- United States

- /

- Health Care REITs

- /

- NYSE:MPW

Medical Properties Trust (MPW): Reassessing Valuation After Settlement and Hospital Asset Sales

Reviewed by Kshitija Bhandaru

Medical Properties Trust (MPW) has drawn attention after announcing a settlement with Yale New Haven Health System and Prospect Medical. The agreement releases Yale from buying three Connecticut hospitals and triggers several asset sales and repayments tied to its debt reduction plan.

See our latest analysis for Medical Properties Trust.

Recent settlements and asset sales appear to have sparked renewed optimism in Medical Properties Trust, with the share price steadily climbing in recent weeks. However, while short-term share price returns are positive, the one-year total shareholder return is essentially flat, and those who held shares over the past three to five years still face significant declines. This suggests that any rebound in sentiment is still in its early stages as investors weigh progress on debt reduction and operational stability.

If you’re curious which other healthcare stocks might be set for a turnaround, it’s a great moment to explore the full range using our See the full list for free..

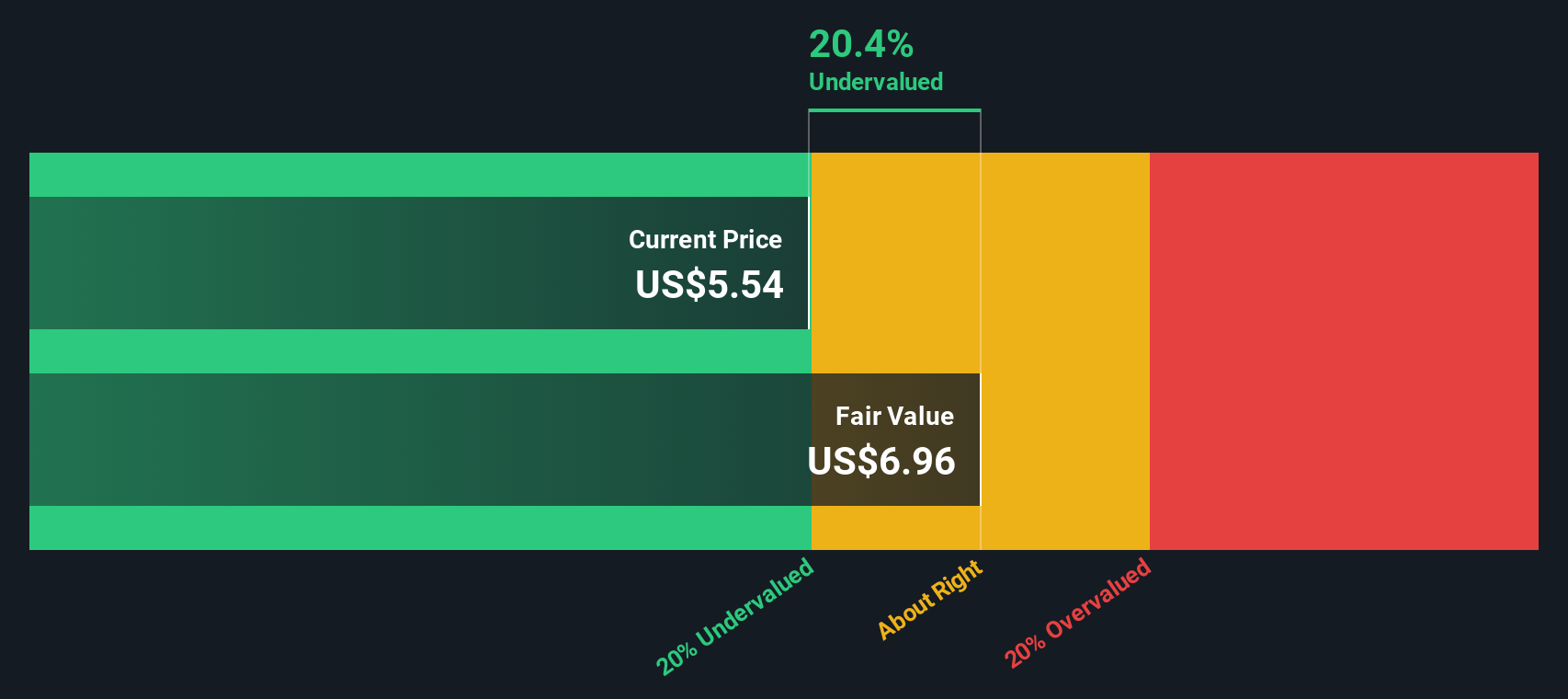

With shares rebounding but long-term returns still negative, is Medical Properties Trust undervalued after these settlements and asset sales? Or is the market already pricing in potential growth from improved fundamentals?

Most Popular Narrative: 13% Overvalued

The most widely followed narrative puts Medical Properties Trust’s fair value at $4.86. This is below the last close price of $5.51, raising questions about whether recent gains reflect real fundamentals or are moving ahead of the company’s outlook.

International expansion and access to affordable capital are enhancing portfolio diversification and enabling sustainable, long-term revenue streams. High tenant concentration, asset impairments, rising debt costs, regulatory uncertainties, and sector-wide pressures threaten earnings stability, cash flow, and long-term dividend sustainability.

How do analysts justify a valuation above the company’s recent lows, despite mounting sector pressures? Examine this narrative’s boldest revenue, profit, and margin assumptions on the next page, as key projections could impact investor expectations.

Result: Fair Value of $4.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on new hospital operators and the potential for further asset impairments could still challenge Medical Properties Trust's recovery narrative.

Find out about the key risks to this Medical Properties Trust narrative.

Another View: What the SWS DCF Model Says

Looking from a discounted cash flow (DCF) perspective, our SWS DCF model estimates Medical Properties Trust’s fair value at $6.82, which is above both the analyst consensus and the current market price. This suggests the shares could be undervalued, raising the question: Are markets overlooking longer-term cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medical Properties Trust Narrative

If you see things differently or like to do your own analysis, you can craft a complete narrative using your own outlook in just a few minutes. Do it your way.

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next smart move by targeting stocks built for growth, income, or an innovative edge. Let Simply Wall Street guide you toward market opportunities you do not want to overlook.

- Capitalize on untapped potential by hunting for these 904 undervalued stocks based on cash flows that the market might be missing. This could set you up for possible future gains.

- Supercharge your portfolio’s income stream by seeking out these 19 dividend stocks with yields > 3% offering strong yields and reliable payouts.

- Ride the technological wave and shape your investment strategy with these 24 AI penny stocks at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives