- United States

- /

- Health Care REITs

- /

- NYSE:LTC

Is There Still Value in LTC Properties After Mixed Signals from Cash Flow and Earnings Multiples?

Reviewed by Bailey Pemberton

- If you are wondering whether LTC Properties is quietly offering value while most investors overlook it, especially in a defensive sector like healthcare real estate, you are not alone.

- The stock has drifted slightly lower in the short term, down 0.9% over the last week and 4.0% over the last month, but it is still up 1.0% year to date and 4.5% over the past year, with a 15.8% three year and 20.1% five year return suggesting a steady, if unspectacular, long term trajectory.

- Recent headlines around the senior housing and skilled nursing space have focused on an aging population, operators working through past disruptions, and ongoing interest rate uncertainty. All of these factors feed directly into sentiment on LTC Properties and its peer group. At the same time, investors are watching how REITs manage balance sheet strength and portfolio quality as markets weigh defensive income against macro risk.

- On our valuation checks, LTC Properties scores just 2 out of 6, which suggests there is more nuance to the story than a simple cheap or expensive label. Next, we will walk through different valuation approaches and then finish with an additional way to think about what this stock might really be worth in a diversified portfolio.

LTC Properties scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: LTC Properties Discounted Cash Flow (DCF) Analysis

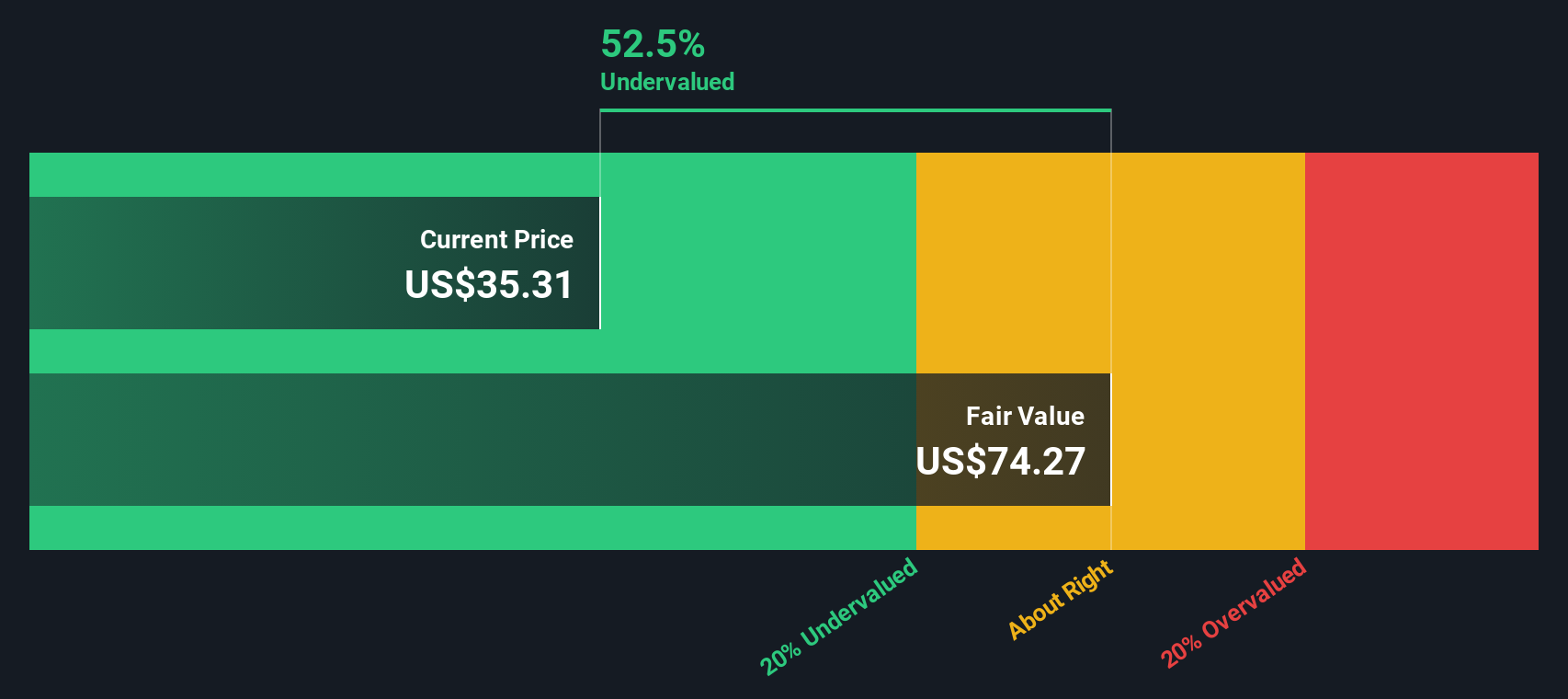

A Discounted Cash Flow model projects LTC Properties adjusted funds from operations into the future and then discounts those cash flows back to today to estimate what the business is worth in dollars right now.

LTC Properties last twelve month free cash flow stands at about $123.4 million. Based on analyst estimates and subsequent extrapolations by Simply Wall St, free cash flow is expected to rise steadily, reaching roughly $229.2 million by 2035, with notable steps up through 2026 to 2028 before growth rates gradually moderate.

Using a two stage Free Cash Flow to Equity model built on these dollar projections, the intrinsic value for LTC Properties is estimated at about $77.27 per share. Compared with the current share price, this indicates the stock is trading at roughly a 55.5% discount, which may suggest that the market is pricing in significantly weaker cash flow or higher risk than the model assumes.

Under these model assumptions, the DCF indicates a substantial margin of safety for long term investors who are comfortable with the underlying cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LTC Properties is undervalued by 55.5%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: LTC Properties Price vs Earnings

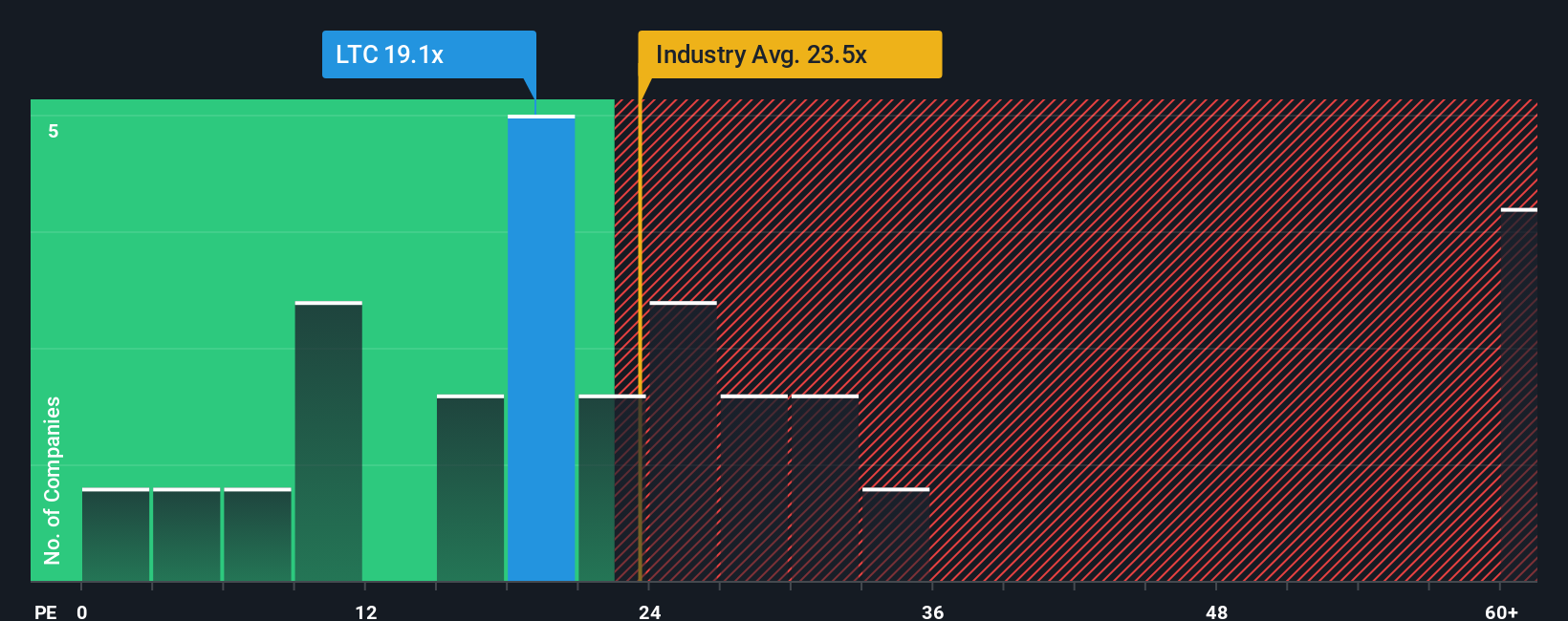

For a profitable REIT like LTC Properties, the price to earnings (P/E) ratio is a useful way to see how much investors are willing to pay for each dollar of current earnings. In general, companies with stronger growth prospects and lower perceived risk tend to warrant higher P/E ratios, while slower growth or elevated risk justifies a lower, more conservative multiple.

LTC Properties currently trades on a P/E of about 49.27x, which sits well above both the Health Care REITs industry average of roughly 25.73x and the peer group average of around 28.89x. At first glance, that kind of premium might suggest investors are baking in optimistic expectations for earnings growth, stability, or both.

Simply Wall St also uses a proprietary “Fair Ratio” framework to estimate what P/E multiple a stock should reasonably trade on, given its earnings growth outlook, profit margins, industry, market cap and risk profile. For LTC Properties, this Fair Ratio sits at about 41.00x, which is a more tailored benchmark than broad industry or peer comparisons. Because the actual P/E of 49.27x is meaningfully higher than this Fair Ratio, the shares look somewhat stretched on an earnings multiple basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LTC Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the story you believe about a company, translated into numbers like future revenue, earnings, margins and ultimately a fair value. A Narrative connects what you think will drive LTC Properties business, such as senior housing demand, acquisition discipline or debt costs, to a financial forecast and then to a fair value that you can compare directly to today’s share price to inform your decision to buy, hold or sell. On Simply Wall St, Narratives are built into the Community page, making it easy for any investor to create or follow a story-based view of LTC Properties that automatically updates when new information, like earnings or major news, is released. For example, one LTC Properties Narrative might assume robust senior housing growth, modest margin compression and a fair value near the high analyst target of about 43 dollars, while a more cautious Narrative could assume slower growth, sharper margin pressure and a fair value closer to the low target around 34 dollars.

Do you think there's more to the story for LTC Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

High growth potential established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion