- United States

- /

- Specialized REITs

- /

- NYSE:NSA

National Storage Affiliates Trust (NSA): Profit Margin Decline Reinforces Margin Pressure Narrative for Earnings Season

Reviewed by Simply Wall St

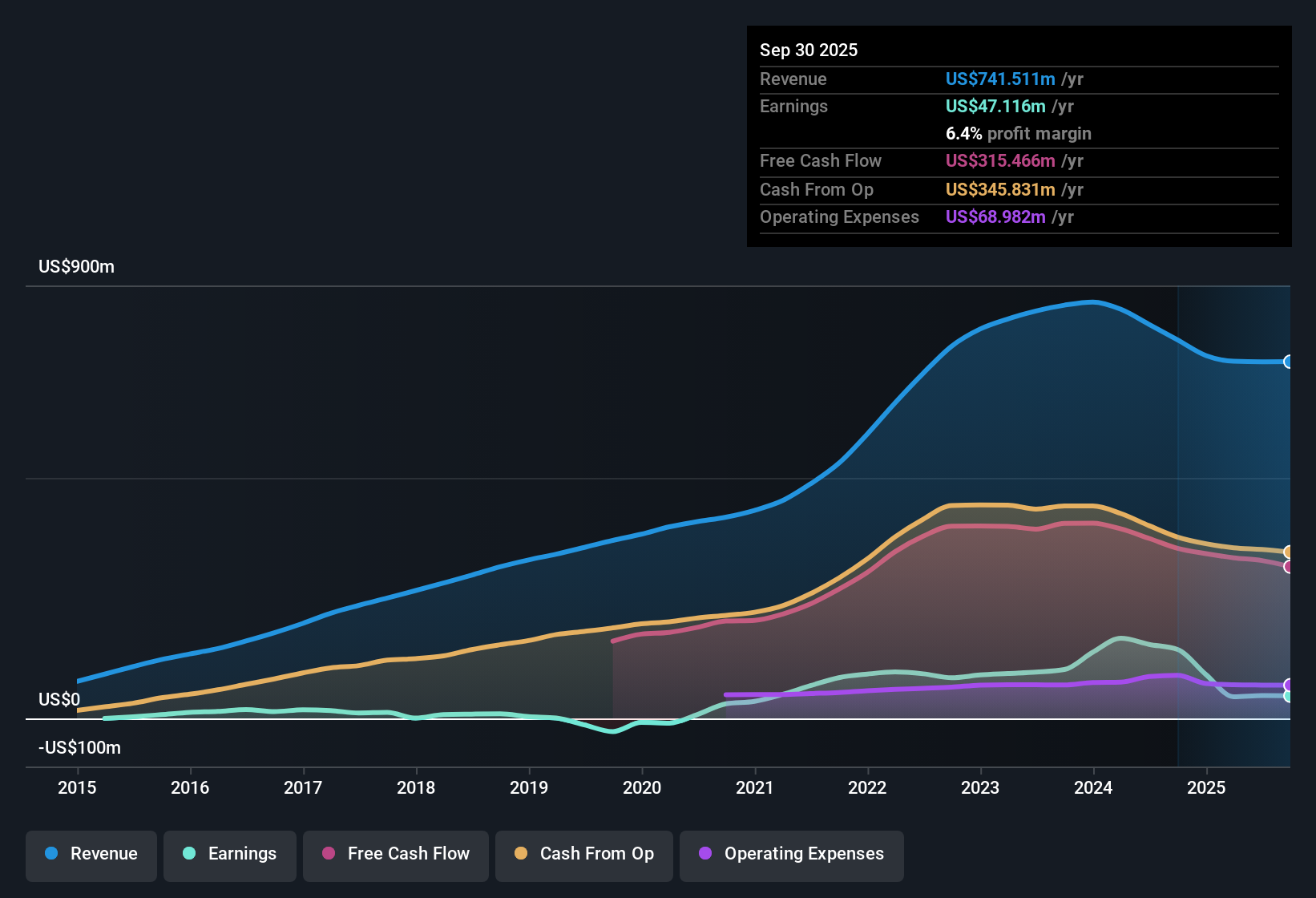

National Storage Affiliates Trust (NSA) posted a year shaped by slowing expansion, with earnings projected to grow at 6.68% per year and revenue at 3.3% per year. Both figures trail the US market, which averages 16% and 10.5%, respectively. After delivering 8.9% average annual earnings growth over the past five years, NSA saw its most recent year marked by negative earnings growth and a net profit margin slip from 18.2% to 6.4%. Investors are weighing consistent, if muted, long-term growth alongside margin pressure and a sharply elevated price-to-earnings ratio of 48.7x, setting a complex scene as the stock heads through earnings season.

See our full analysis for National Storage Affiliates Trust.Next, we’ll see how NSA’s numbers compare to the main market narratives, spotlighting where expectations and results match up and where surprise may be brewing.

See what the community is saying about National Storage Affiliates Trust

DCF Fair Value Outpaces Current Price

- NSA's current share price of $29.86 is notably below its DCF fair value of $41.05, creating a potential upside gap of over 37% if DCF estimates prove accurate.

- Analysts' consensus view centers around mixed signals: while the price discount implies value, the analyst price target stands at $33.77, only about 13% above today’s price. This suggests that, on average, the company may only be modestly undervalued.

- This modest gap is backed by the fact that consensus expects revenue to rise just 2.6% annually for the next three years, with earnings progressing from $47.4 million now to $56.7 million by 2028.

- Consensus also expects profit margins to inch up slightly from 6.4% to 7.1% over three years. This reflects cautious optimism but not a dramatic turnaround.

- See more market perspectives in the full Consensus Narrative for National Storage Affiliates Trust. Analysts lay out both the subtle positives and key watchpoints. 📊 Read the full National Storage Affiliates Trust Consensus Narrative.

Margin Pressure Remains a Central Concern

- Net profit margin is currently 6.4%, far below last year’s 18.2%, and future projections show only a gradual recovery to 7.1% over three years.

- Consensus narrative highlights that expense growth is challenging the company. Rising property taxes, repair and maintenance, and marketing costs in competitive and rebranded markets are compressing operating margins.

- Elevated competition and the need for concessions to retain tenants are limiting rent growth and pricing power, which keeps margins under pressure even as demand for storage holds steady.

- Together, these headwinds underpin why management and analysts are taking a conservative stance on margin recovery, despite efficiencies expected from tech integration and portfolio optimization in the longer term.

Dividend Attractiveness Versus Financial Health Risks

- Despite margin setbacks, NSA continues to offer an attractive dividend, which is one of the few areas where analysts agree the company stands out for income-seeking investors.

- According to the consensus narrative, NSA's ability to maintain and grow this dividend is being tested by weaker financial positioning, as slower acquisition activity and a temporarily higher payout ratio risk balance sheet strength.

- Bears point to the combination of higher dividend payout and recent margin compression as a reason to question durability, especially if operational improvements stall or cost pressures linger.

- Bulls, however, emphasize the company’s focus on recycling underperforming assets and strategic market selection. They argue these moves lay the groundwork for sustaining dividends and recovery in cash flow over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for National Storage Affiliates Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the latest data another way? Take two minutes to craft your perspective and share your own narrative: Do it your way.

A great starting point for your National Storage Affiliates Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

National Storage Affiliates Trust faces ongoing margin compression, muted growth, and questions about the sustainability of its dividend due to financial health pressures.

Want steadier portfolios? Redirect your search toward solid balance sheet and fundamentals stocks screener (1981 results) to uncover companies built on stronger balance sheets and more resilient fundamentals for the road ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage Affiliates Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSA

National Storage Affiliates Trust

A real estate investment trust headquartered in Greenwood Village, Colorado, focused on the ownership, operation and acquisition of self storage properties predominantly located within the top 100 metropolitan statistical areas throughout the United States.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives