- United States

- /

- Specialized REITs

- /

- NYSE:RYN

Rayonier (RYN): Revisiting Valuation as Shares Settle into a Period of Stability

Reviewed by Simply Wall St

Most Popular Narrative: 13.2% Undervalued

According to the most widely followed narrative, Rayonier is trading well below its estimated fair value. The current discount rate assumed in this view is 7.3%.

The development and sale of high-value real estate in the U.S. South, particularly through large master-planned communities like Wildlight and Heartwood, is capitalizing on population growth and migration trends. Continued robust demand and a substantial unsold acreage pipeline support expectations for steadily increasing earnings and margin enhancement.

Curious what’s fueling this sharp undervaluation call? The narrative’s fair value relies on future profit margins taking a surprising turn and earning power shifting dramatically. What bold forecasts did analysts make to justify such an aggressive upside? Clues in the details may surprise you. Discover exactly which financial levers are at play.

Result: Fair Value of $30.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, extreme weather events and declining timber demand could quickly challenge the optimistic outlook and disrupt Rayonier’s forecasted growth trajectory.

Find out about the key risks to this Rayonier narrative.Another View: Discounted Cash Flow Tells a Different Story

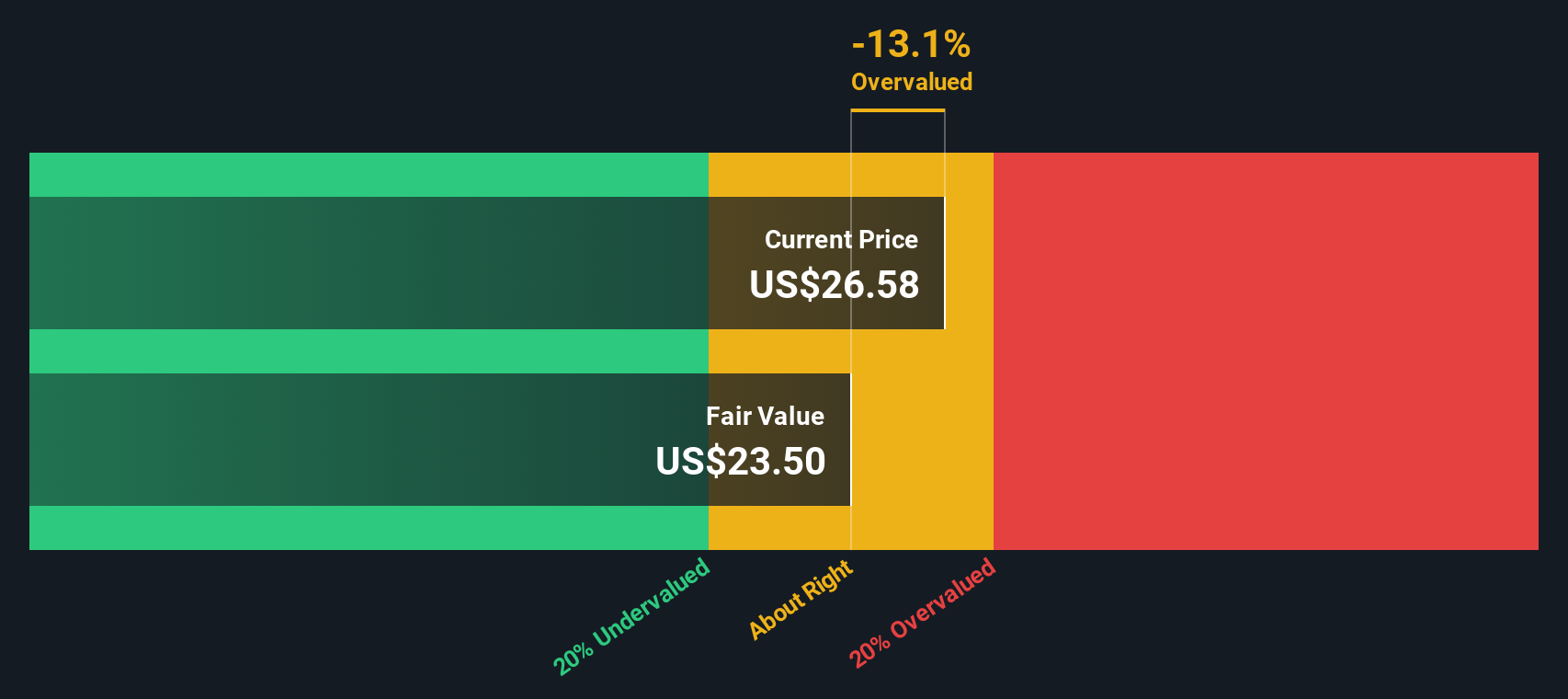

While analyst consensus finds Rayonier undervalued based on future earnings, our DCF model reaches a different conclusion. This approach suggests the market may be less optimistic about Rayonier’s intrinsic value. Which lens feels more convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rayonier Narrative

If this perspective doesn’t quite fit your view, or you’d rather dig into the numbers yourself, you can assemble your own narrative in just a few minutes. Do it your way.

A great starting point for your Rayonier research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass by. Broaden your research and tap into promising trends with these handpicked stock ideas designed to match your ambitions and curiosity.

- Unlock resilience and potential with high-yield companies by checking out dividend stocks with yields > 3%, which puts healthy cash returns at the forefront.

- Spot tomorrow’s breakout technologies and ride the wave of innovation with AI penny stocks as leaders in the artificial intelligence transformation.

- Capitalize on undervalued gems prepared for the future by exploring undervalued stocks based on cash flows, focusing on real financial strength and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYN

Rayonier

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives