") that as of the date of this release owns 14 hotels comprised of 6,999 rooms, the majority of which are operated under nationally recognized brands.

Slight risk with moderate growth potential.

Market Insights

Community Narratives