- United States

- /

- Retail REITs

- /

- NYSE:O

Assessing Realty Income (O) Valuation as Investor Enthusiasm Cools

Reviewed by Simply Wall St

See our latest analysis for Realty Income.

After a solid run earlier this year, Realty Income’s momentum has cooled a bit in recent weeks, with a 1-year total shareholder return of 4.2% and a current share price at $57.98. However, the longer-term gains remain notable, and the recent shift suggests investors are becoming more cautious as expectations normalize around valuation and income stability.

If you’re considering what else might be gaining traction right now, consider broadening your search and check out fast growing stocks with high insider ownership.

With the stock trading below analyst targets and boasting a strong history of income growth, is Realty Income now a bargain for value-seeking investors, or are current prices fully reflecting its future potential?

Most Popular Narrative: 5.4% Undervalued

Realty Income’s fair value of $61.26, as calculated in the featured narrative, stands modestly above its last close of $57.98. This suggests a small upside for value-focused investors who emphasize dividend consistency and growth rates.

“Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty, and so it will have a lower weight on the valuation.”

Want to know what’s driving this fair value? One assumption in this narrative changes everything, shifting the balance between two classic models. Curious which underlying pattern powers this estimate? Get the full story behind the number in the complete narrative.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changing interest rates or slower than expected growth could quickly shift the outlook, making today’s fair value less certain for Realty Income.

Find out about the key risks to this Realty Income narrative.

Another View: Multiples Raise Questions

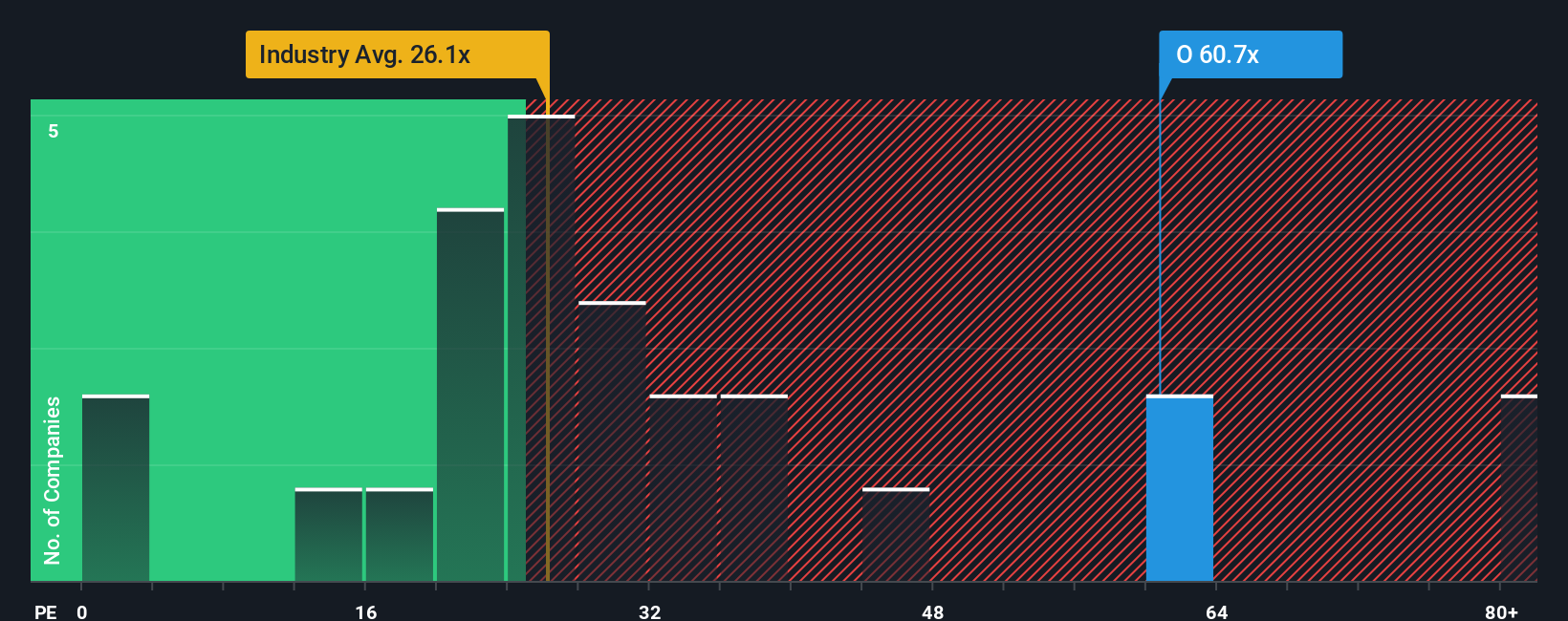

Looking at Realty Income through the lens of price-to-earnings, the numbers tell a different story. Its ratio stands at 58.4 times earnings, which is much higher than both the industry average of 26 and peers at 32.1. Even when measured against the fair ratio of 38.4, it looks steep.

This big gap suggests investors could be paying a higher premium than usual for Realty Income’s reliability. This could mean there is less margin for error if growth slows. Is the market’s confidence misplaced, or is the premium justified for such consistency?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If you’d rather examine the numbers for yourself or think the story could go another way, you can craft your own personalized analysis in just a few minutes. Do it your way.

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big opportunity slip by. Use Simply Wall Street’s top screeners to quickly zero in on stocks with real potential for your portfolio.

- Boost your income stream with picks offering strong yields and reliable growth by taking a closer look at these 22 dividend stocks with yields > 3%.

- Tap into the wave of intelligent automation and be part of tomorrow’s winners by exploring these 26 AI penny stocks.

- Seize value you might be missing by finding companies that are flying under the radar with these 832 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives