- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RHP

Ryman Hospitality Properties (RHP): Valuation Insights After Mixed Q3 Results and Updated 2025 Guidance

Reviewed by Simply Wall St

Ryman Hospitality Properties (RHP) just reported its third quarter results, showing higher revenue compared to last year, but a drop in net income. The company also updated its 2025 full-year guidance by narrowing projections for several key financial metrics.

See our latest analysis for Ryman Hospitality Properties.

After narrowing its outlook and posting mixed quarterly numbers, Ryman Hospitality Properties has seen its share price rebound 6.9% over the past month but remains down 7.8% year-to-date. The one-year total shareholder return sits at -10.8%. However, three- and five-year figures remain solidly positive, highlighting resilience despite recent volatility.

If you’re looking for more interesting opportunities beyond Ryman’s latest moves, now’s a great time to discover fast growing stocks with high insider ownership.

But with shares still trading nearly 18% below analyst price targets and at a sizable discount to intrinsic value, investors now face a key question: Is Ryman Hospitality Properties a bargain with further upside, or is the market already factoring in all of its future growth?

Most Popular Narrative: 15.8% Undervalued

With Ryman Hospitality Properties last closing at $94.63, the most closely watched narrative assigns a fair value nearly $18 higher, suggesting the market may still be missing some key drivers behind the company.

Visible increases in advance group booking activity and robust pipeline for 2026 and 2027 indicate sustained demand for destination meetings and conventions as organizations prioritize periodic large-scale events. This provides predictability for future revenues and earnings.

What’s the secret behind this elevated target? The narrative leans heavily on bullish forward assumptions such as growing demand, expanding margins, and a leap in future profitability multiples. Want to see which game-changing forecasts underpin this price? Don’t miss the details inside.

Result: Fair Value of $112.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high competition in core markets and a continued rise in labor costs could significantly pressure Ryman’s margins and future earnings growth.

Find out about the key risks to this Ryman Hospitality Properties narrative.

Another View: Market Multiples Tell a Different Story

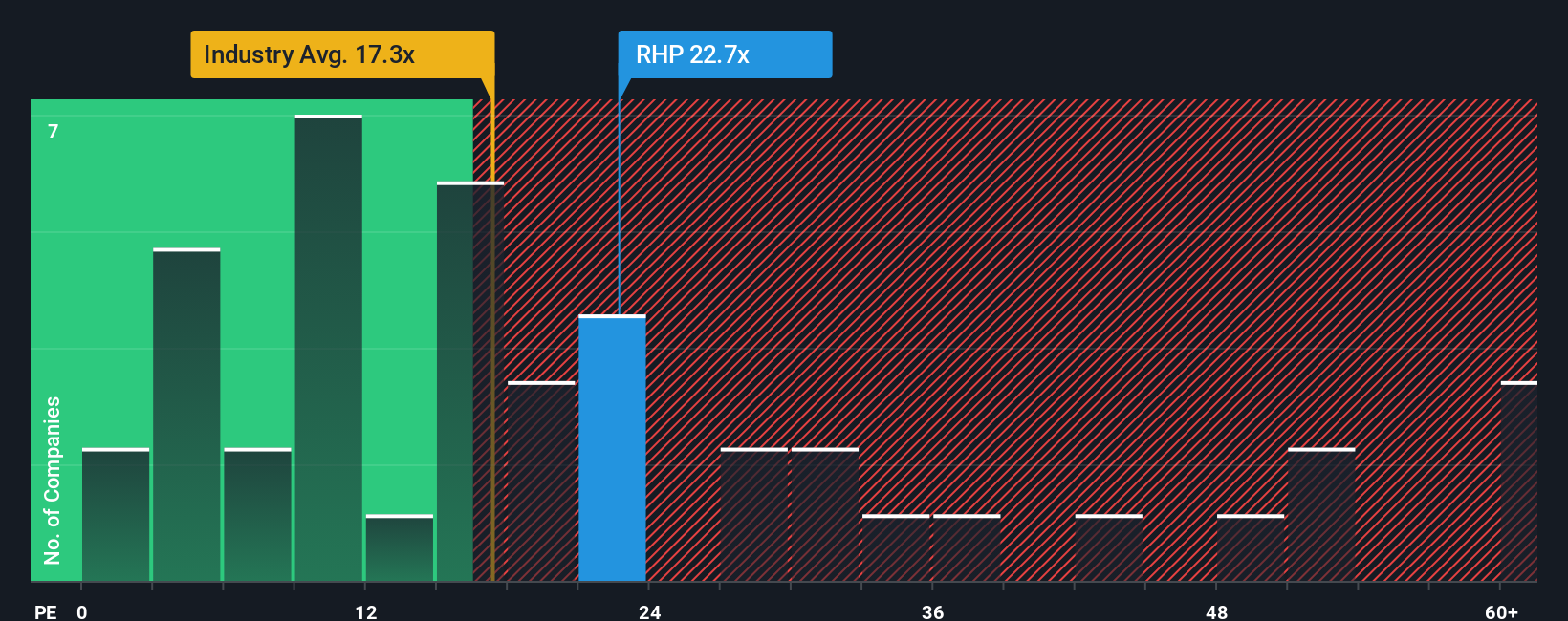

Taking a look at common market multiples, Ryman Hospitality Properties currently trades at a price-to-earnings ratio of 24.7x. This is higher than both its peer average of 22.5x and the broader global industry at 16x. While the fair ratio stands at 36.2x, the clear premium over peers indicates investors may be expecting more than the fundamentals suggest. Could this signal additional risk lurking beneath the surface, or is it an opportunity waiting to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryman Hospitality Properties Narrative

If you see gaps in the numbers or want to shape your own story, diving into the data and building your outlook takes just a few minutes. Do it your way.

A great starting point for your Ryman Hospitality Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Every investor deserves the best tools for smart decisions. Don’t miss your chance to uncover unexpected gems, lucrative trends, or future leaders with these strategies:

- Spot opportunities in established companies trading far below their potential by reviewing these 906 undervalued stocks based on cash flows. See which stocks could be real bargains right now.

- Tap into a fast-changing healthcare landscape and get ahead of the latest breakthroughs by checking out these 31 healthcare AI stocks for companies driving innovation in this crucial sector.

- Uncover emerging trends in digital finance by connecting directly with these 82 cryptocurrency and blockchain stocks. Discover which businesses are shaping the future of cryptocurrencies and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHP

Ryman Hospitality Properties

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives