- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (O): $359.5 Million One-Off Loss Tests Bullish Narratives on Margin Recovery

Reviewed by Simply Wall St

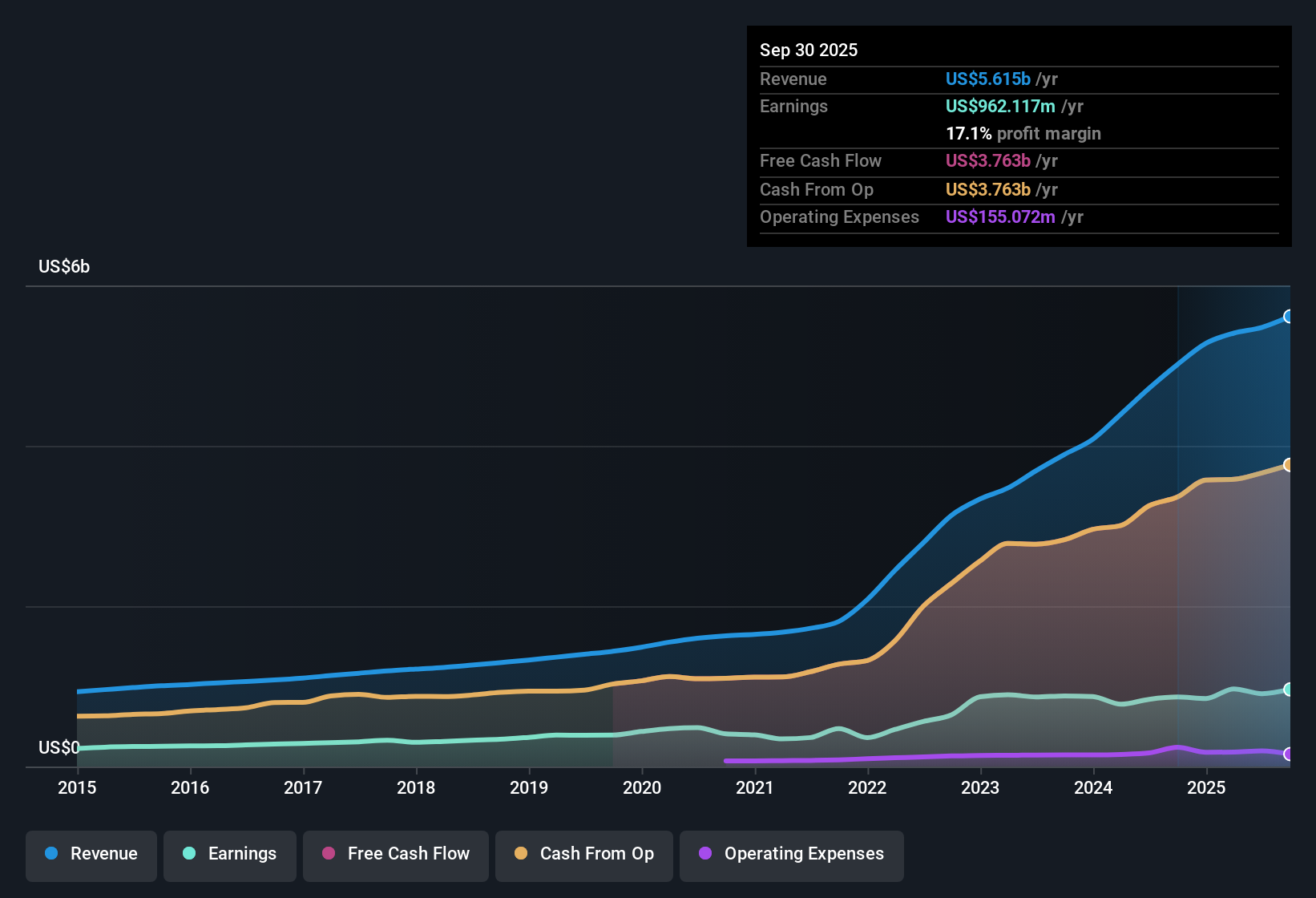

Realty Income (O) reported earnings growth of 11% for the past year, continuing its five-year annual average increase of 19.5%. Net profit margins currently sit at 17.1%, slightly below last year’s 17.3%, with recent results affected by a one-off loss of $359.5 million for the twelve months to September 2025. Shares trade at $56.14, well below a discounted cash flow fair value estimate of $100.01. Analysts project earnings growth of 16.15% per year ahead, even as revenue growth of 3.8% trails the broader market’s pace. The company remains attractive for its dividend, but investors must weigh persistent earnings momentum against softer margins and a premium valuation.

See our full analysis for Realty Income.Now, let’s see how these headline results compare to the narratives echoed by the market and the Simply Wall St community. This will set the stage for where expectations may shift and where long-held views could be tested.

See what the community is saying about Realty Income

Profit Margins Projected to Rebound

- Analysts expect profit margins will widen from 16.6% today to 26.6% by 2028, a significant increase that, if achieved, would represent a powerful reversal from this year’s slight dip to 17.1%.

- The analysts' consensus view pivots on international expansion and embedded rent escalators, claiming

- global diversification and necessity-based retail assets could drive stable occupancy and support higher margins even as competition intensifies. Europe makes up 76% of new investment activity this quarter, emphasizing the global reach of this strategy,

- though this upside is moderated by rising exposure to currency risk and evolving European regulations. As a result, long-term margin gains depend on navigating these new markets effectively.

Find out how margin growth could shift Realty Income’s competitive standing in the full consensus narrative. 📊 Read the full Realty Income Consensus Narrative.

Record Deal Flow Tightens Acquisition Spreads

- Realty Income sourced $43 billion in new deals this quarter, with nearly half stemming from the European market, highlighting the scope and complexity of its current acquisition pipeline.

- The analysts' consensus view highlights two counterbalancing forces:

- on one side, this robust deal flow and the company’s scale advantage support an expanding pipeline of opportunities to drive earnings and AFFO growth beyond 2025,

- while on the other, the influx of private capital chasing similar assets is likely to compress acquisition spreads. This raises the bar for finding accretive deals that meaningfully boost returns.

Premium Valuation Versus Industry Peers

- The current Price-To-Earnings ratio stands at 53.7x, well above both the industry average of 25.6x and the peer group’s 31.8x, despite shares trading markedly below their DCF fair value of $100.01.

- The analysts' consensus view suggests

- the price gap may reflect expectations of resilient growth and sustained dividend appeal,

- but it also signals caution as premium pricing requires the margin and growth story to translate into consistent outperformance. This is especially relevant with only a modest 4.9% upside to the $63.45 analyst target from the current $56.14 share price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Realty Income on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different perspective on the results? Shape your own view and build a unique narrative in just a few minutes: Do it your way

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust deal flow and ambitious margin forecasts, Realty Income’s high valuation, modest price upside, and recent margin softness may limit near-term returns.

If you want to target stronger value opportunities with greater upside, check out these 840 undervalued stocks based on cash flows that could offer more compelling entry points right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives