- United States

- /

- Specialized REITs

- /

- NYSE:RYN

Is Rayonier Trading Close to Fair Value After Its Recent 12.9% Decline?

Reviewed by Bailey Pemberton

If you’re watching Rayonier lately and wondering whether now is the right time to buy, hold, or steer clear, you’re not alone. The stock closed most recently at $23.33, catching the eye of many investors after a choppy ride. Over the last week, shares are down 5.0%, capping off a one-month slide of nearly 11.8%. Looking further back, the story is mixed: a painful 12.9% drop on the year, but the five-year performance shows a solid 23.5% gain, which can’t be ignored. This tug-of-war between short-term turbulence and longer-term promise is raising some questions in the market about risk and reward.

Recent headlines offer some helpful context for Rayonier’s price swings. Changes in the broader real estate investment trust landscape and evolving expectations around interest rates have contributed to increasing volatility, as investors reassess the relative value and resilience of timberland assets. Rayonier’s unique business, which blends land and forestry with a real estate twist, makes it especially sensitive to these larger economic shifts.

So how does Rayonier’s valuation stack up right now? According to our analysis, the company scores a 4 out of 6 on undervaluation checks. That means there are multiple ways in which Rayonier looks cheaper than its peers, but not across the board. As we dig deeper, we’ll examine the various methods analysts use to determine real value and, later on, introduce a perspective that is even more revealing than the usual numbers.

Why Rayonier is lagging behind its peers

Approach 1: Rayonier Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future adjusted funds from operations and discounting them back to their value today. For Rayonier, this method takes into account expected annual cash flows and long-term growth, helping to paint a clearer picture of what the shares are likely worth given future expectations.

According to the latest analysis, Rayonier's projected free cash flow in 2029 is anticipated to reach $167 million. Looking ahead over the next decade, forecasts suggest a gradual rise, with FCF projections increasing each year based on both analyst estimates and extrapolations. Each cash flow figure is converted to its present-day equivalent using a discount rate, which factors in the risk and time value of money.

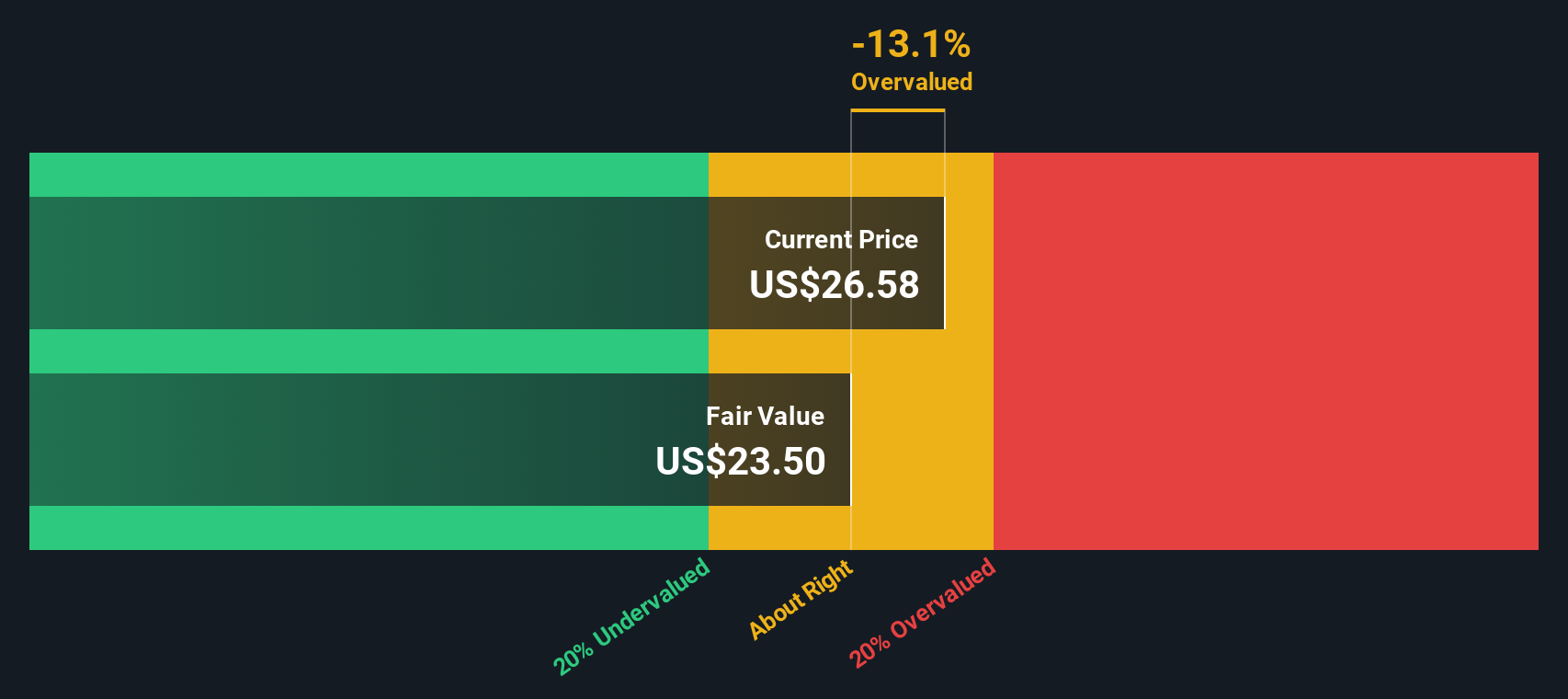

After modeling these cash flows, the DCF approach arrives at an intrinsic fair value of $23.04 per share. Compared to Rayonier’s recent share price of $23.33, this result implies the stock is about 1.3% overvalued. Since this difference is relatively small, the shares appear to be trading in line with their fundamental value at this time.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Rayonier's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Rayonier Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric that is especially useful for evaluating profitable companies like Rayonier. This ratio tells investors how much they are paying for each dollar of current earnings, helping to put the share price into context based on company performance.

Growth expectations and risk both play important roles in what is considered a “normal” or “fair” PE ratio. Companies with faster expected earnings growth or less perceived risk usually command higher PE multiples, while slower-growth or riskier firms tend to trade at lower multiples.

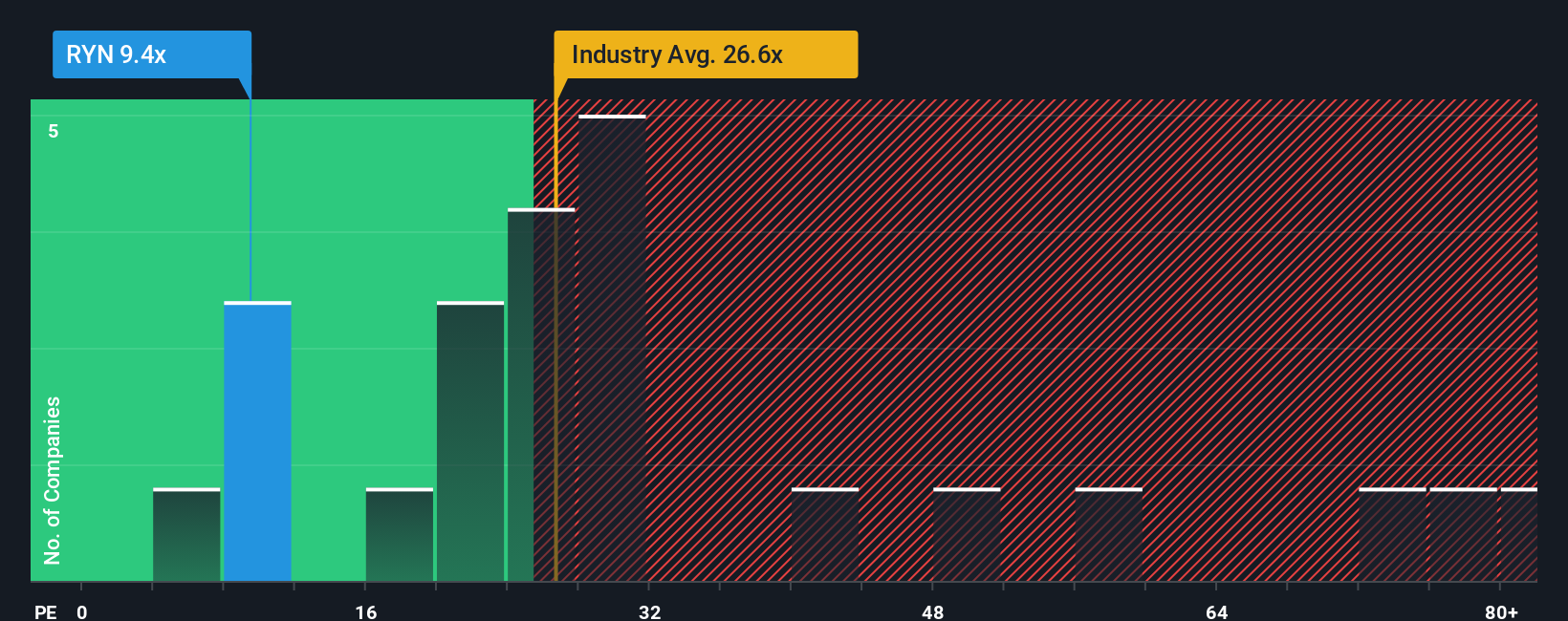

Rayonier’s current PE ratio stands at 9.76x, which is well below the industry average of 17.74x and significantly under its peer group average of 54.61x. At first glance, this low multiple may suggest Rayonier is undervalued versus its sector competition, but comparing only to peers can be misleading without context.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio is a more sophisticated benchmark, taking into account not just industry and market cap, but also Rayonier’s unique earnings growth, profit margins and risk factors. For Rayonier, the Fair Ratio is 17.33x. Since this estimate incorporates relevant company-specific details, it gives a more meaningful sense of what Rayonier’s true valuation should be.

Rayonier’s PE of 9.76x is noticeably below its Fair Ratio of 17.33x, indicating the stock is undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rayonier Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that connects a company’s story, including your own assumptions about future revenue, profits, and margins, to a financial forecast and ultimately to what you believe is its fair value. By giving context to the numbers and letting investors build their own scenarios, Narratives make the decision process more dynamic and personal.

On Simply Wall St’s platform, millions of investors use Narratives within the Community page to quickly explore and create their own investment stories for companies like Rayonier. Narratives show how your outlook on key drivers such as growth, risk, and profit can change the valuation and compare it to today’s stock price, helping you decide when to buy or sell, and why.

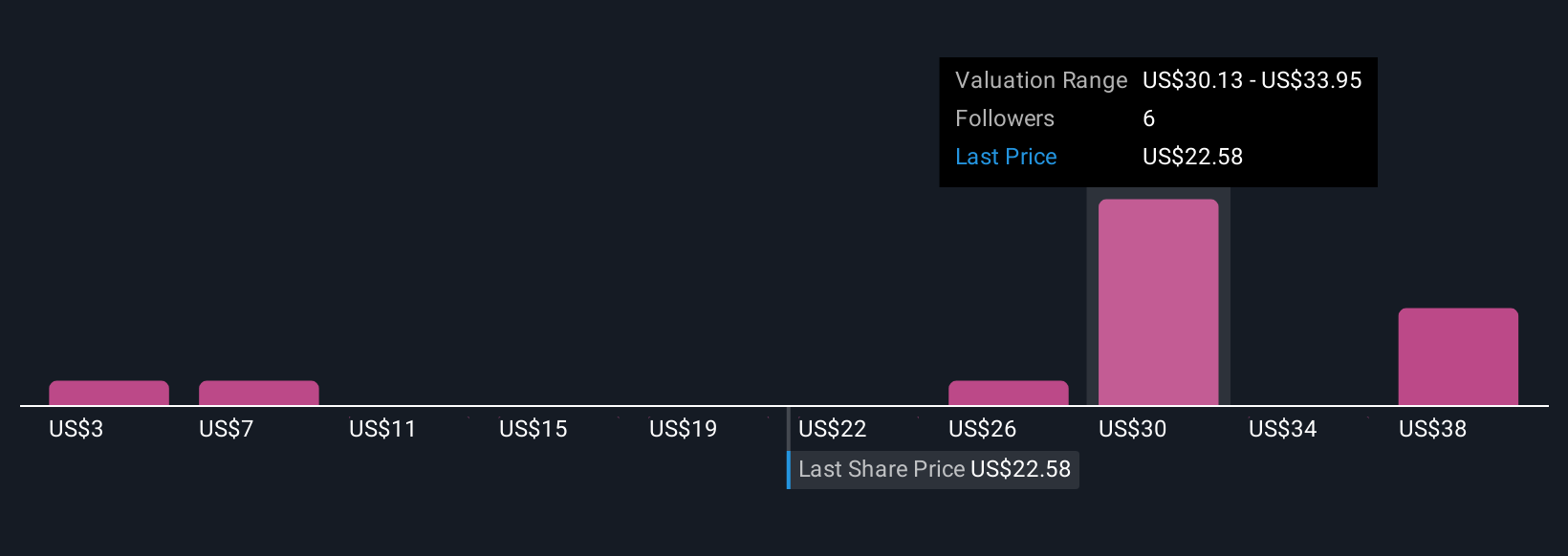

Most importantly, Narratives update automatically as new news, earnings, and market information arrive, so your viewpoint and fair value estimate always stay relevant. For Rayonier, for example, one Narrative sees long-term value driven by renewable energy and real estate expansion (with a fair value target of $37.00), while another expresses caution about climate and market risks, giving a lower target of $27.00.

Do you think there's more to the story for Rayonier? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYN

Rayonier

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives