- United States

- /

- Specialized REITs

- /

- NYSE:OUT

Why Are Analysts Upgrading OUT (OUTFRONT Media) After Its Dividend and Q3 Earnings Reveal?

Reviewed by Sasha Jovanovic

- OUTFRONT Media Inc. recently reported its third quarter 2025 earnings, revealing sales of US$467.5 million and net income of US$51.3 million, alongside a declared quarterly dividend of US$0.30 per share payable at year end.

- Analysts from several major brokerage firms have expressed increased confidence in OUTFRONT Media’s outlook within the out-of-home advertising sector, with multiple upgrades and raised recommendations highlighting renewed interest.

- We’ll explore how the wave of analyst upgrades and sector optimism is influencing OUTFRONT Media’s investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

OUTFRONT Media Investment Narrative Recap

To be a shareholder in OUTFRONT Media, you need to believe in the company's ability to successfully transition its core out-of-home advertising business toward digital, data-driven solutions, capturing a larger share of advertiser budgets. The latest quarterly earnings beat and multiple analyst upgrades suggest positive momentum for digital transformation, but near-term catalysts remain tied to growth in digital billboard and transit revenues, while the biggest risk continues to be declining demand for static and legacy assets, unchanged by this news event.

One announcement that stands out is OUTFRONT's recent partnership with Amazon Web Services to integrate AI into planning, measurement, and delivery of out-of-home campaigns. This initiative directly links to the catalyst of digital expansion, aiming to close the gap between traditional and digital ad spending, and could influence both revenue growth and competitive positioning in the coming quarters.

By contrast, investors should also be aware that despite digital advances, ongoing structural declines in static billboard and transit markets may still pose...

Read the full narrative on OUTFRONT Media (it's free!)

OUTFRONT Media's narrative projects $2.0 billion in revenue and $194.1 million in earnings by 2028. This requires 2.8% yearly revenue growth and a $95.4 million earnings increase from $98.7 million currently.

Uncover how OUTFRONT Media's forecasts yield a $20.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

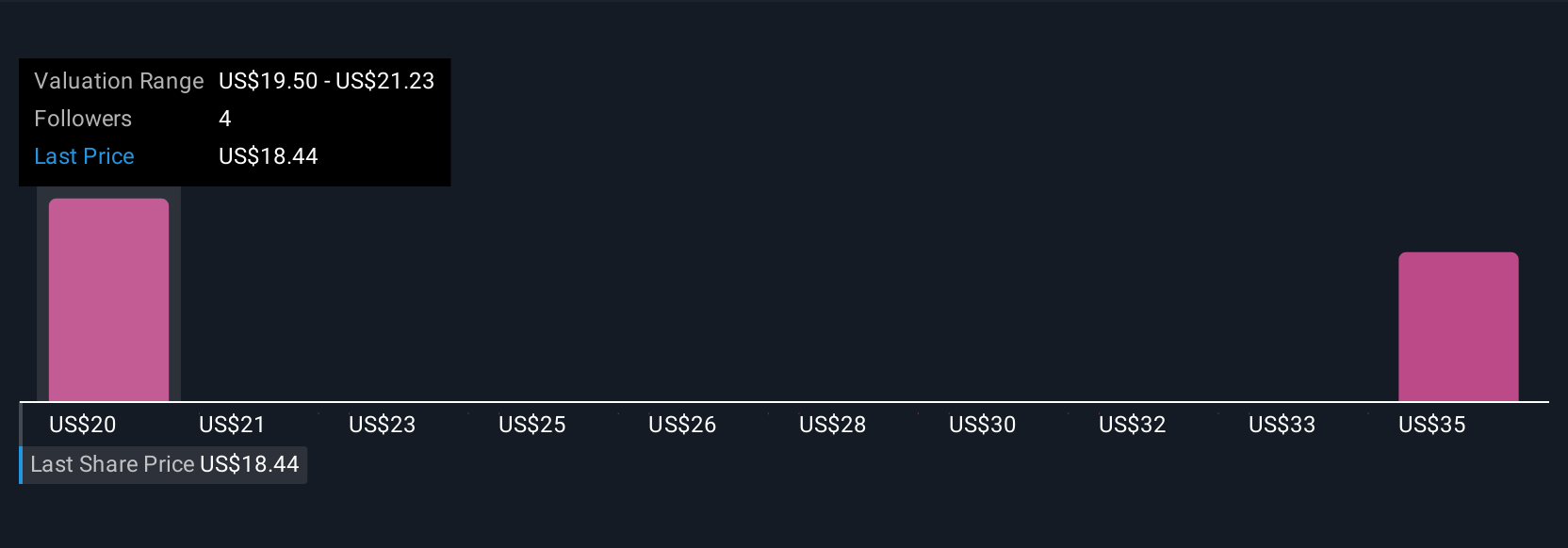

Simply Wall St Community fair value estimates for OUTFRONT Media range from US$20 to US$39.60, based on two individual analyses. Shifting advertiser budgets toward digital remains a critical challenge that could influence these varied outlooks and your own assessment of OUTFRONT’s future.

Explore 2 other fair value estimates on OUTFRONT Media - why the stock might be worth 9% less than the current price!

Build Your Own OUTFRONT Media Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OUTFRONT Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free OUTFRONT Media research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OUTFRONT Media's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives