- United States

- /

- Specialized REITs

- /

- NYSE:OUT

OUTFRONT Media (OUT): Assessing Valuation Following Recent Analyst Upgrades and Renewed Market Confidence

Reviewed by Simply Wall St

See our latest analysis for OUTFRONT Media.

OUTFRONT Media has caught investors’ eyes lately, with strong analyst upgrades following upbeat earnings and a newly affirmed dividend. In the last month alone, the stock delivered a powerful 24% share price return, contributing to a solid 26.8% total return over the past year. This signals that fresh momentum is building around its growth story.

If you’re curious about what else is gaining traction in the market, now’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With analyst upgrades fueling the rally and shares trading just above consensus price targets, investors face a pivotal question: is OUTFRONT Media undervalued, or is the market already pricing in all its future growth?

Most Popular Narrative: 10.4% Overvalued

According to the most widely followed narrative, the stock’s fair value estimate of $20 stands about 10% below the latest closing price of $22.08. This gap highlights rising market optimism at a time when recent analyst upgrades have translated into tangible share price gains.

OUTFRONT's ongoing digital conversion of static billboards and transit assets to digital displays enables higher ad rotation, dynamic content, and premium pricing. This directly supports accelerated top-line growth and long-term margin expansion.

What is the real reason behind the market’s high hopes? The narrative hinges on the company’s bold technology shift and a margin outlook that might surprise you. Want to see what financial milestones are driving this price target? You’ll have to check the full narrative for the inside story.

Result: Fair Value of $20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued shifts in ad budgets to digital and the capital intensity of OUTFRONT Media's business could still challenge this growth narrative.

Find out about the key risks to this OUTFRONT Media narrative.

Another View: Discounted Cash Flow Paints a Different Picture

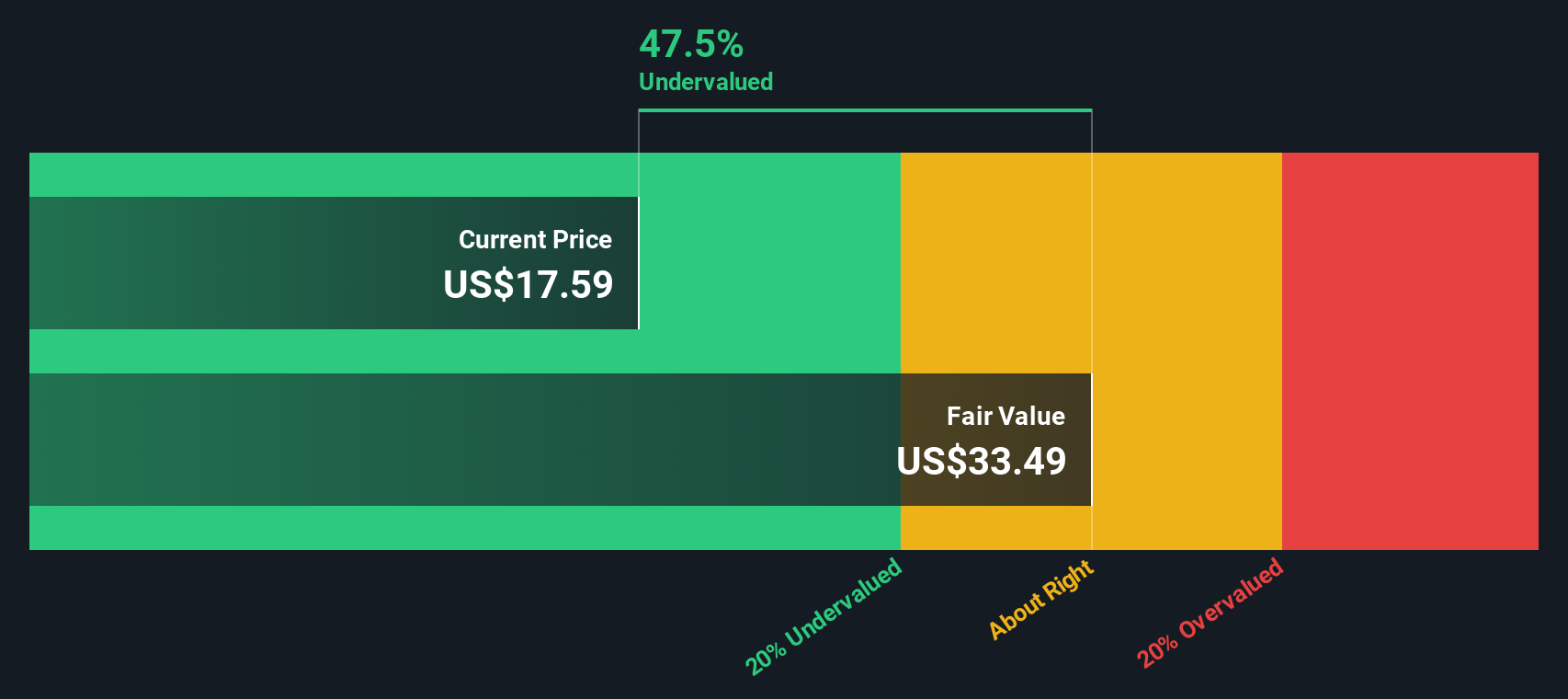

Looking through the lens of our DCF model, things look very different. According to SWS DCF, OUTFRONT Media’s shares are trading about 44% below the model’s fair value estimate. While the market’s favorite analysts see the stock as overvalued, DCF suggests there could be meaningful upside. Which side of the valuation debate will prove right in the end?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OUTFRONT Media for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OUTFRONT Media Narrative

If you’re the type who prefers to dig into the numbers and shape your own view, you can easily craft a personalized narrative in just minutes. Do it your way

A great starting point for your OUTFRONT Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t let your next big opportunity slip away. Use the Simply Wall St Screener to uncover high-potential companies most investors miss and start building a portfolio that stands out.

- Amplify your returns by targeting these 879 undervalued stocks based on cash flows that the market is currently overlooking and could be set for rebound.

- Capture long-term income with these 16 dividend stocks with yields > 3% offering healthy, reliable yields above 3% to power up your passive strategy.

- Ride the innovation wave and spot tomorrow’s leaders with these 25 AI penny stocks as artificial intelligence transforms industries at a rapid pace.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives