- United States

- /

- Specialized REITs

- /

- NYSE:PSA

How Does Public Storage Stack Up After a 15.7% Drop This Year?

Reviewed by Bailey Pemberton

- Ever wondered if Public Storage stock is a bargain right now, or if there's a better place to put your money? You're not alone, and it's exactly the question we're diving into today.

- The shares have been on a bit of a rollercoaster lately, with a 7.4% drop in the last week and 15.7% over the past year, but they're still up nearly 46% over the last five years.

- Recent headlines have focused on shifting investor sentiment and larger trends in the real estate sector, with industry news highlighting changing demand for storage solutions and the impact of interest rates on REITs like Public Storage. These topics help to explain why the stock price has seen some swings as investors weigh both risks and opportunities.

- If we zoom in on the valuation scorecard, Public Storage clocks in at 4 out of 6 for undervaluation based on our most relevant checks. Let's break down what this score actually means using a few different approaches. Stay tuned because there is an even smarter way to judge the stock's value coming up at the end.

Find out why Public Storage's -15.7% return over the last year is lagging behind its peers.

Approach 1: Public Storage Discounted Cash Flow (DCF) Analysis

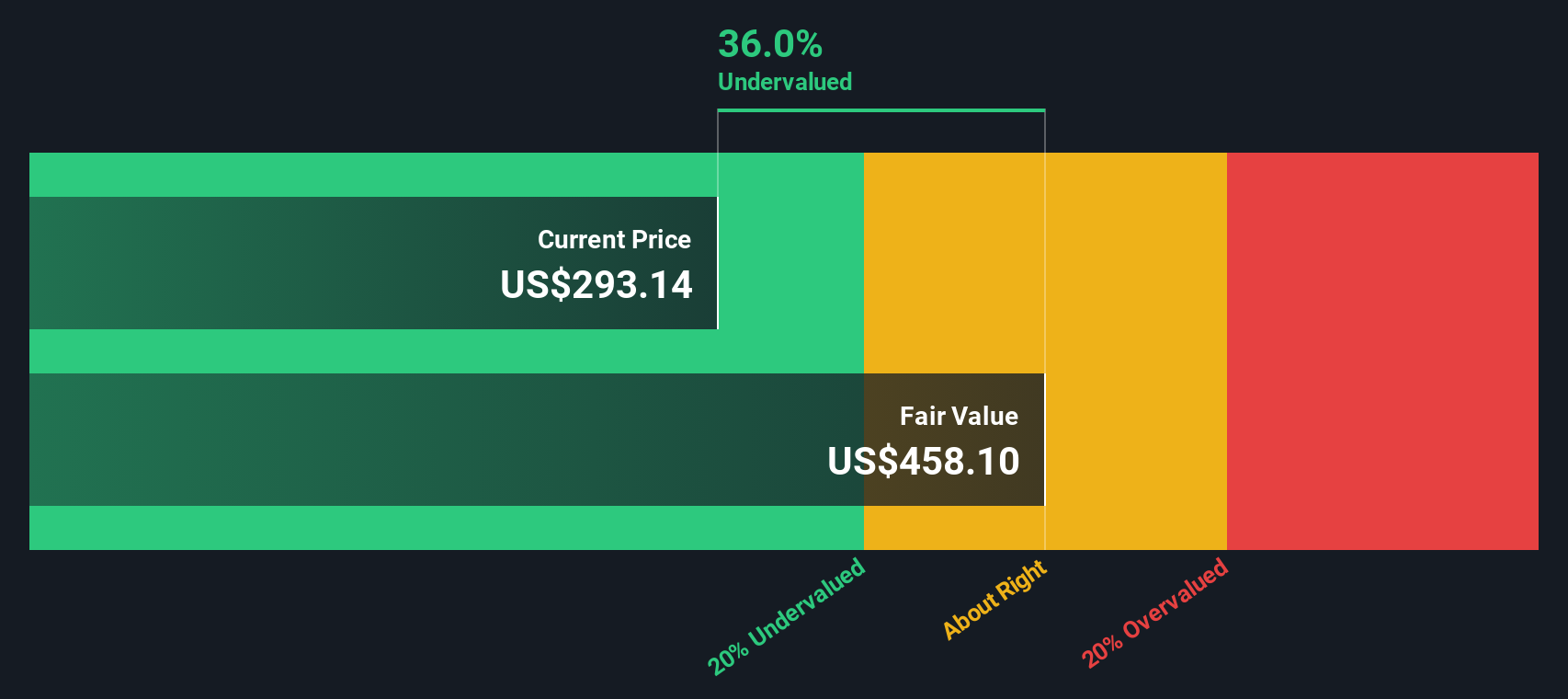

The Discounted Cash Flow (DCF) approach is a widely used valuation model that estimates what a company is worth today by projecting its future adjusted funds from operations and discounting those forecasts back to their present value. This method helps investors judge whether a stock is trading below or above its intrinsic value.

For Public Storage, the analysis starts with its latest reported Free Cash Flow, which is $3.03 billion. Analysts offer cash flow forecasts for the next several years, anticipating consistent growth. Looking out to 2029, Free Cash Flow is projected to reach $3.47 billion. Beyond the analyst estimates, Simply Wall St extrapolates cash flows up to 2035, maintaining a steady but slightly decelerating growth rate over this horizon.

When all of these future cash flows are discounted to today's dollars, the DCF model calculates an intrinsic value of $437.30 per share. This suggests that Public Storage is trading at a 36.9% discount to its estimated fair value, which may highlight meaningful upside potential for investors at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Public Storage is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

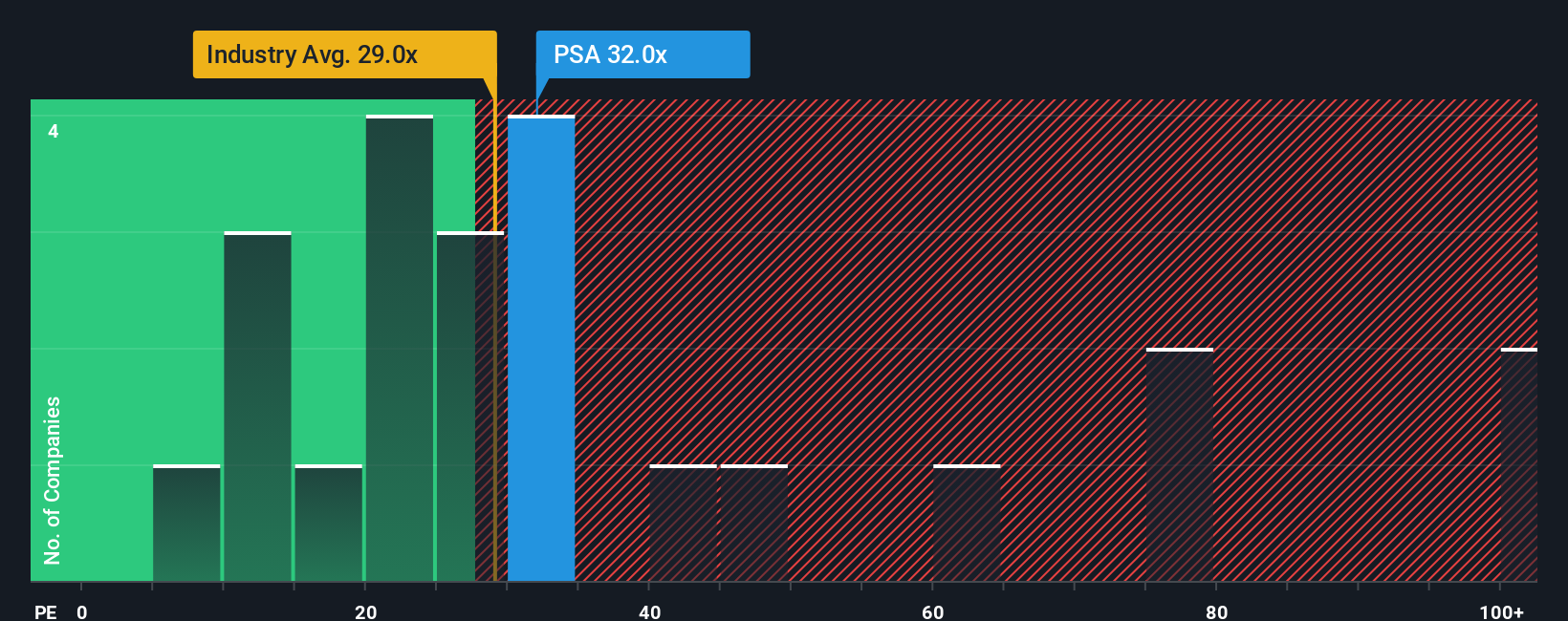

Approach 2: Public Storage Price vs Earnings (PE Ratio)

When analyzing profitable companies like Public Storage, the price-to-earnings (PE) ratio is a time-tested metric for assessing whether a stock's valuation seems justified. This measure tells us how much investors are willing to pay for each dollar of earnings and works best for companies with stable, positive profit streams such as established REITs.

But what makes a "fair" PE ratio? Generally, companies with higher expected growth or lower risk should command a higher PE, while those facing more uncertainty or slower growth see lower ratios. The market also looks at industry norms and peer comparisons, but these do not always capture the nuances of a specific business.

Currently, Public Storage is trading at a PE ratio of 28.6x. For context, the average for its closest peers is 36.2x, while the broader Specialized REITs industry average is significantly lower at 17.3x. At first glance, this suggests that Public Storage is priced below its peer group but well above the typical industry company.

Now, let's bring in Simply Wall St's proprietary "Fair Ratio" metric, which goes beyond just comparing similar companies. The Fair Ratio for Public Storage is 33.5x, taking into account its earnings growth, robust profit margins, market capitalization, industry category, and specific risk factors. This insight is more comprehensive than industry or peer averages alone, making it a smarter yardstick for valuation.

With the actual PE ratio (28.6x) currently below the Fair Ratio (33.5x), Public Storage appears modestly undervalued based on this approach, especially considering how the Fair Ratio reflects the company's unique strengths and challenges.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Public Storage Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story behind the numbers. It connects what you believe about Public Storage’s business and industry outlook to specific forecasts for its future revenue, earnings, and margins, ultimately estimating what you think is a fair value for the stock.

By using Narratives, available to millions of investors right within the Community page on Simply Wall St, you can easily tie recent developments or your unique perspective to dynamic financial forecasts. Narratives serve as a bridge between a company’s evolving story and its numbers, helping you see in real time whether the current share price sits above or below your calculated fair value. When conditions change, Narratives update instantly to reflect new earnings results, news, or market shifts.

For example, some investors may build a bullish Narrative for Public Storage based on resilient urban demand, digital innovation, and aggressive expansion, justifying the highest analyst target of $350 per share. Others may focus on risks like oversupply or regulatory pressures, supporting a more cautious fair value closer to $287. These differences empower you to personalize your investment decisions, all using the same intuitive Narrative tool.

Do you think there's more to the story for Public Storage? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSA

Public Storage

A member of the S&P 500, is a REIT that primarily acquires, develops, owns, and operates self-storage facilities.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives