- United States

- /

- Industrial REITs

- /

- NYSE:PLYM

Plymouth Industrial REIT (PLYM): Is the Current Share Price a Fair Reflection of Value?

Reviewed by Kshitija Bhandaru

See our latest analysis for Plymouth Industrial REIT.

Plymouth Industrial REIT has picked up momentum lately, adding to a strong 1-year total shareholder return of 6.6%. Its recent gains suggest investor sentiment is building behind the company’s growth plans. Short and long-term performance trends have been positive, hinting at renewed interest as the market assesses the firm’s valuation and prospects.

If you’re looking for other opportunities beyond industrial real estate, now is a great time to broaden your research and discover fast growing stocks with high insider ownership

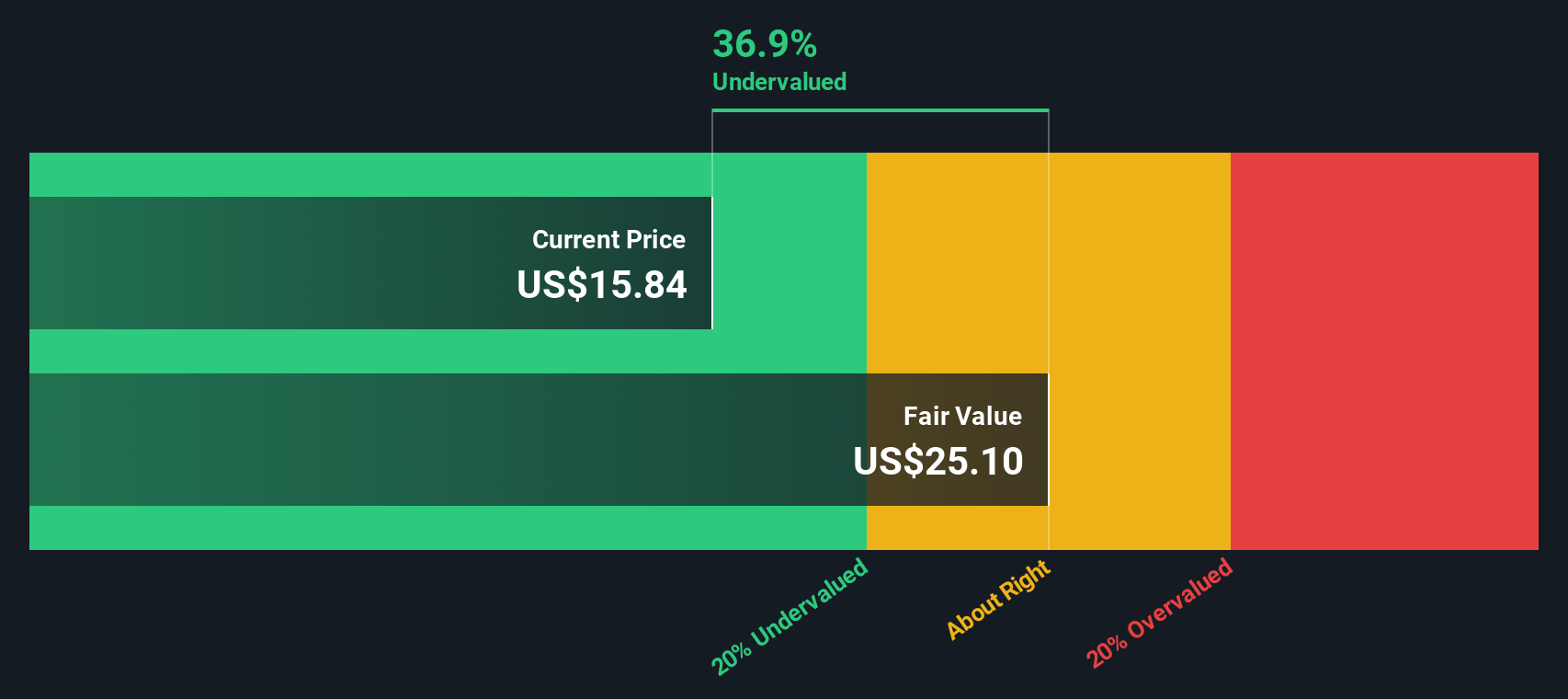

But after months of gains, the big question remains: Is Plymouth Industrial REIT still undervalued, or has the market already priced in all of its expected growth?

Most Popular Narrative: Fairly Valued

At $22.19, Plymouth Industrial REIT’s share price closely matches the most widely followed narrative’s fair value estimate of $22.00. This highlights a rare alignment between analysts and the market ahead of major catalysts.

“Sustained demand from life sciences and manufacturing tenants seeking long-term commitments in core, supply-constrained secondary markets has driven strong leasing activity and high tenant retention, supporting continued revenue growth and above-average occupancy rates.”

Wondering what underpins this precise valuation? The numbers point to big calls on future revenue growth rates, margin compression, and a new equilibrium for earnings. What bold analyst projections create this razor-thin margin between price and fair value? Click to uncover the surprising drivers shaping this fair value assessment.

Result: Fair Value of $22.00 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, short lease terms and rising capital costs could pressure earnings and margins, casting doubt on the company’s ability to sustain its current growth momentum.

Find out about the key risks to this Plymouth Industrial REIT narrative.

Another View: Discounted Cash Flow Suggests Deep Value

Looking through the lens of our SWS DCF model, Plymouth Industrial REIT appears significantly undervalued. The model estimates fair value at $31.26 per share, representing a substantial 29% premium to the recent market price. Could the market be underappreciating the company’s long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Plymouth Industrial REIT Narrative

If you see things differently or want to dive into your own research, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Plymouth Industrial REIT research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors always keep options open, so don’t miss your chance to stay ahead of the curve with ideas just a click away.

- Supercharge your portfolio by tapping into these 909 undervalued stocks based on cash flows with solid cash flows and significant potential upside before the wider market catches on.

- Spot opportunity early by checking out these 3568 penny stocks with strong financials showing strong financials and the makings of tomorrow’s market leaders.

- Stay ahead of industry shifts and find growth in healthcare by evaluating these 31 healthcare AI stocks at the intersection of technology and medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLYM

Plymouth Industrial REIT

Plymouth Industrial REIT, Inc. (NYSE: PLYM) is a full service, vertically integrated real estate investment company focused on the acquisition, ownership and management of single and multi-tenant industrial properties.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives