- United States

- /

- Specialized REITs

- /

- NYSE:OUT

How OUTFRONT Media’s (OUT) AWS Partnership and AI Platform Have Shifted Its Investment Story

Reviewed by Sasha Jovanovic

- On October 15, 2025, OUTFRONT Media Inc. announced a partnership with Amazon Web Services to modernize out-of-home (OOH) advertising by integrating AI-enabled workflows for planning, purchasing, and measuring static and digital inventory within a unified platform.

- This collaboration aims to standardize and digitize the traditionally manual OOH advertising process, enabling agencies and brands to access real-time inventory, automate campaign execution, and streamline analytics through AI-driven systems.

- We'll now explore how OUTFRONT Media's adoption of AI-powered, cloud-based OOH solutions could impact its long-term investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

OUTFRONT Media Investment Narrative Recap

To be a shareholder in OUTFRONT Media, you need to believe in the company's ability to transform the out-of-home advertising industry through digital innovation and AI-powered data analytics. The recent AWS partnership is likely to reinforce OUTFRONT’s most important short-term catalyst, capturing advertiser budgets moving to digital channels, by making its OOH assets more accessible, measurable, and efficient. However, it does not eliminate the immediate risk that advertiser demand for traditional static assets may keep declining and exert ongoing pressure on core billboard revenue.

Of recent announcements, the AWS partnership is the most relevant, setting OUTFRONT apart as it brings end-to-end digitization to both static and digital OOH inventory. By providing agencies the tools for automated planning, purchasing, and analytics, OUTFRONT is advancing its goal of integrating with omnichannel ad buying processes and increasing the appeal of its assets for digital-centric brands. The effectiveness of this transformation will be crucial for supporting future revenue growth and offsetting the decline of legacy static formats.

Yet, in contrast, it is important for investors to be aware of the structural decline in demand for non-digital OOH inventory and related impacts on...

Read the full narrative on OUTFRONT Media (it's free!)

OUTFRONT Media's narrative projects $2.0 billion in revenue and $194.1 million in earnings by 2028. This requires 2.8% yearly revenue growth and an increase in earnings of $95.4 million from the current $98.7 million.

Uncover how OUTFRONT Media's forecasts yield a $19.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

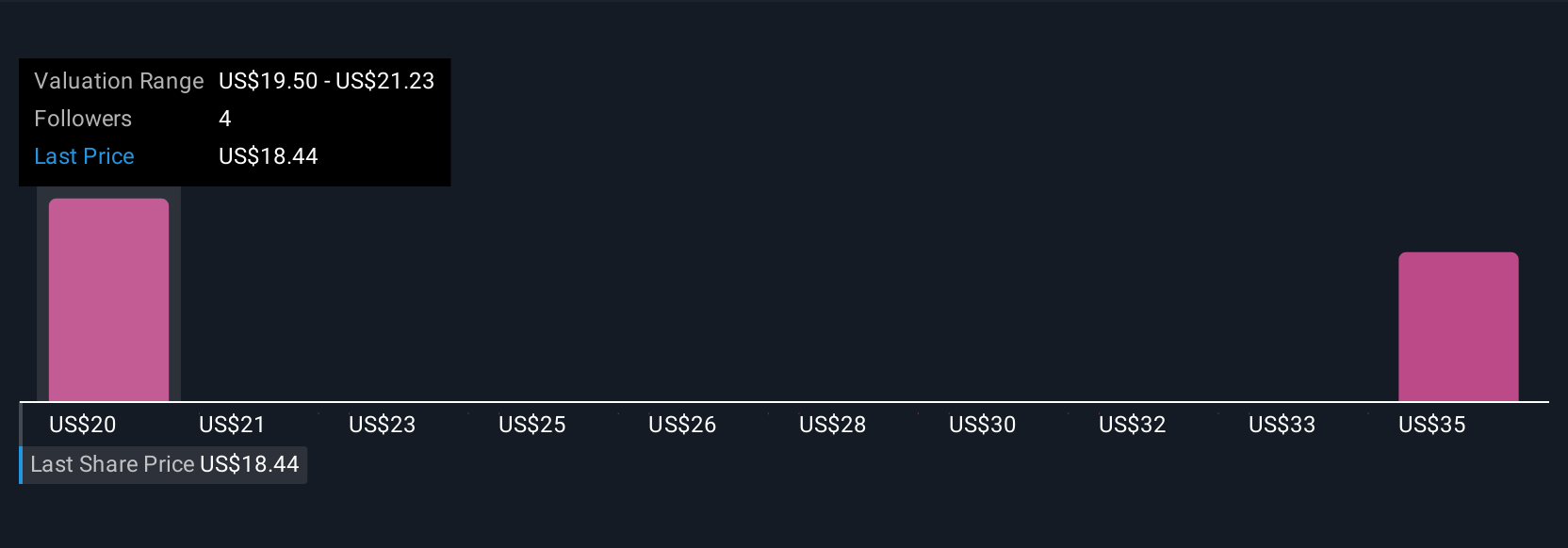

Fair value estimates from two members of the Simply Wall St Community range from US$19.50 to US$35.41 per share. While investors see a wide spectrum of possibilities, the shift of advertiser budgets toward digital and social media continues to emerge as a significant factor affecting OUTFRONT Media’s future cash flow and margin profile.

Explore 2 other fair value estimates on OUTFRONT Media - why the stock might be worth over 2x more than the current price!

Build Your Own OUTFRONT Media Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OUTFRONT Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free OUTFRONT Media research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OUTFRONT Media's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion