- United States

- /

- Health Care REITs

- /

- NYSE:MPW

Medical Properties Trust (MPW): Valuation in Focus After New Lease Deal and Strengthened Balance Sheet

Reviewed by Kshitija Bhandaru

Medical Properties Trust (MPW) has caught investors’ attention with its recent announcement of a new lease agreement for six California facilities with NOR Healthcare System Corp, pending regulatory approval. This deal follows a period of strategic focus on shoring up financial strength. This effort is now evident in the company’s reported $1.2 billion of liquidity and no debt maturities for the next year after recent refinancing. These moves have started raising eyebrows among both committed long-term holders and those watching from the sidelines, wondering if the tide could be turning for MPW.

It’s clear something is shifting. The stock has gained 16% over the past three months, outpacing its sector and reversing earlier negative sentiment. While MPW’s one-year return remains in the red, the pace has picked up recently on the back of this lease news and its enhanced balance sheet. There’s still a long way to go, as MPW’s five-year total return is down more than 57%. However, the momentum in recent weeks has many investors asking if the worst might be behind the company.

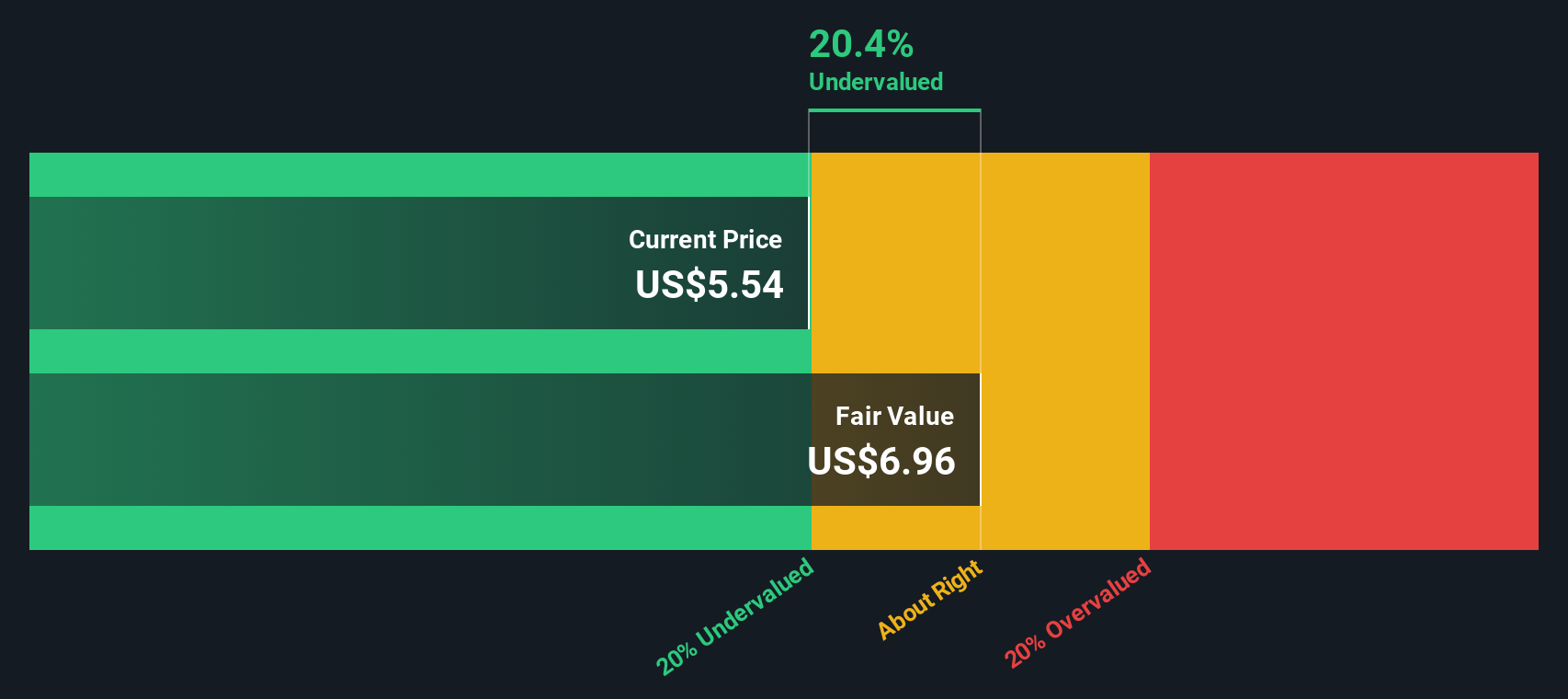

So with Medical Properties Trust showing signs of life but still wrestling with long-term losses, is the stock truly undervalued now, or are rising expectations already reflected in the price?

Most Popular Narrative: 3% Overvalued

The most widely followed narrative suggests Medical Properties Trust is trading slightly above its fair value, with the consensus viewing the company as around 3% overvalued. This subtle premium comes amid debate over whether recent improvements will translate to sustainable growth.

Strategic international expansion, including increased investments in the UK, Germany, and Switzerland, is enhancing portfolio diversification, reducing geographic concentration risk, and providing exposure to higher-growth healthcare markets. This approach is positively impacting long-term net margins and earnings consistency.

Curious how analysts landed on this tight valuation margin? The projections rely on an ambitious earnings turnaround, global shifts in hospital trends, and assumptions about profitability that could catch even seasoned investors off guard. Which bold growth assumptions drive this calculation? What is the real story behind the numbers? Dive deeper to uncover the quantitative logic defining this fair value.

Result: Fair Value of $4.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tenant concentration risks and potential asset impairments could quickly undermine the case for sustained recovery at Medical Properties Trust.

Find out about the key risks to this Medical Properties Trust narrative.Another View: Discounted Cash Flow Model

Looking at the company through the lens of our DCF model reveals a much more optimistic outlook. This analysis suggests Medical Properties Trust may be trading well below its intrinsic value. Could this method be highlighting hidden upside that traditional valuation misses?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medical Properties Trust Narrative

If you see the numbers differently, or if you want to chart your own course with the data, it's never been easier to shape your own view. Get started in just a few minutes. Do it your way

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Act on More Investment Ideas?

Don't limit your strategy to just one stock. Open the door to new opportunities by using these smart tools to spot market movers before everyone else.

- Kickstart your hunt for exceptional value by searching for undervalued stocks based on cash flows with undervalued stocks based on cash flows right now and get ahead of potential bargains.

- Capitalize on tech’s next frontier by tracking AI penny stocks shaking up industries and outpacing traditional players through AI penny stocks.

- Recharge your income strategy by pursuing dividend stocks with yields above 3% using dividend stocks with yields > 3% and put your cash to work more efficiently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives