- United States

- /

- Specialized REITs

- /

- NYSE:SAFE

Safehold (SAFE): How a Major $400M Unsecured Loan Impacts Valuation and Financial Flexibility

Reviewed by Simply Wall St

Safehold (SAFE) just closed a $400 million unsecured term loan. This move is designed to boost liquidity and refinance previously secured debt. The transaction frees up key ground lease assets and extends financial flexibility for the company.

See our latest analysis for Safehold.

Safehold’s latest $400 million loan announcement seems to have caught investors’ attention, with a 3.9% one-day share price jump and an 8% rally over the week. However, despite this burst of momentum, the stock’s 12-month total shareholder return is still deep in negative territory. This reflects ongoing challenges even as the company’s financial flexibility improves.

If moves like Safehold’s refinancing have you rethinking your strategy, now could be a great time to broaden your search and discover fast growing stocks with high insider ownership

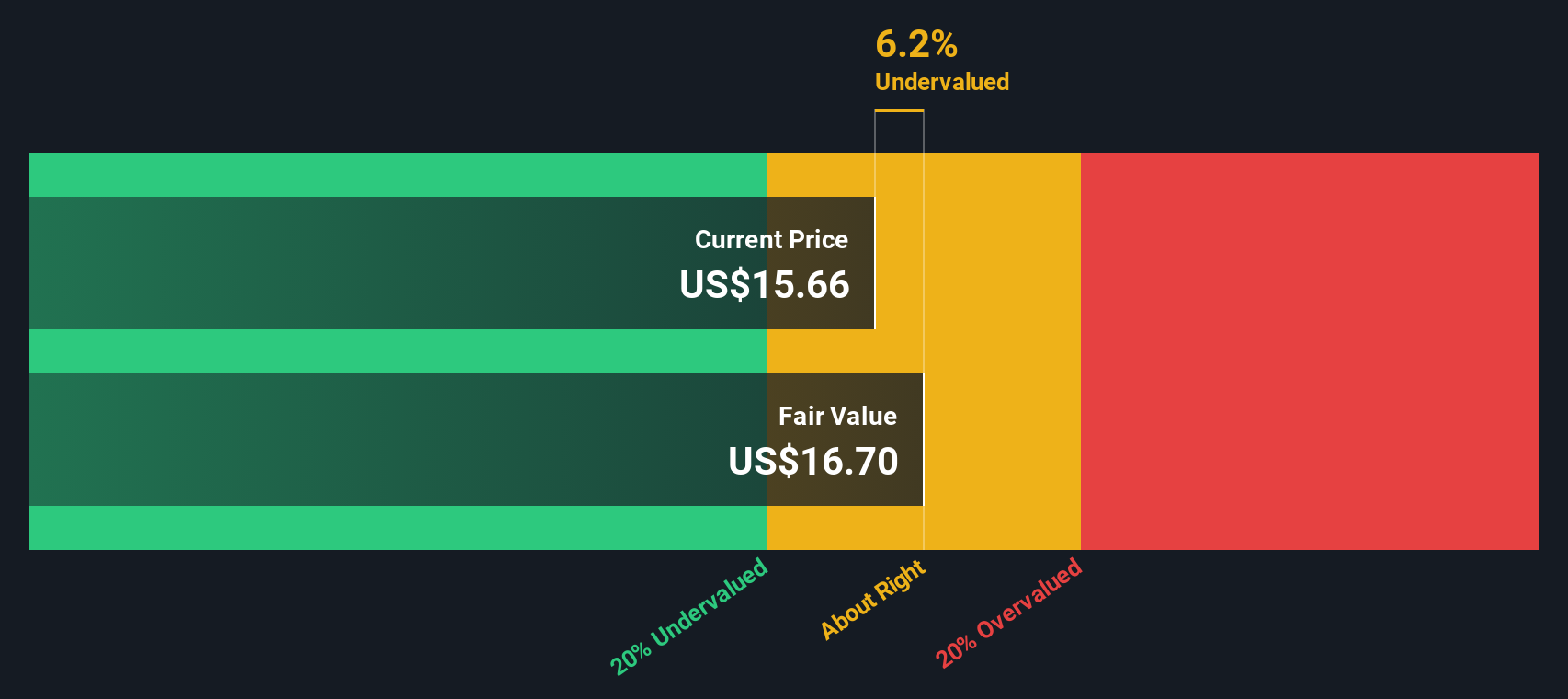

With shares still trading at a sizable discount to analyst targets despite recent gains, investors must ask whether Safehold is offering real value at today’s levels or if the market is already factoring in future recovery. Is there a true buying opportunity here, or is the expected turnaround already reflected in the price?

Most Popular Narrative: 29.9% Undervalued

With Safehold’s current price well below the consensus narrative’s fair value, attention is on whether the business transformation can justify the premium analysts see ahead.

Strong momentum in the multifamily and affordable housing segments, including a growing pipeline weighted toward these resilient asset classes, positions Safehold to benefit from long-term urbanization and densification trends. This supports predictable, inflation-protected cash flows and enhances earnings visibility. The expansion of Safehold's addressable market, as institutional and developer demand rises for innovative, alternative real estate capital structures such as ground leases, is likely to lift deal originations, drive portfolio growth, and positively impact long-term top-line revenue.

There's one financial assumption embedded here that could turn conventional wisdom upside down. Will next-level earnings and market expansion propel a rerating, or is a surprise lurking in the growth story? Only the full narrative reveals what really drives this bold valuation.

Result: Fair Value of $20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic volatility and tighter regulation in key markets could quickly undermine Safehold’s growth assumptions and put pressure on future earnings projections.

Find out about the key risks to this Safehold narrative.

Another View: SWS DCF Model Offers a Stricter Perspective

While Safehold’s valuation appears attractive using traditional market ratios, our SWS DCF model tells a different story. Based on projected future cash flows, the DCF estimate suggests Safehold is actually trading above its fair value. This indicates that recent optimism may be getting ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Safehold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Safehold Narrative

If you think the story is different or want to dive deeper into the numbers yourself, you can build your own narrative in just a few minutes, your way. Do it your way

A great starting point for your Safehold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your search end here. The best opportunities often hide in plain sight, waiting for those bold enough to seize them before everyone else does.

- Unlock income potential with these 14 dividend stocks with yields > 3% paying yields above 3%, for investors serious about steady cash flow.

- Catch the next wave by tapping into AI innovators. Check out these 26 AI penny stocks and see which companies could lead tomorrow’s technology breakthroughs.

- Target value that others miss by filtering for these 932 undervalued stocks based on cash flows based on robust cash flow signals and true market mispricings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAFE

Safehold

Safehold Inc. (NYSE: SAFE) is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings.

Fair value with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.