- United States

- /

- REITS

- /

- NYSE:NXDT

Strong week for NexPoint Diversified Real Estate Trust (NYSE:NXDT) shareholders doesn't alleviate pain of five-year loss

While it may not be enough for some shareholders, we think it is good to see the NexPoint Diversified Real Estate Trust (NYSE:NXDT) share price up 30% in a single quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. Indeed, the share price is down 66% in the period. So we're not so sure if the recent bounce should be celebrated. We'd err towards caution given the long term under-performance.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for NexPoint Diversified Real Estate Trust

NexPoint Diversified Real Estate Trust wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, NexPoint Diversified Real Estate Trust saw its revenue increase by 9.5% per year. That's a fairly respectable growth rate. The share price, meanwhile, has fallen 11% compounded, over five years. That suggests the market is disappointed with the current growth rate. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

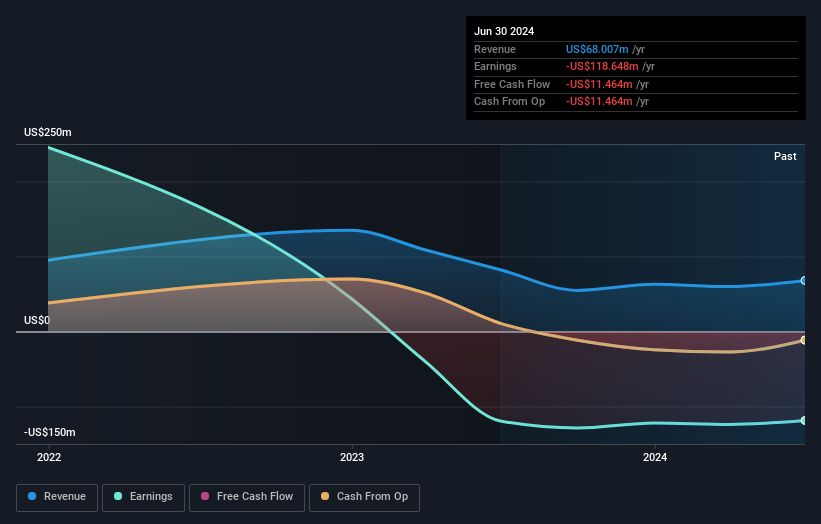

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on NexPoint Diversified Real Estate Trust's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, NexPoint Diversified Real Estate Trust's TSR for the last 5 years was -51%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

NexPoint Diversified Real Estate Trust shareholders are down 24% for the year (even including dividends), but the market itself is up 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand NexPoint Diversified Real Estate Trust better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for NexPoint Diversified Real Estate Trust (of which 2 are significant!) you should know about.

NexPoint Diversified Real Estate Trust is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NexPoint Diversified Real Estate Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NXDT

NexPoint Diversified Real Estate Trust

NexPoint Diversified Real Estate Trust (“NXDT”) is an externally advised diversified real estate investment trust (“REIT”), with its shares of common stock and 5.50% Series A Cumulative Preferred Shares listed on the New York Stock Exchange under the symbols NXDT and NXDT-PA, respectively.

Low and slightly overvalued.