- United States

- /

- Health Care REITs

- /

- NYSE:MPW

Medical Properties Trust (MPW): Assessing Valuation as Asset Sales and Debt Repayment Drive Investor Optimism

Reviewed by Kshitija Bhandaru

Medical Properties Trust has advanced its turnaround efforts with a recently announced settlement involving Prospect Medical Holdings and Yale New Haven Health System. The deal includes Yale’s $45 million payment and the pending sales of three Connecticut facilities, subject to Bankruptcy Court approval.

See our latest analysis for Medical Properties Trust.

Following these recent agreements and asset sales, Medical Properties Trust has drawn renewed investor interest. This is reflected in share price gains over the last month and revived business momentum. Still, while the company’s short-term share price performance turned positive, its longer-term total shareholder returns remain deeply negative. This indicates that optimism is just starting to rebuild.

If you’re curious to see what other companies are taking bold steps in healthcare, consider checking out See the full list for free.

With these positive developments now reflected in Medical Properties Trust’s recent gains, the key question remains: does the stock have room to run from here, or is the market already factoring in any future recovery?

Most Popular Narrative: 13% Overvalued

With Medical Properties Trust closing at $5.51, the most widely followed narrative suggests a fair value of $4.86. This places the current share price above analyst consensus and sets up a debate about whether the recent rally has gone too far, especially in light of the company's turnaround momentum.

Strategic international expansion, including increased investments in the UK, Germany, and Switzerland, is enhancing portfolio diversification, reducing geographic concentration risk, and providing exposure to higher-growth healthcare markets. This is positively impacting long-term net margins and earnings consistency.

What’s driving this pricing disconnect? The narrative values future growth and enhanced profitability, but the hidden levers could change everything. Want to see which underlying forecasts power the analysts' conviction or sow uncertainty for the bulls?

Result: Fair Value of $4.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as tenant concentration and large-scale debt refinancings. These factors could challenge the company’s improving outlook if conditions worsen.

Find out about the key risks to this Medical Properties Trust narrative.

Another View: DCF Model Sees More Upside

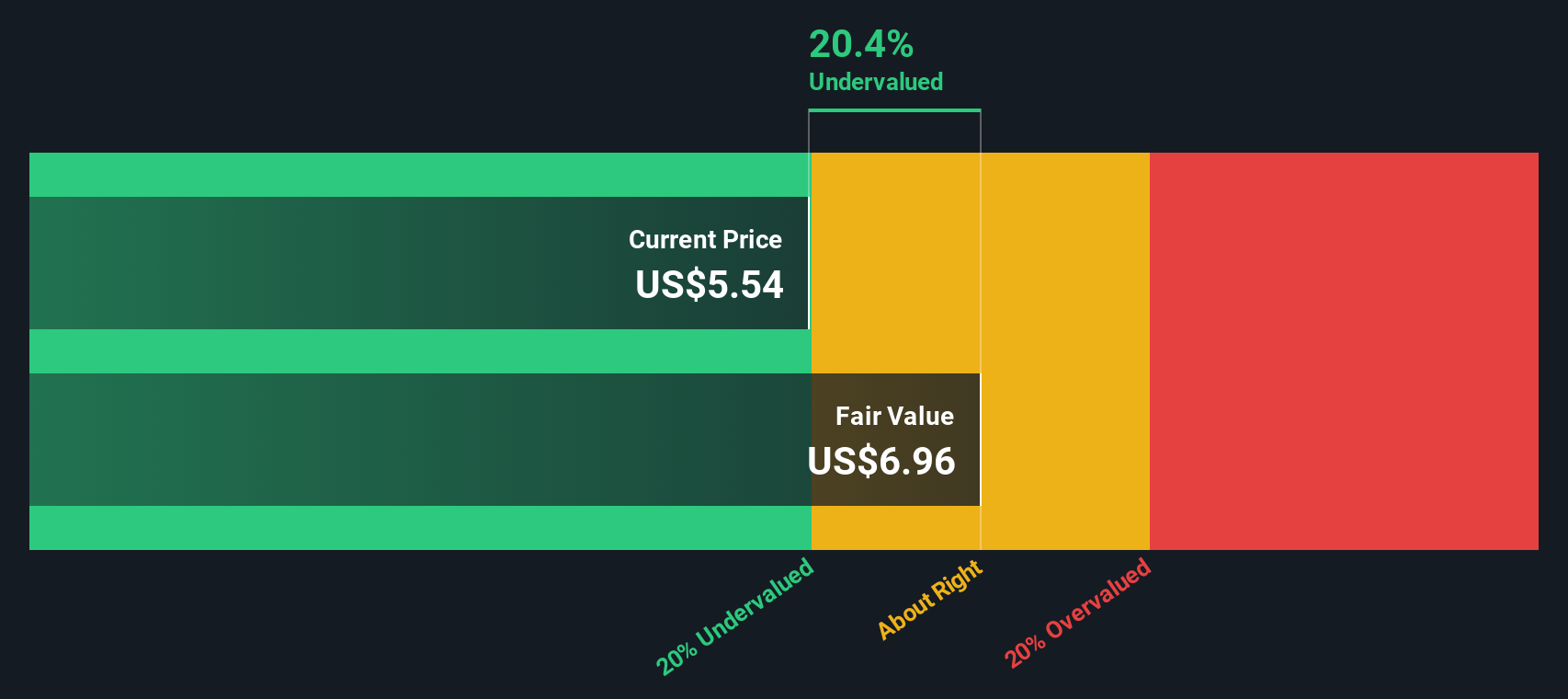

While the most popular narrative suggests Medical Properties Trust is overvalued on a consensus basis, the SWS DCF model points toward a different story. According to this method, the shares are trading below fair value, indicating potential upside. Is the discount based on fundamentals, or is market skepticism justified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medical Properties Trust Narrative

If you see things differently or prefer your own hands-on analysis, you can dive into the numbers and build your own narrative in just a few minutes, Do it your way

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There is much more to the market than one stock. Now is the perfect moment to expand your watchlist and capitalize on timely themes you can’t afford to overlook.

- Unleash your search for reliable yields and kickstart your passive income strategy by checking out these 19 dividend stocks with yields > 3% offering above-average returns.

- Boost your portfolio’s future potential by targeting innovation leaders through these 24 AI penny stocks harnessing breakthroughs in artificial intelligence.

- Stay ahead of market trends by tracking these 78 cryptocurrency and blockchain stocks shaping the next generation of financial technology and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives