- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income's (O) £900 Million Refinancing Might Change The Case For Investing In The REIT

Reviewed by Sasha Jovanovic

- Realty Income Corporation recently closed a £900 million Sterling-denominated unsecured term loan, with proceeds used to refinance existing debt and pre-fund future maturities, while concurrently executing variable-to-fixed interest rate swaps to lock in a 4.3% interest rate.

- This proactive step in capital management highlights Realty Income’s focus on strengthening its financial flexibility as it expands its growth initiatives in asset management and debt financing.

- We’ll explore how Realty Income’s early refinancing and interest rate hedging could influence its investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Realty Income Investment Narrative Recap

To own Realty Income stock, investors need to believe in the long-term stability of necessity-based retail and industrial assets, underpinned by dependable cash flow and dividend growth, even as the company expands internationally. The recent £900 million term loan refinancing, with an interest rate swap locking at 4.3%, enhances financial flexibility but does not significantly alter the most important current catalyst, Realty Income’s ability to source accretive acquisitions at attractive spreads. The biggest risk remains the company’s increasing exposure to Europe, with related FX and regulatory uncertainties; this refinancing move helps address funding costs, but does not remove these risks.

Among recent announcements, the November 7 follow-on equity offering of 150,000,000 shares stands out. While unrelated to the debt refinancing, it adds another funding lever for future acquisitions and speaks to Realty Income's consistent strategy of maintaining access to capital, which underpins its acquisition-driven growth catalysts.

In contrast, a key risk investors must watch is how Realty Income’s growing exposure to European markets could leave future cash flows vulnerable to...

Read the full narrative on Realty Income (it's free!)

Realty Income's narrative projects $6.2 billion revenue and $1.6 billion earnings by 2028. This requires 4.1% yearly revenue growth and a $691.9 million increase in earnings from $908.1 million today.

Uncover how Realty Income's forecasts yield a $63.45 fair value, a 11% upside to its current price.

Exploring Other Perspectives

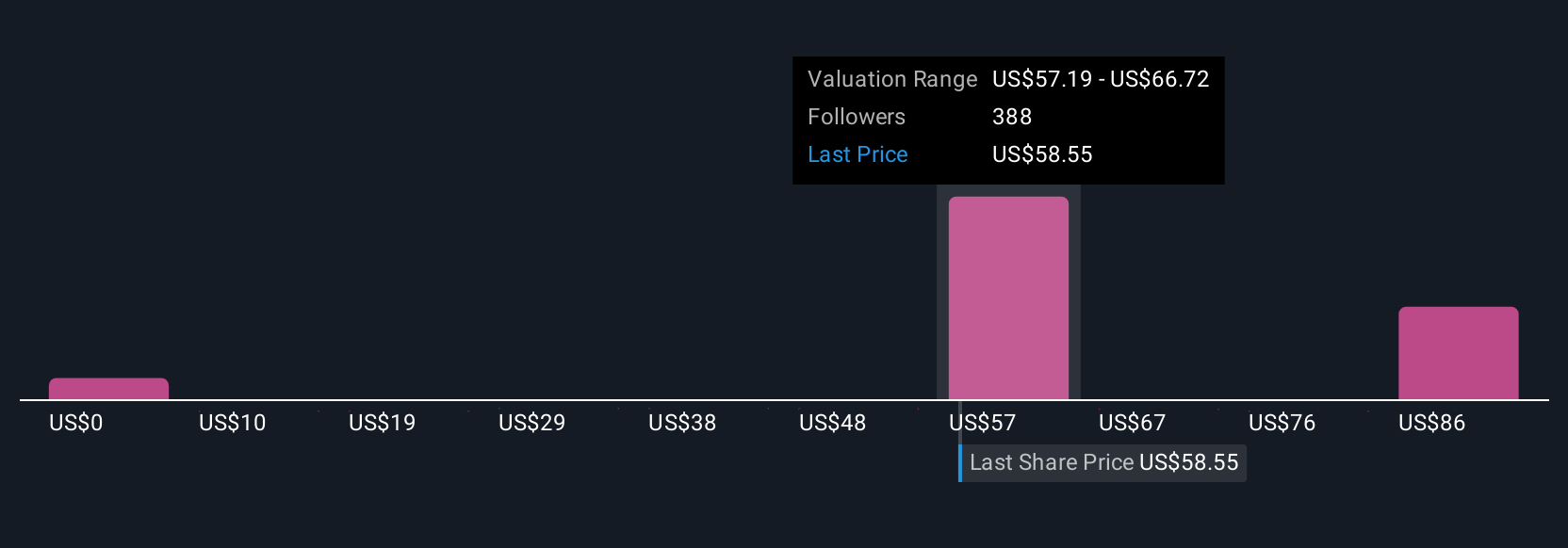

Sixteen retail investors from the Simply Wall St Community assigned fair values for Realty Income ranging from US$56.50 to US$97.35 per share. While many see room for price appreciation, the company’s expanding international investments raise important questions about volatility and future earnings power; consider all these views as you form your own outlook.

Explore 16 other fair value estimates on Realty Income - why the stock might be worth as much as 70% more than the current price!

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives