- United States

- /

- Specialized REITs

- /

- NYSE:NSA

National Storage Affiliates Trust (NSA): Assessing Current Valuation as Shares Rebound from Recent Lows

Reviewed by Simply Wall St

National Storage Affiliates Trust (NSA) shares have had a challenging run over the past year, with a 31% decline in total return. The stock's performance has caught the eye of investors who are looking for value opportunities in the self-storage real estate sector.

See our latest analysis for National Storage Affiliates Trust.

After a tough stretch, National Storage Affiliates Trust shares have started to show flickers of momentum, with a 1.84% jump in the latest trading session even as the 30-day share price return stands at -8.71%. However, longer-term total shareholder returns remain deeply in the red, reflecting a sector that continues to face headwinds and shifting investor sentiment.

If you’re watching trends like this unfold, now could be the perfect time to broaden your perspective with fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets, is National Storage Affiliates Trust truly undervalued, or are investors simply accounting for slower growth ahead? The core issue is whether there is a buying opportunity here or if the market already reflects what is to come.

Most Popular Narrative: 14.7% Undervalued

With National Storage Affiliates Trust’s fair value estimated at $33.77, the current share price sits nearly $5 below this midpoint. This gap has drawn attention, especially as forward-looking assumptions factor in recovery and renewed stability for the business. This sets the stage for a closer look at the drivers of this valuation.

The recent internalization and rebranding of PRO (Participating Regional Operator) properties, combined with investments in centralized technology and enhanced digital marketing, are likely to drive efficiency gains and margin expansion as integration challenges subside, supporting earnings growth.

Want to know what’s powering this valuation boost? Discover the ambitious targets for future earnings and margin expansion, which could potentially outpace past trends. The full narrative breaks down the behind-the-scenes operational upgrades, digital strategy, and the financial leap that analysts believe sets National Storage Affiliates Trust apart.

Result: Fair Value of $33.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic pressures and higher operating costs could challenge National Storage Affiliates Trust’s ability to sustain occupancy and margin improvements in the future.

Find out about the key risks to this National Storage Affiliates Trust narrative.

Another View: Multiples Raise Caution

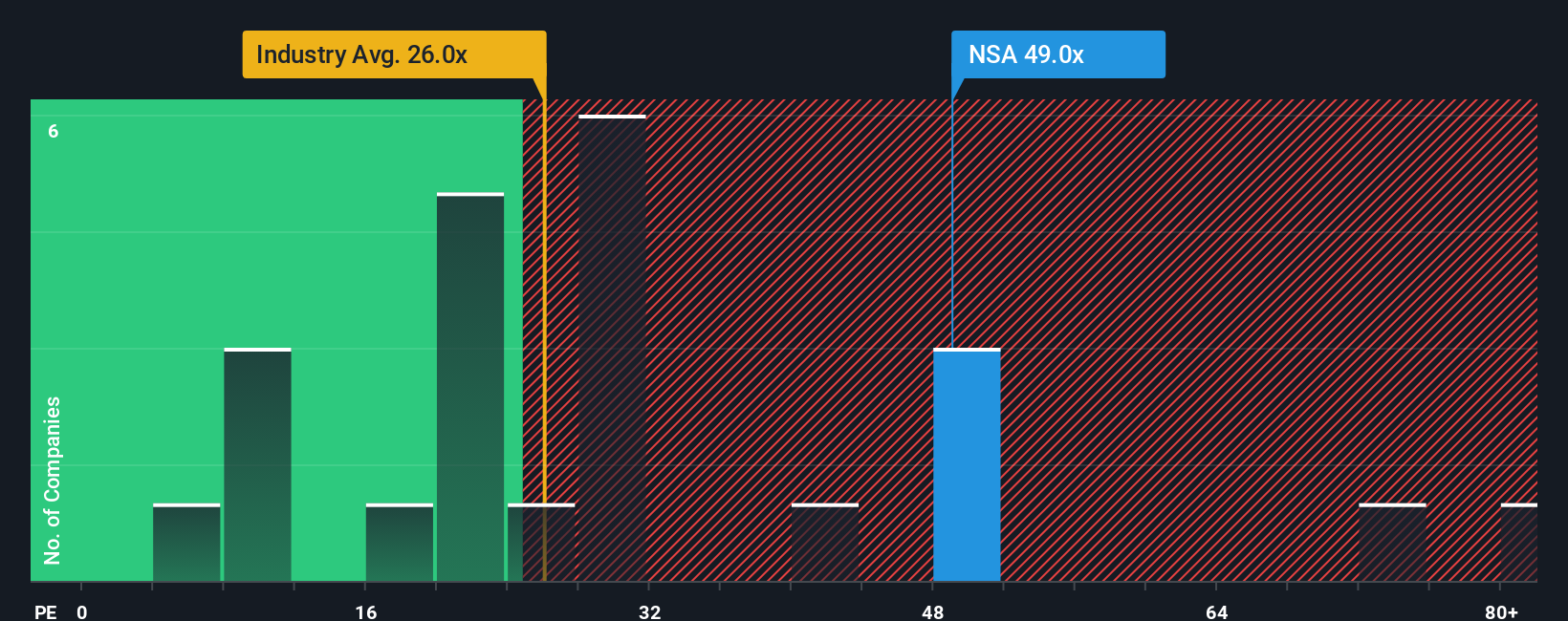

While the fair value model suggests National Storage Affiliates Trust is undervalued, its price-to-earnings ratio stands at 47x. This is far above the US Specialized REITs industry average of 28.3x and its peers at 28.4x. The fair ratio, based on broader market fundamentals, sits at 31.8x. This premium brings up the question: are investors paying too much for today’s growth potential, or is there real outperformance ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Storage Affiliates Trust Narrative

If you see things differently or prefer hands-on research, you can dig into the numbers and craft your own narrative in just a few minutes. Do it your way.

A great starting point for your National Storage Affiliates Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your edge and seize fresh opportunities by checking out other standout stocks. Don’t miss the momentum, as new market leaders may already be on your radar tomorrow.

- Capture gains from overlooked companies by scanning these 928 undervalued stocks based on cash flows tailored to highlight stocks trading well below their intrinsic value.

- Power up your portfolio’s future by targeting innovation through these 26 AI penny stocks, where artificial intelligence breakthroughs are reshaping global industries.

- Find reliable payouts to boost your income with these 16 dividend stocks with yields > 3%, built to spotlight stocks offering yields above 3% for consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage Affiliates Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSA

National Storage Affiliates Trust

A real estate investment trust headquartered in Greenwood Village, Colorado, focused on the ownership, operation and acquisition of self-storage properties predominantly located within the top 100 metropolitan statistical areas throughout the United States.

6 star dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives