- United States

- /

- Health Care REITs

- /

- NYSE:LTC

Does Recent Acquisition Activity Signal a Good Entry Point for LTC Properties in 2025?

Reviewed by Bailey Pemberton

- Ever wonder if LTC Properties is actually a bargain, or if today's price is just smoke and mirrors? Let's dive beneath the surface and see what the numbers are telling us.

- Recently, the stock has shown modest gains, up 2.4% this month and 6.0% year-to-date. This hints at growing investor optimism or shifting risk sentiment.

- LTC Properties has been in the headlines with a series of strategic property acquisitions and updates on portfolio diversification. These actions have generated discussions among investors about the company's long-term resilience and growth strategies. As a result, recent stock movements have taken on new context, making this an intriguing time for a closer look.

- At the moment, LTC Properties scores a 2 out of 6 on our valuation checks, so there is plenty to unpack regarding price and value. The next section breaks down traditional valuation approaches, and a new perspective on fair value will be highlighted at the end of the article.

LTC Properties scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: LTC Properties Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future adjusted funds from operations, then discounting these future cash flows back to today’s dollars. This approach helps investors see whether the current stock price reflects the business’s expected ability to generate cash over time.

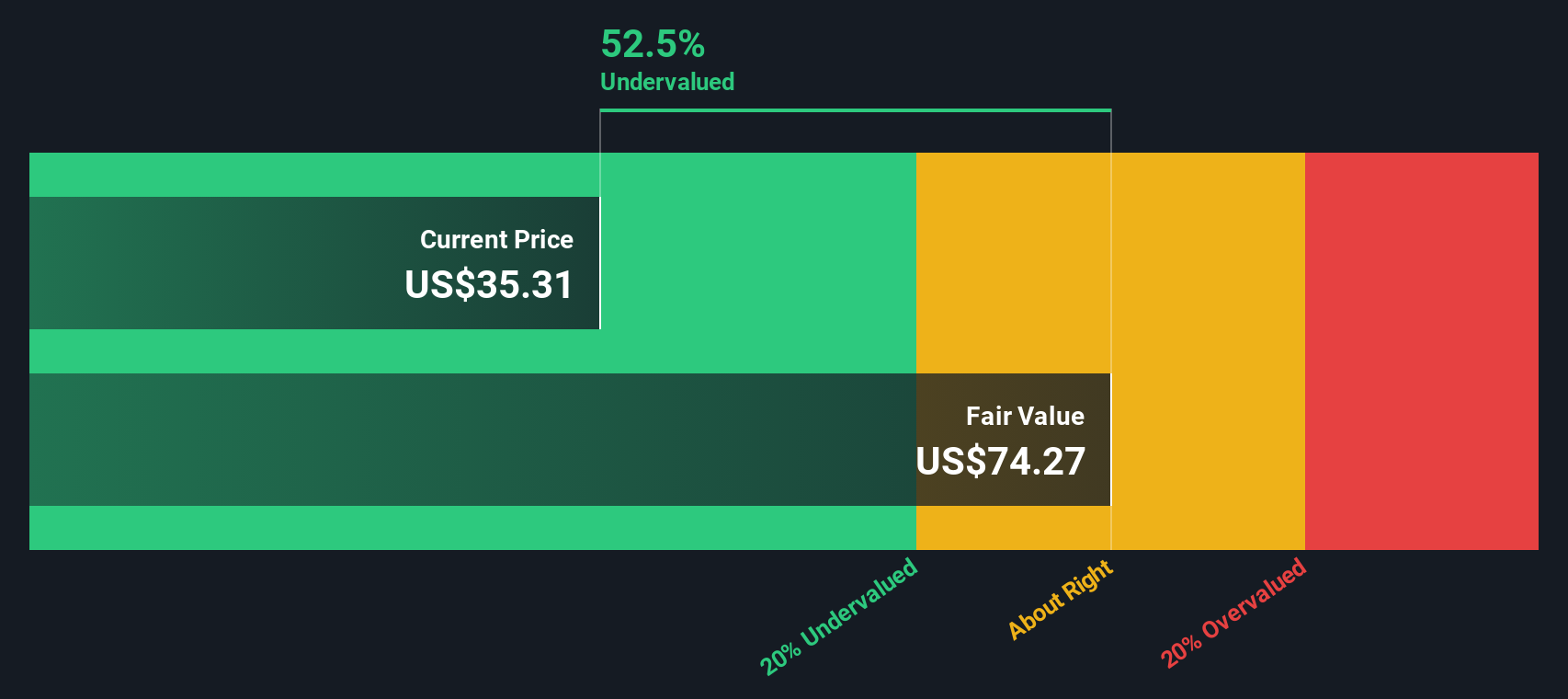

For LTC Properties, current free cash flow stands at $123.43 million. Analyst estimates project this figure will steadily increase, with a notable jump to $167.85 million by the end of 2027. Beyond the official forecast window, further estimates are extrapolated, with projected free cash flows reaching up to approximately $248.98 million in 2035. Each year’s projection is discounted back to its present value, giving the most weight to the nearer-term, analyst-backed figures.

Based on this cash flow growth path, the DCF model calculates an intrinsic fair value of $83.34 per share. Compared to the present share price, this represents a discount of 56.7%, which indicates that the stock appears substantially undervalued relative to its projected cash generation capabilities.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LTC Properties is undervalued by 56.7%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: LTC Properties Price vs Earnings

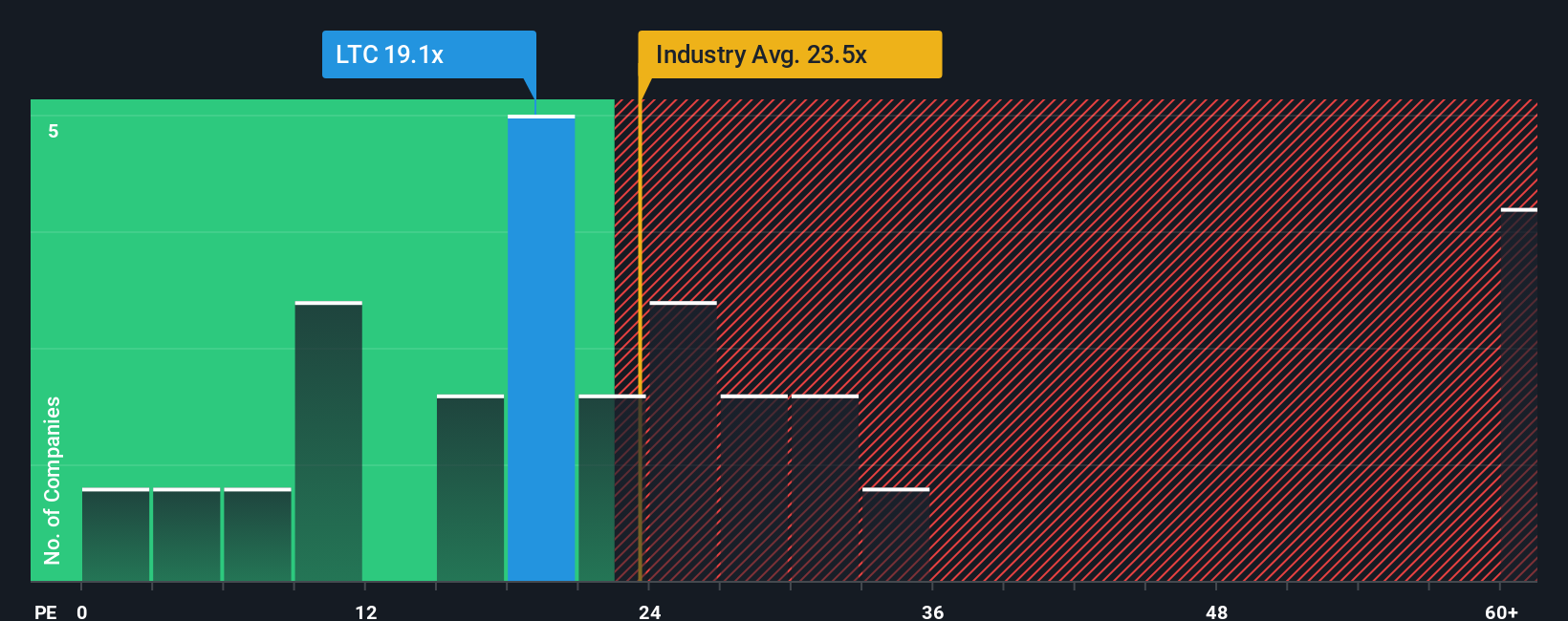

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies because it measures how much investors are willing to pay for each dollar of a company’s earnings. It is especially useful for comparing firms within the same industry, as it accounts for current profitability relative to the share price.

In general, companies with higher expected growth or lower risk tend to command higher PE ratios, while slower growers or riskier companies deserve lower multiples. Industry benchmarks can help set a baseline, but they do not always capture company-specific dynamics.

LTC Properties currently trades at a PE ratio of 51.7x. This is well above the Health Care REITs industry average of 25.3x, and it is also higher than the peer average of 26.8x. However, the “Fair Ratio” for LTC Properties, calculated by Simply Wall St using factors like earnings growth, risk, profit margin, industry, and market cap, is 45.8x. This proprietary measure is more informative than a simple comparison to averages because it reflects the company’s unique profile rather than general market trends.

Comparing LTC Properties’ current 51.7x PE ratio to its Fair Ratio of 45.8x, the stock appears to be trading slightly above what would be considered fair value based on its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LTC Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a powerful tool that let you frame your own story about a company, connecting your expectations, such as future revenue, earnings, and margins, to a specific fair value based on those beliefs.

Instead of relying solely on static numbers or traditional ratios, a Narrative helps you put the company's evolving story front and center by turning your unique perspective into a logical forecast and a defendable estimate of intrinsic value. This makes it easy to see if the current price reflects your outlook or if there is a disconnect worth considering.

Available within the Simply Wall St Community page, Narratives are simple and accessible to use. Millions of investors are already using them to compare their fair value to the current price and quickly decide if an investment fits their strategy. Your calculations and view are also updated dynamically as new news or earnings data emerges.

For example, with LTC Properties, one user who expects rapid rent growth and improved profit margins might see a fair value above $43, while a more cautious investor factoring in competitive risks and softer growth could arrive closer to $34. Narratives empower you to invest based on your own informed convictions, not just consensus estimates.

Do you think there's more to the story for LTC Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

High growth potential established dividend payer.

Similar Companies

Market Insights

Community Narratives