- United States

- /

- Residential REITs

- /

- NYSE:MAA

Is MAA’s Expanded $1.5 Billion Credit Facility Reshaping Its Approach to Growth and Risk Management?

Reviewed by Sasha Jovanovic

- In October 2025, Mid-America Apartment Communities, Inc. announced it had secured a Fifth Amended and Restated Credit Agreement, establishing an unsecured revolving credit facility of up to US$1.5 billion, with maturity in 2030, optional extensions, an accordion feature to expand to US$2.0 billion, and various compliance covenants.

- This significant credit facility enhances the company's financial flexibility, reflecting lender confidence and providing support for debt management and future liquidity needs.

- We'll explore how this expanded access to long-term, flexible capital may influence Mid-America Apartment Communities' ability to address near-term risks and pursue growth opportunities.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mid-America Apartment Communities Investment Narrative Recap

Owning shares in Mid-America Apartment Communities means believing in the resilience of Sun Belt markets and the company's ability to capture rental housing demand as supply growth moderates. The newly secured US$1.5 billion credit facility may help address short-term refinancing or liquidity risks by enhancing financial flexibility, but it does not materially ease exposure to sluggish rental growth pressures from elevated new supply in key markets.

Among recent developments, MAA's Q2 2025 results showed steady revenue and net income growth, providing context for how additional capital resources could support ongoing operations if leasing velocity remains slow. While this financial backdrop is encouraging, the real test remains whether improved financial access can offset the market fundamentals driving rent and occupancy headwinds in several core regions.

By contrast, investors should be aware that pricing power remains under pressure as new apartment supply continues to weigh on...

Read the full narrative on Mid-America Apartment Communities (it's free!)

Mid-America Apartment Communities is projected to reach $2.5 billion in revenue and $488.4 million in earnings by 2028. This outlook assumes annual revenue growth of 4.8%, but earnings are expected to decline by $79.4 million from the current $567.8 million.

Uncover how Mid-America Apartment Communities' forecasts yield a $156.72 fair value, a 17% upside to its current price.

Exploring Other Perspectives

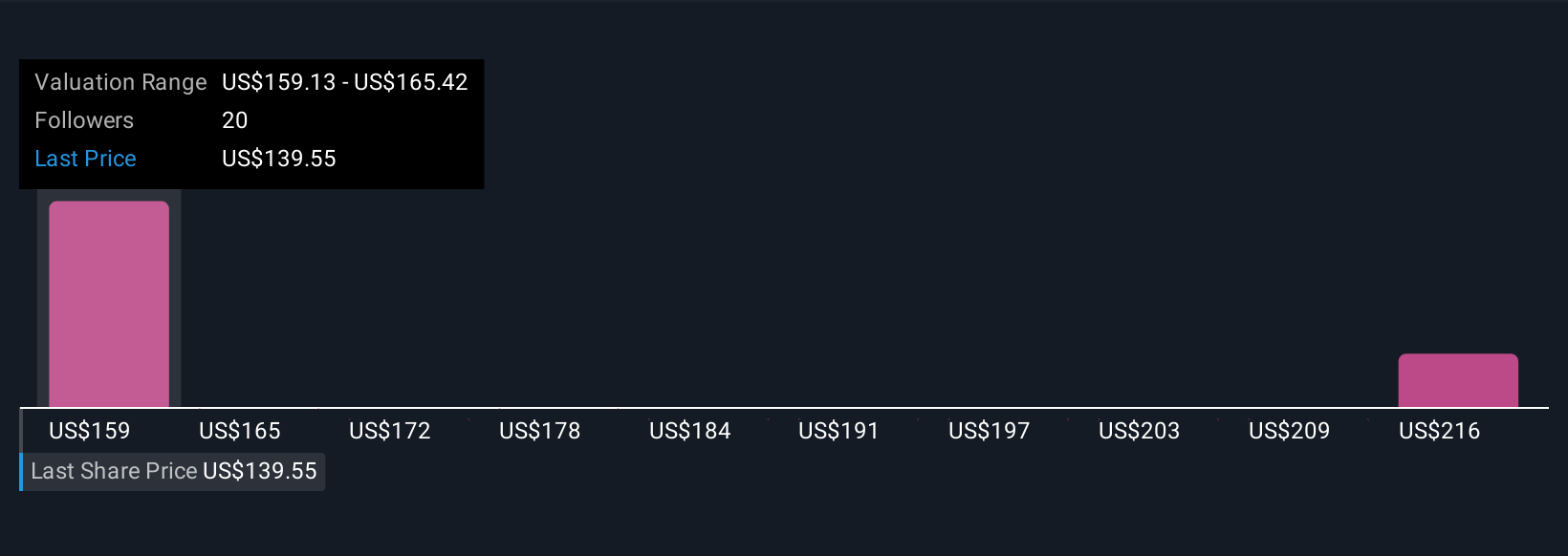

The Simply Wall St Community's fair value estimates for MAA range from US$90.19 to US$224.88 across five independent perspectives. Despite this wide spread, a key catalyst many are watching is whether declining supply can drive stronger occupancy and revenue, which could shift the outlook for future company performance.

Explore 5 other fair value estimates on Mid-America Apartment Communities - why the stock might be worth as much as 68% more than the current price!

Build Your Own Mid-America Apartment Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mid-America Apartment Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mid-America Apartment Communities' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives