- United States

- /

- Health Care REITs

- /

- NYSE:MPW

How Rising Cash Rent and German Refinancing at Medical Properties Trust (MPW) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Medical Properties Trust recently reported a surge in cash rent from new tenants, jumping from US$3.4 million in Q1 to US$11 million in Q2, along with a successful refinancing of its German joint venture at a favorable fixed rate.

- This momentum highlights growing investor confidence and signals the company's ambition to surpass US$1 billion in total annualized cash rent by the end of 2026.

- We'll examine how Medical Properties Trust's strong rise in cash rent from new tenants influences its outlook and investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Medical Properties Trust Investment Narrative Recap

For investors to feel comfortable holding Medical Properties Trust, they must believe the company can successfully re-tenant previously distressed hospital properties and achieve robust, recurring rental income amid sector risks. The recent surge in cash rent from new tenants and a favorable refinancing in its German joint venture are meaningful, but the biggest short term catalyst, full ramp-up of rent payments from new tenants, still depends on continued tenant financial improvement. The main risk of operator credit quality and property sales below book value remains largely unchanged.

One announcement closely tied to the latest news is the August 28 lease agreement with NOR Healthcare Systems Corp., covering six more facilities at an initial annualized rent of US$45 million. This reinforces the company's focus on growing rental streams and expanding its tenant base, both key to mitigating risks associated with tenant turnover and cash flow volatility.

But while rental income progress shines, investors should pay close attention to the risk of unresolved asset sales and lingering tenant financial health, as...

Read the full narrative on Medical Properties Trust (it's free!)

Medical Properties Trust's narrative projects $1.1 billion in revenue and $136.7 million in earnings by 2028. This requires 3.1% yearly revenue growth and an increase in earnings of approximately $1.54 billion from the current -$1.4 billion level.

Uncover how Medical Properties Trust's forecasts yield a $4.86 fair value, a 8% downside to its current price.

Exploring Other Perspectives

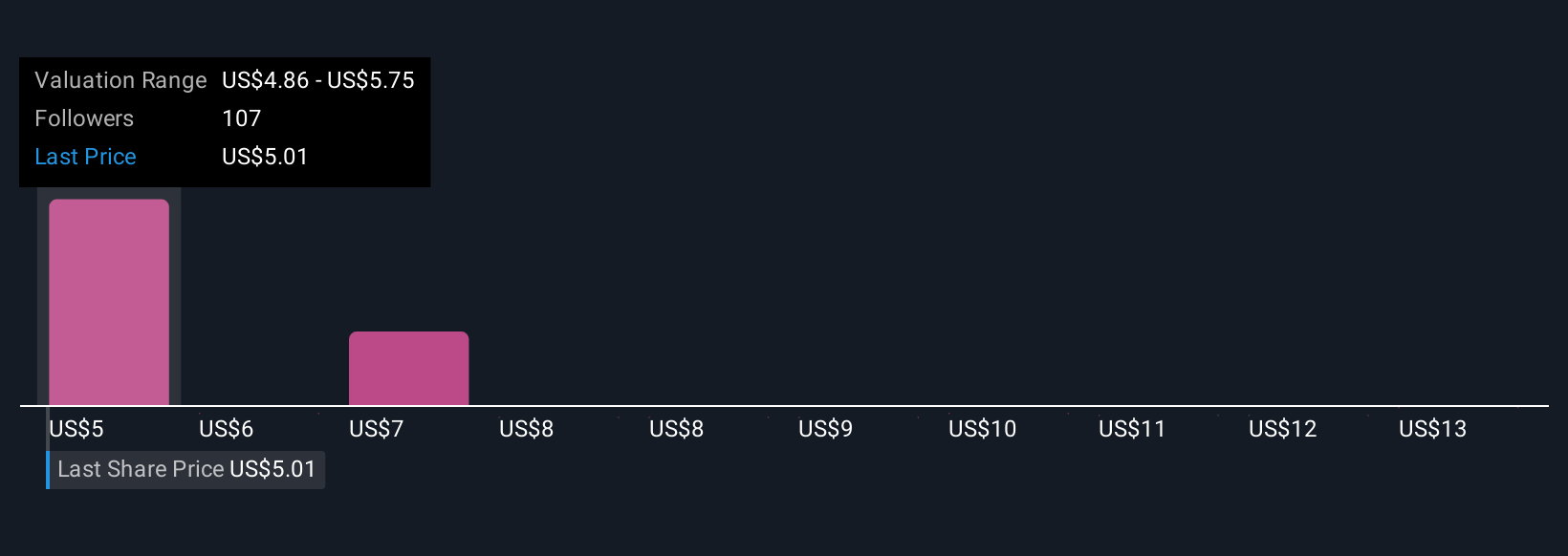

Simply Wall St Community members published 12 fair value estimates for Medical Properties Trust, ranging widely from US$4.86 to US$13.75 per share. With the company's rental income rising rapidly but credit and asset risks still present, it's clear that interpretations of the future can vary significantly, exploring multiple views can be instructive.

Explore 12 other fair value estimates on Medical Properties Trust - why the stock might be worth 8% less than the current price!

Build Your Own Medical Properties Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Medical Properties Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medical Properties Trust's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives