- United States

- /

- Real Estate

- /

- NYSE:MLP

Announcing: Maui Land & Pineapple Company (NYSE:MLP) Stock Increased An Energizing 124% In The Last Five Years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term Maui Land & Pineapple Company, Inc. (NYSE:MLP) shareholders would be well aware of this, since the stock is up 124% in five years. And in the last week the share price has popped 6.0%. But this could be related to the buoyant market which is up about 3.2% in a week.

Check out our latest analysis for Maui Land & Pineapple Company

Maui Land & Pineapple Company isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade Maui Land & Pineapple Company's revenue has actually been trending down at about 34% per year. On the other hand, the share price done the opposite, gaining 17%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, we are a bit cautious in this kind of situation.

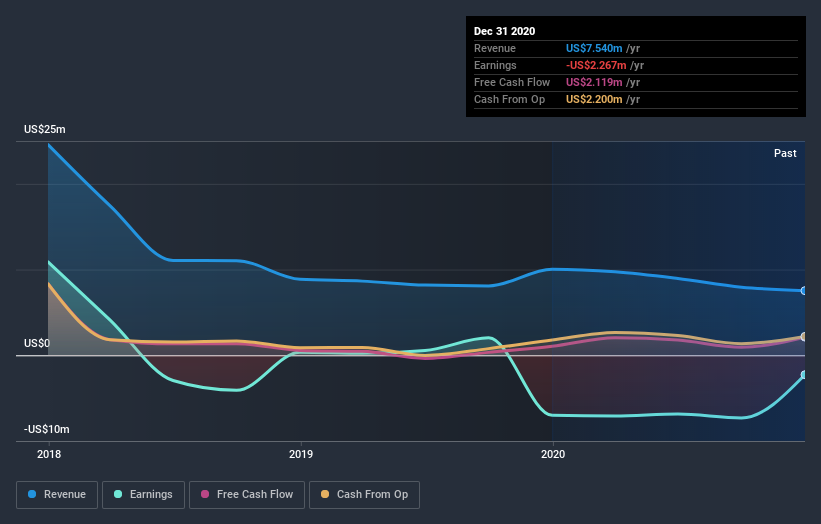

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Maui Land & Pineapple Company stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Maui Land & Pineapple Company shareholders are up 16% for the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 17% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Maui Land & Pineapple Company better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Maui Land & Pineapple Company you should know about.

We will like Maui Land & Pineapple Company better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Maui Land & Pineapple Company, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:MLP

Maui Land & Pineapple Company

Engages in the planning, managing, developing, and selling residential, resort, commercial, agricultural, and industrial real estate properties in the United States.

Mediocre balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.