- United States

- /

- Retail REITs

- /

- NYSE:O

Can Realty Income’s (O) Sterling Refinancing Move Strengthen Its Case for Dividend Sustainability?

Reviewed by Sasha Jovanovic

- Earlier this month, Realty Income Corporation announced it had secured a £900 million unsecured term loan in Sterling with an initial maturity in January 2028, using the proceeds to refinance existing Sterling-denominated debt and fix interest rates through swaps at 4.3% per annum for the first two years.

- This refinancing strategy highlights the company's commitment to proactively managing its debt profile and reducing future interest rate uncertainty as analysts focus on leverage and dividend sustainability risks.

- We'll explore how Realty Income's move to secure fixed-rate Sterling debt could shape its investment narrative and financial outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Realty Income Investment Narrative Recap

To be a Realty Income shareholder, you have to believe in the durability of necessity-based retail and industrial real estate, and the company's ability to grow dividends amid evolving debt and acquisition strategies. The recent £900 million term loan in Sterling helps contain near-term interest costs but does not significantly alter the most important short-term catalyst, continued stable cash flows supporting dividends, or the main risk, which remains exposure to European markets and potential foreign currency headwinds.

Among recent announcements, Realty Income declared its 665th consecutive monthly dividend, maintaining an annualized dividend of US$3.234 per share. While the company's refinancing does not directly affect dividend levels, it shows operational steps being taken as investors weigh dividend reliability against rising leverage and overseas expansion.

However, with growing overseas investment, the risk of adverse foreign currency movement is something investors should keep in mind as ...

Read the full narrative on Realty Income (it's free!)

Realty Income's narrative projects $6.2 billion revenue and $1.6 billion earnings by 2028. This requires 4.1% yearly revenue growth and a $691.9 million earnings increase from $908.1 million today.

Uncover how Realty Income's forecasts yield a $63.45 fair value, a 12% upside to its current price.

Exploring Other Perspectives

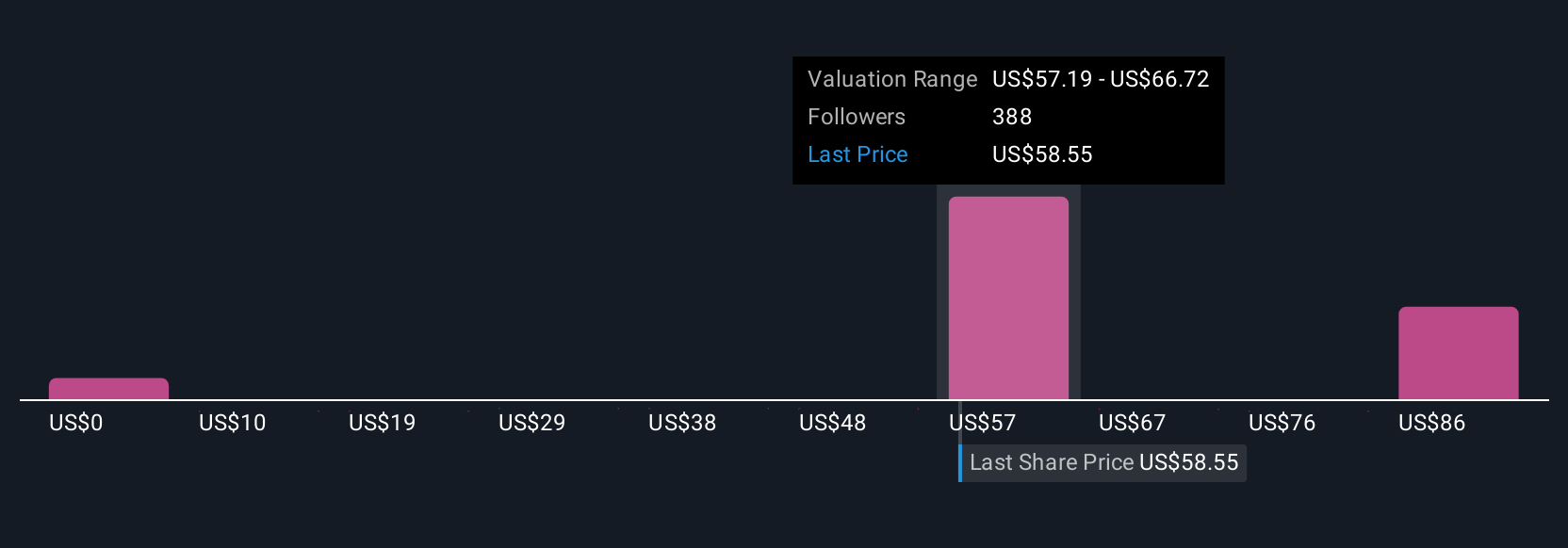

Sixteen different fair value estimates from the Simply Wall St Community range from US$56.50 to US$97.01. While community opinions diverge, many continue to watch management's approach to expansion in Europe and how it could impact Realty Income's long-term earnings stability.

Explore 16 other fair value estimates on Realty Income - why the stock might be worth just $56.50!

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

No Opportunity In Realty Income?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success