- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (O): Assessing Valuation After Securing £900 Million Term Loan and Sustained Dividend Growth

Reviewed by Simply Wall St

Realty Income (NYSE:O) has just completed a £900 million unsecured sterling term loan, taking steps to pre-fund future refinancing and maintain its financial flexibility. This move comes as the company continues to demonstrate confidence in the consistency of its dividend.

See our latest analysis for Realty Income.

Realty Income’s proactive management has reinforced investor confidence. Despite some recent share price volatility, the year-to-date share price return of 7.74% and steady 4.35% total shareholder return over the past year reflect both resilience and reliable income. Overall, momentum remains steady, with the company’s prudent refinancing efforts and longstanding monthly dividend growth underpinning a defensive profile amid sector headwinds.

If you’re looking beyond real estate for strong performers with an edge, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But does Realty Income’s stable yield and resilient profile suggest an undervalued opportunity for investors? Or has the market already priced in its future dividend growth and defensive strengths?

Most Popular Narrative: 7.5% Undervalued

According to andre_santos, the fair value for Realty Income is set at $61.26, suggesting meaningful upside compared to the recent closing price of $56.67. The latest fair value hinges on nuanced dividend assumptions and expects dividend growth momentum to slow, shaping the overall return profile presented below.

*Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty, and so it will have a lower weight on the valuation.*

The mysterious backbone of this valuation lies in the forward dividend growth rates and the analyst’s margin of safety. There is a strategic blend of established formulas, but one growth assumption above all tips the scale. Wondering what that is? Unlock the full narrative to learn the precise reasoning that justifies this fair value.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any further slowdown in dividend growth or weaker than expected rent collections could challenge the current valuation and investor sentiment.

Find out about the key risks to this Realty Income narrative.

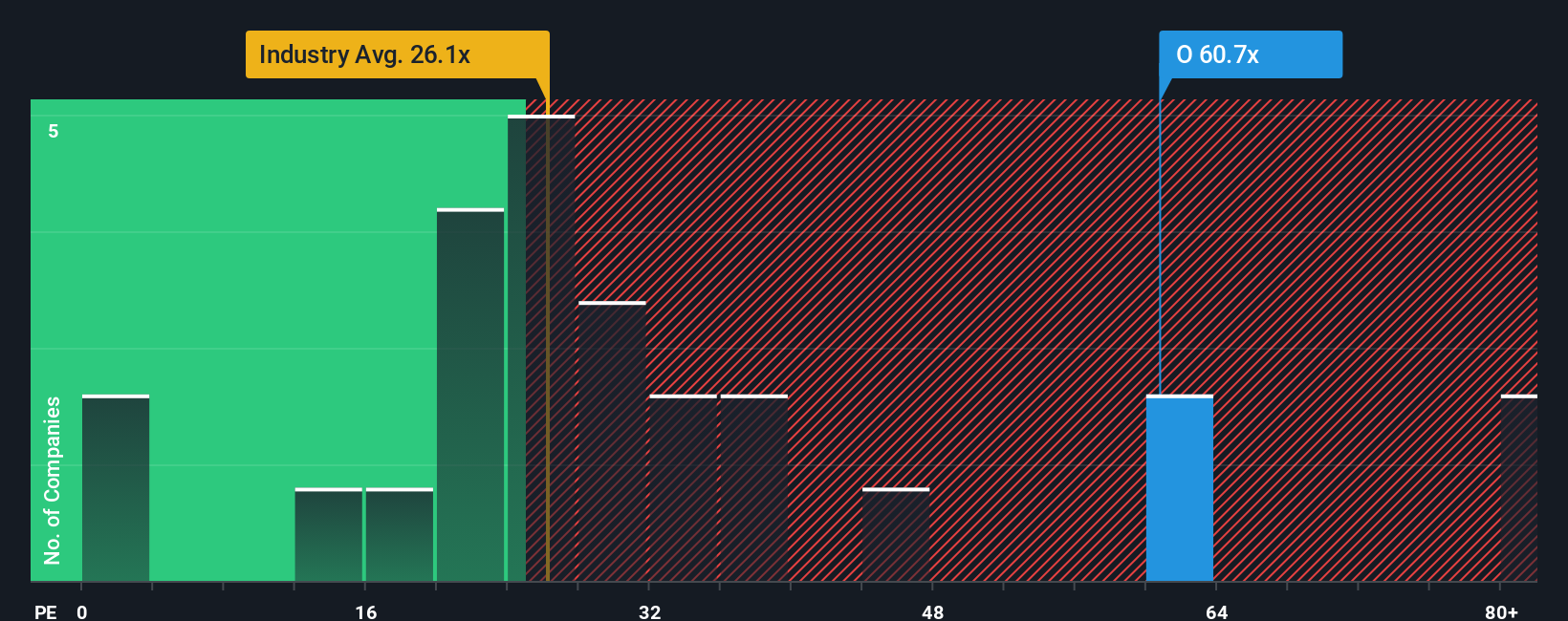

Another View: The Valuation Using Price-to-Earnings

Looking from the angle of the price-to-earnings ratio, Realty Income stands out as expensive. Its P/E sits at 54.2x, nearly double the US Retail REITs industry average of 26.9x and above its fair ratio estimate of 37.8x. This premium suggests higher valuation risk if growth expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If you’d rather shape your own perspective or put the data through your own filter, you can easily craft a personalized narrative in just minutes. Do it your way

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to one sector when the market is bursting with opportunities? Get ahead by targeting high potential in niche growth areas and future trends.

- Tap into the future of medicine by checking out these 30 healthcare AI stocks that are revolutionizing patient care through artificial intelligence and innovative healthcare solutions.

- Uncover stable passive income streams by focusing on these 15 dividend stocks with yields > 3% offering attractive yields and consistency even in shifting markets.

- Seize the momentum in rapidly growing tech. Scan these 26 AI penny stocks transforming industries with automation and unmatched intelligence-driven tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives